Last week in a nutshell

- After weeks of tense negotiations, the US Congress passed a bill to raise the debt ceiling, thereby avoiding default.

- The US employment report was a mixed bag as job creations amounted to 358K while the unemployment rate rose to 3.7%.

- Estimates of the euro zone inflation and core inflation revealed a slowdown from 7% to 6.1%, and a dip in the core to 5.3%.

- The euro zone monetary and credit data showed further slowdown, including for private credit, M3 and M1 growth.

What’s next?

- The preliminary data on the euro zone GDP growth rate and Germany’s industrial production are expected as investors assess the pace and width of the slowdown in activity.

- Euro zone retail sales and the ECB’s consumer expectations survey will give us an indication of consumer behaviour and sentiment amid the pursuit of the ECB monetary tightening.

- The evolution of the Chinese services PMI, trade-related data as well as car sales and inflation will shed some light on the need for additional measures to sustain the re-opening momentum.

- The US will publish ISM services index, factory orders and trade balance figures.

Investment convictions

Core scenario

- Our main scenario incorporates slow growth, both in the US and the euro zone and remains the most likely. The magnitude of the market downside risk will depend on the upcoming economic slowdown. In our central scenario, it should be limited in a tight trading range.

- Looking forward, all our economic scenarios – though with different trajectories – point to lower growth, lower inflation, lower Fed Fund rates and lower 10Y bond yields by the end of next year.

- In the euro zone, the expected next stage of lower economic growth and increasing cyclical worries have likely already started. Deterioration in economic data has been widespread. After peaking in February, economic surprise indicators have fallen sharply into negative territory in May.

- In Emerging markets, Chinese pent-up demand was a positive point but a strong sustainable momentum behind the re-opening has not materialised yet. Clearly, this is not the post-pandemic recovery the world was betting on.

Risks

- May saw a dramatic drop in growth surprises in all major regions.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks have resurfaced recently in the US and represent a new macro risk.

- In Europe too, we believe the risks on growth are on the downside. The ECB is hawkishly tilted and geopolitical tensions are not supportive.

- Overall, central banks have a narrow path and will have to compromise between price stability (keeping rates at a restrictive level for longer than currently priced) and financial stability (decisive action to avoid materialisation of systemic risk).

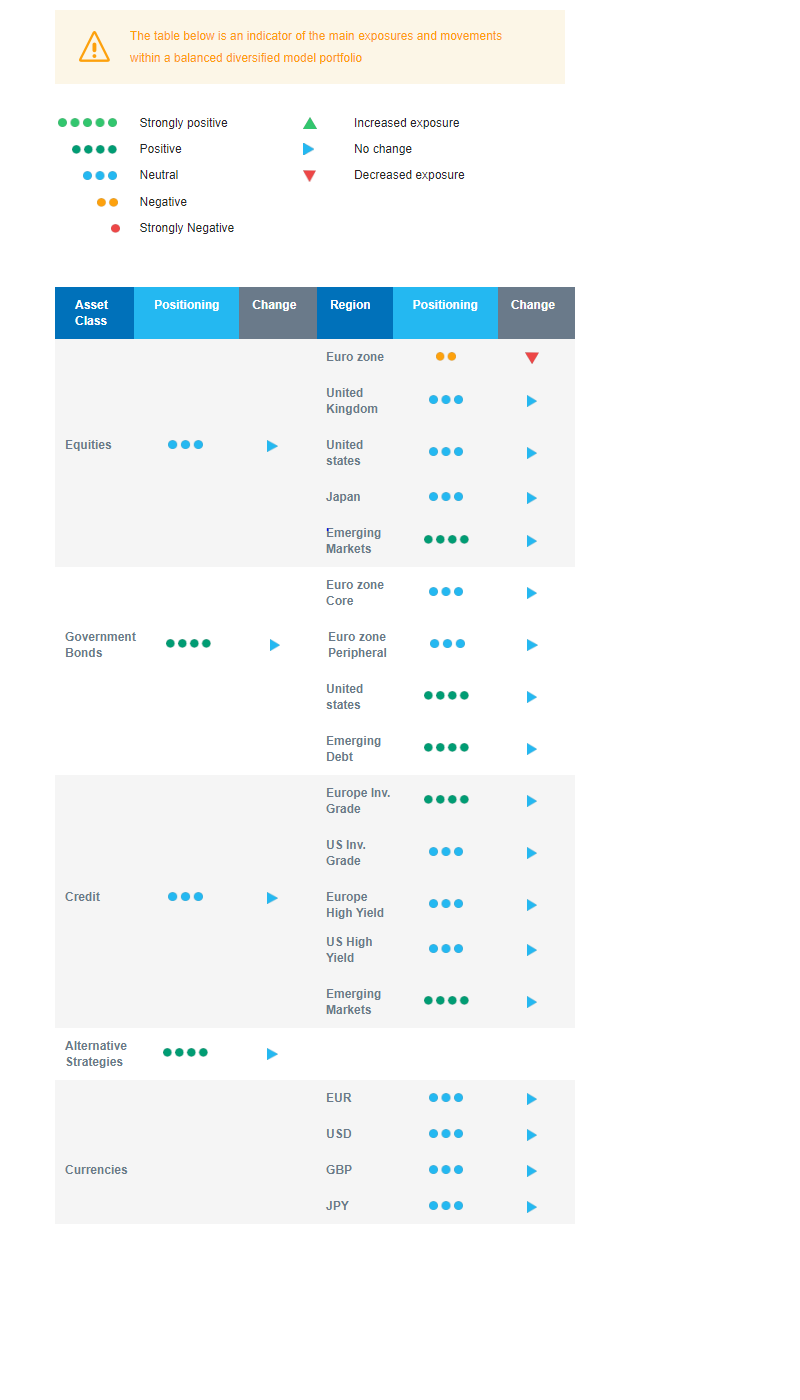

Cross asset strategy

- We have a cautious neutral equities allocation after downgrading our views on euro zone equities from neutral to slightly underweighted. The expected next stage of lower economic growth and increasing cyclical worries have likely already started, while the monetary policy remains hawkishly tilted. In addition, geopolitical tensions are not supportive. Carry and long duration assets are of increasing interest in this context.

- The potential credit restrictions along with central bank’s anti-inflation stance are capping the upside potential for risky assets. On the other hand, inflation is declining, and a slowing growth is limiting the market downside.

- Within a cautious neutral equities positioning, we have convictions in specific assets:

- In terms of regions, we believe in Emerging markets and we downgraded our allocation to Europe.

- At this stage of the cycle, we prefer defensive over cyclical names, especially in Europe. We prefer Health Care and Consumer Staples. The former is expected to provide some stability: No negative impact from the war in Ukraine, defensive qualities, low economic dependence, innovation, and attractive valuations. The latter, pricing power.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery from 2022.

- In the fixed income space, we have increased the duration and we are positive on US government bonds.

- We are positive on US government bonds as the slowdown is advanced in the region. We do not expect a Fed easing as early as markets do.

- European investment grade credit has been a strong conviction at the start of 2023 since the carry that was reconstituted by the rise in yields in 2022 looked attractive.

- We are cautious on High Yield bonds.

- Emerging bonds continue to offer the most attractive carry and the USD is not strengthening.

- We have exposure to some commodities, including gold and commodity-related currencies, including the Canadian dollar.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Following the outperformance of the euro zone region this year and the recent deterioration in cyclical indicators, we downgrade our views on euro zone equities from neutral to slightly underweighted. The overall equity strategy is neutral, with a moderated preference for Emerging markets as we recently became neutral Chinese equities, in the absence of a strong sustainable momentum behind the re-opening. Further to the equities’ allocation, we are neutral US, Japan and Europe ex-EMU. The “late cycle” asset allocation strategy is axed around defensive sectors, credit, and long duration.