Last week in a nutshell

- Donald Trump won the New Hampshire Republican primary and is in the lead to become the party's presidential candidate.

- The European Central Bank, the Bank of Canada, the Bank of Japan met and made no change to their interest rate. The ECB press conference was significantly less hawkish than expected.

- First estimates of purchasing managers activity indexes showed a slight uptick on both sides of the Atlantic.

- The US earnings season brought a mixed result so far, with some misses from Tesla and Intel but optimism in the guidance and sentiment.

What’s next?

- Over the next 5 trading days, markets will work through the busiest week of the earnings season, as 108 companies representing 38.3% of the S&P 500’s market cap will report results, including Apple, Microsoft, Alphabet, Amazon, Meta, ExxonMobil, Mastercard, and Merck.

- On Wednesday, all eyes will be on the US Federal Reserve bank’s first meeting of the year. The subsequent press conference will shed light on the timing and amplitude of future rate cuts.

- Germany, Spain and the euro zone will publish preliminary estimates of their Q4 GDP growth rates as well as the area’s January inflation rate.

- This busy week will be rounded up with US employment data giving details on nonfarm payrolls, unemployment rate and average hourly earnings.

Investment convictions

Core scenario

- Inflation gave way and is set to fall rapidly below 3% in both the US and the euro zone, and is no longer a primary concern for investors. The growth / inflation mix is thereby finally returning to “familiar” territory although the start of the year could be somewhat bumpy.

- A soft-landing/ongoing disinflation scenario in the United States remains our most likely scenario, implying no rush for the Central bank to deliver monetary support. We don’t expect the first monetary easing before the end of H1 2024, still leaving room for disappointments compared to current market pricing.

- 2024 should bring better visibility with a narrowing economic growth gap between countries while most central banks have restored room for manoeuvre.

- In China, economic activity has shown some fragile signs of stabilisation (4% GDP growth expected in 2024) while the evolution of prices remain deflationary.

Risks

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold. An upward reversal in the price of Oil, US yields or the US dollar are key variables to watch.

- A risk would be a stickier inflation path than expected which could force central banks to reverse course.

- Similarly, financial stability risks could return as a result of the steepest monetary tightening of the past four decades and the tightening in financial conditions.

- While uncertainty remains on the timing and on the conditions of the start of monetary easing, an upside risk would be an earlier exit from central banks’ restrictive monetary policy.

Cross asset strategy

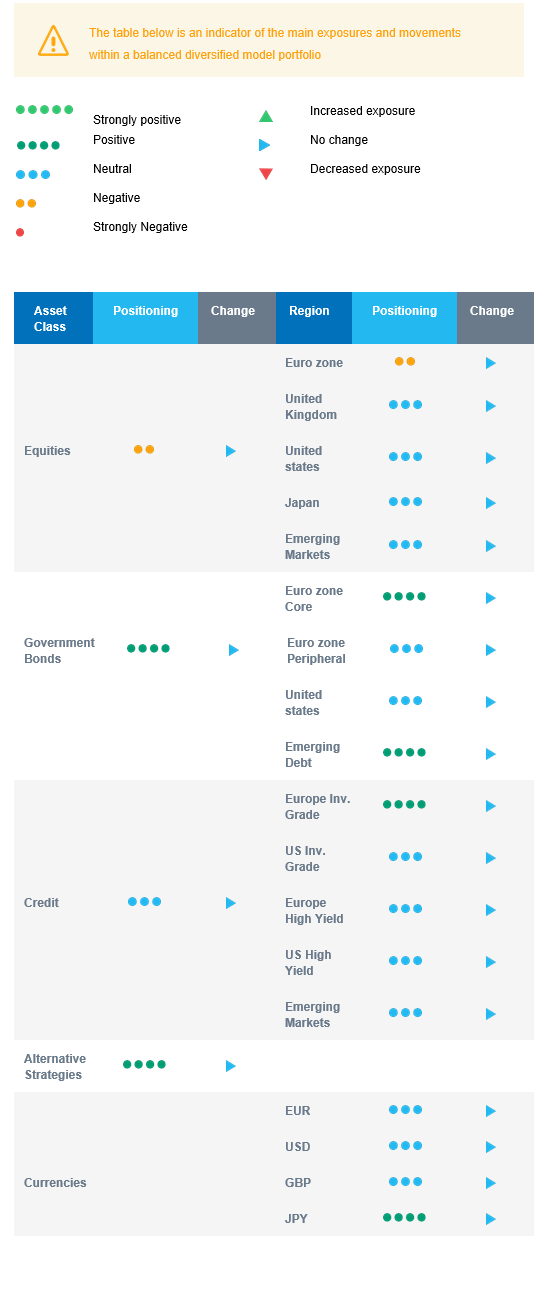

- Our asset allocation shows a relative preference for bonds over equities as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We expect limited equity upside, and are currently slightly underweight on equities pending a better risk/reward and clearer signals on when to increase our exposure. We have a cautious view on euro zone equities and are neutral on other regions.

- We look for specific themes within Equities. Among them, we like Technology / AI and look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment. We also remain buyers of late-cycle sectors like Health Care and Consumer Staples.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European government bonds with the objective to benefit from the carry in a context of slowing economic activity and cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We still hold a long position in the Japanese Yen albeit after some profit taking and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

Our strategy takes into account that sentiment has turned bullish, imbalances have risen and financial markets are calling into question Fed interest rate cuts as early as March. With equities becoming relatively less attractive, we look for specific themes within this asset class. In terms of sectors, we are constructive on the Technology, Health Care and Consumer Staples sectors. Within regional equities, we are underweight euro zone and stay neutral on Japan, Emerging markets, and the US. We maintain a long European bond duration and a neutral US duration. Our focus is also on credit bringing carry, i.e., investment grade and emerging debt.