Last week in a nutshell

- A crucial US CPI report showed a faster than expected decline of the rate of inflation. Stocks rallied and bond yields tumbled as investors concluded that the Fed hiking cycle was over.

- November homebuilder sentiment looked gloomy again in the US as homebuyers feel the pinch of higher mortgage interest rates.

- Despite overall decent employment levels across the region, the euro zone economy experienced a slight contraction in Q3, reinforcing the possibility of a technical recession if Q4 proves to be similarly weak.

- On the geopolitical front, Chinese President Xi Jinping met with President Biden in the US, marking Jinping's first visit to the US in six years. With little progress on the outcome.

What’s next?

- Early estimates of manufacturing and services business activities for key countries, such as the US, the euro zone, Great Britain, and Japan will reveal whether economies are softening.

- Sentiment gauges in the euro zone and the US will give clues on the consumer mood just at the start of the holiday season sales.

- The US Federal Reserve Bank will publish its latest minutes and the president of the European Central Bank, Christine Lagarde, as well as several ECB officials will deliver speeches.

- On the earnings front, the usual late reporting of Nvidia will be in the spotlight.

Investment convictions

Core scenario

- The desynchronisation growth continues. The US economy is growing on a softening trend as well as inflation, backing the last Federal Reserve bank’s decision to pause monetary tightening and keep interest rate high for long.

- Europe remains in the worst fundamental situation, with economic and inflation data coming in below expectations (negative surprises). This does, however, take some of the pressure off the ECB, which should regain its easing capacity more quickly than expected in 2024 if necessary.

- In China, economic activity and the evolution of prices have shown some timid signs of stabilisation.

- The perception of a softer bias from developed countries’ central banks has led to a significant downward repricing in bond yields. Meanwhile, China’s likelihood to export deflation to the world is fading only slowly.

- The decline in real rates has been a tailwind for equity valuations since the November FOMC while the deceleration of economic growth and positive real wages will likely weigh on profits.

Risks

- Risks to the outlook for global growth remain tilted to the downside as geopolitical developments unfold.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- US inflation needs a credible Federal Reserve as inflation breakeven anticipations have not decreased yet while the European Central Bank must be mindful of the peripheral countries.

- Oil price, US yields and USD are the key variables to watch.

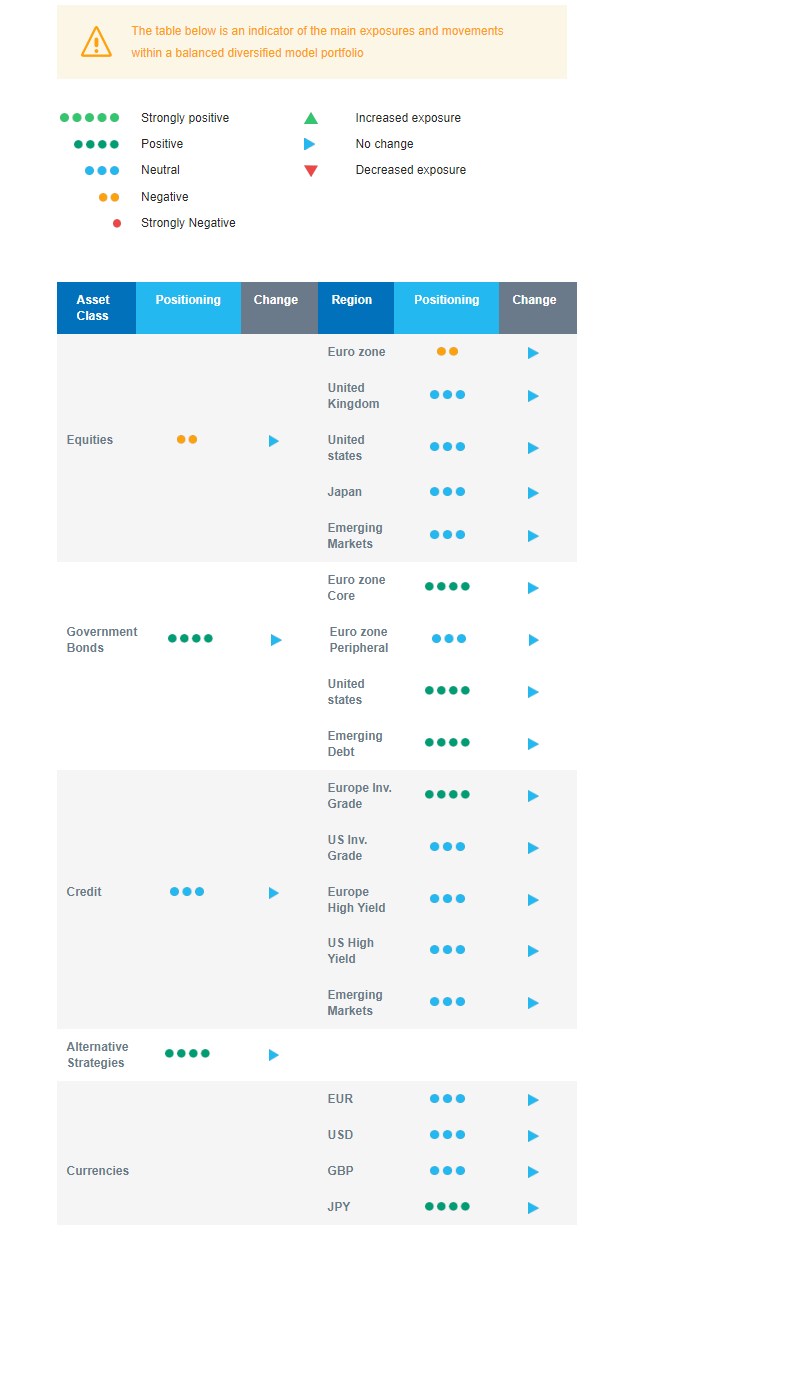

Cross asset strategy

- Our asset allocation shows a relative preference for bonds over equities as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We are overall slightly underweight equities.

- In terms of regional allocation, we are underweight euro zone equities, as the likelihood of a contraction in activity has increased.

- We are neutral US, Japan and Emerging markets.

- We keep a preference for defensive, late-cycle, sectors. Given our expected gradual decline in bond yields and proven earnings resilience, we have become more constructive on the US Technology sector.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European and American government bonds with the objective to benefit from the rise in interest rates and bond yields in a context of slowing economic activity and cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

With equities being relatively less attractive, we maintain a slight underweight positioning on equities and a long bond duration. Regionally, we are underweight euro zone and neutral on Japan, Emerging markets, and US equities. In the fixed income bucket, our focus is on credit that brings carry, i.e., investment grade and emerging debt. In terms of sectors, given our expected gradual decline in bond yields and proven earnings resilience, we are constructive on the US Technology sector. Beyond this, we stick to our defensive preference for Health Care and Consumer Staples and take into account that central banks are at the end of their hiking cycle.