Last week in a nutshell

- Risk-off increased along with rising yields after the Fed indicated that rates would remain at their current levels, or even higher, for longer than markets were hoping for.

- Central banks in emerging markets marched to their own drum as Brazil cut rates while China stayed put, Turkey raised rates and the central banks of the Philippines, Indonesia, Taiwan and Hong Kong kept their benchmark interest rates steady, just like the Fed.

- Global PMI Manufacturing and Services flash estimates pointed at further slowdown in activity as new orders deteriorated.

- The US NAHB Housing Market Index declined for a second consecutive month as high mortgage rates are clearly taking a toll on builder confidence and consumer demand.

What’s next?

- Financial markets will continue to digest the remaining round of central bank meetings, including the latest one from the Bank of Japan.

- In a timely fashion, inflation trends will be in the spotlight with the release of the US PCE inflation, flash September CPI’s, preliminary estimates of the euro zone inflation rate and the Tokyo CPI.

- In the US, consumer strength will also be analysed with the release of personal income and spending data and the Conference Board's consumer confidence data.

- China will publish the final Caixin manufacturing and services PMI as investors assess the effectiveness and adequacy of stimulus measures by the government and the central bank.

Investment convictions

Core scenario

- In terms of economic growth, the landing has started in the US while the ongoing dataflow is weak in the euro zone. Meanwhile, in China, we see growth losing momentum but triggering more action - in small doses - from authorities.

- The inflation path is on a decelerating trend. In the US, the downward trend is set to resume in Q4 whereas in Europe, the ECB will remain vigilant as core inflation is above 5% (but predicted to be below 4% in Q1 2024). China is still a candidate for exporting deflation to the world.

- The persistent hawkish bias by central banks in developed markets is impacting financial conditions. The credit channel is still restrictive as central banks keep their policy rates high for longer than markets have hoped for.

- In summary, we have a scenario of range bound markets: Activity deceleration puts a cap to the upside, but the end of central banks’ tightening cycle is seen as a floor.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- While economic policy uncertainty is declining in Europe from last year’s excessive levels, the US elections of November 2024 are looming.

Cross asset strategy

- We have a range-bound market in mind and consider limited upside potential. At current levels, a positive economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

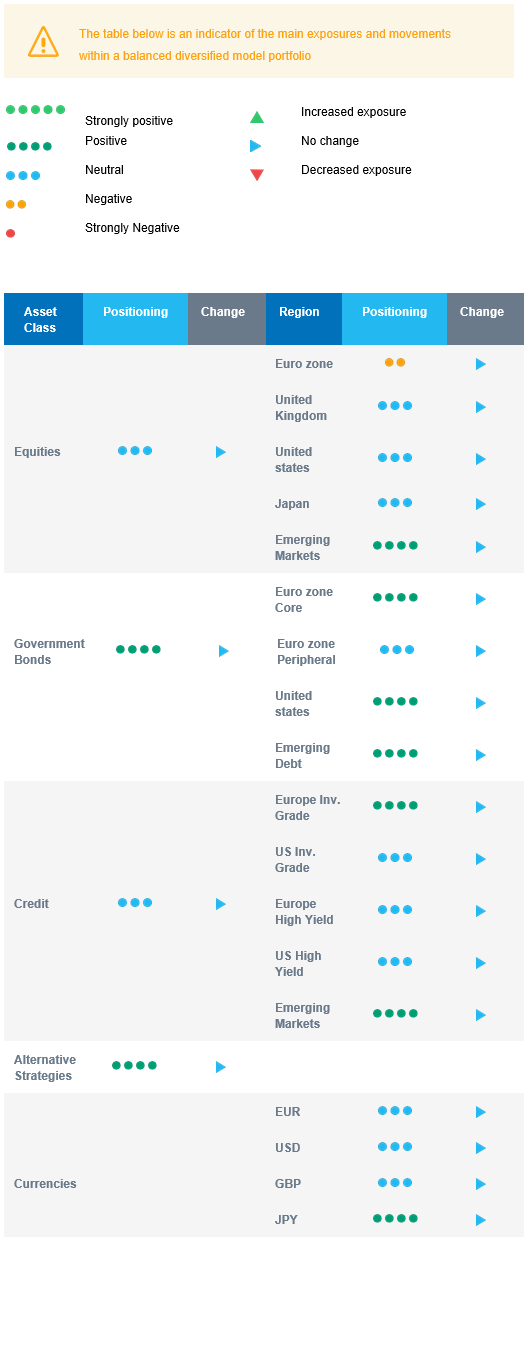

- We have the following investment convictions:

- Our positioning on equities is somewhat more defensive. We are neutral on US equities and underweight euro zone where pricing has become too complacent in our view given the restrictive monetary and financial backdrop.

- We believe in the upside potential of Emerging markets, which should benefit from improving economic and monetary cycles vs developed markets, while valuations remain attractive.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as cyclicals are already pricing a strong improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery, albeit at a reduced pace compared to the first three quarters of this year.

- In the fixed income allocation:

- In government bonds, we remain positive on US and EU duration. While in the US, the landing has started, there is no reason for the Fed to become dovish. By the same token, there is less growth in the euro zone, but inflation is still too high for the ECB.

- In credit, we focus on carry and are positive on Investment Grade, especially by European issuers. The conviction has been strong since the start of the year as carry-to-volatility is attractive.

- We are more prudent on high yield bonds: After rallying in 2023, spreads are now close to historical levels. Strong tightening credit standard should be a headwind.

- We are positive on Emerging debt (hard and local currency) as the bonds continue to offer the most attractive carry. The accommodative stance of the central banks is positive for the asset class. As investor positioning is still light, this should represent a tailwind for local currency debt.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, both are good hedges in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into a long duration mostly via European and US government bonds, a focus on credit that brings carry, i.e., investment grade and emerging debt while being more cautious on high yield and lastly a neutral equity stance but with regional nuances. We are positive on emerging equities, amid dovish local central banks and potential further Chinese stimulus. We are negative on euro zone equities due to continued negative economic surprises and monetary restriction. We are neutral US equity as the positive US economic scenario seems priced in for equities, capping further upside. In terms of sectors, our “late cycle” asset allocation strategy is axed around defensive sectors over cyclicals ones, which are already priced for a recovery.