Money market strategies are coming back. The multi-decade bonanza on the back of lower yields and accommodative central bank policies ended abruptly last year. The stop of central bank asset purchase programs and the unwinding of their balance sheets will inevitably reveal market dislocations which will have to be corrected. In 2022, despite uncertainties - and the risks they pose to economic growth - central banks across the globe remained focused on their fight against inflation and raised interest rates for the first time in many years: a 375bp hike for the ECB’s deposit rate (from a negative 0.50% to +3.25% today) and a 525bp hike for the Fed’s fund rate, into the 5.25%-5.50% range.

Policy makers remain confident in the resilience of the economy and seem to prefer to err the side of caution, taking the risk of overtightening rather than not going the distance. The possibility of stickier than expected inflation leading to a higher terminal rate and lower growth should not be discounted. As a result, current market pricing seems optimistic on inflation or assumes a severe economic slowdown that would force the hand of central banks.

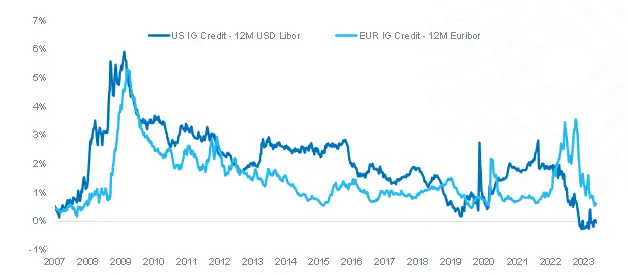

Money market strategies are now a source of good carry and an opportunity for investors as the inverted yield curve has transformed the attractiveness of the asset class. Investors are no longer forced to accept negative yields as the price for very high liquidity and low volatility. Instead, the asset class offers a very interesting risk-return profile in its own right.

Money markets offer an attractive yield compared to longer term credit

Source: Candriam and Bloomberg®, as at 31/05/2023, yield spreads between investment grade credit and money market. For EUR: Bloomberg EuroAgg Corporate Statistics index vs Euribor, for USD: ICE BofA US Corporate index vs Libor. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future.

Opportunities in Candriam Money Market strategies

With a proven track record, over 40 billion euros under management and more than 25 years of expertise in fixed income markets, Candriam ranks among the leaders in Europe. Managed by a dedicated team of three money market investment specialists within a broader team of 40 fixed income managers and credit analysts, Candriam Money Market strategies offer investors:

- A large investment universe that favors diversification and may improve yield.

We currently remain cautious in our credit exposure because of the many uncertainties to economic growth and the end of asset purchase programs. Central banks’ potential balance sheet reduction implies the removal of an important source of support for credit spreads. Our highly prudent approach and focus on maintaining volatility at very low levels are key to navigate turbulent markets.

- An in-depth analysis of issuers including ESG factors and a rigorous credit selection.

We exclude issuers involved in controversial activities: thermal coal, tobacco, controversial weapons.

- A low interest rate duration over the hiking cycle, via a diversified mix amongst floating rate securities and fixed rate securities with a short maturity.

We believe that the current market pricing of a policy pivot is overdone and that rate cuts for 2023 and 2024 will gradually be priced out of the market. Consequently, we maintain our low duration approach for the moment but stand ready to seize opportunities as market conditions correct and visibility improves.

- In terms of liquidity, European money market funds are better protected against systemic risks than in 2008. After 2009, the European Commission put in place new legislation regulating money market funds to ensure financial stability and an enhanced protection for investors.

- Implementation and daily monitoring of risk limits by an independent risk team.

Source: Candriam, May 2023. Indicative data which may change over time. * The scenarios presented are an estimate of performance based on evidence from the past on how the value of this investment varies, and/or current market conditions and are not an exact indicator. What you will get will vary depending on how the market performs and how long you keep the investment/product.

Conclusion

We believe that our highly prudent investment philosophy and focus on volatility are key attributes for investors. Since inception in 2008, the strategies have successfully navigated periods of heightened market stress (Lehman, Covid).[1]

Investment solutions built around money market instruments provide an appropriate solution to the conundrum as the naturally low durations provide investors with natural protection against rising rates and inflation surprises. Furthermore, the asset mix can enhance portfolio diversification and typically decrease its overall volatility level, thereby contributing to improving its risk-adjusted returns.

Risks

All our investment strategies are subject to risks including the risk of loss of capital.

The main risks associated with the presented strategies are the following: Risk of loss of capital, Interest rate risk, Credit Risk, Liquidity Risk, Derivative risk, Counterparty Risk, Sustainability risk, ESG Investment risk.

This is a marketing communication. This document is provided for information purposes only and does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Warning: Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance does not predict future returns. Gross performances may be impacted by commissions, fees and other expenses. Performances expressed in a currency other than that of the investor's country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.

The risk of loss of the principal is borne by the investor.

[1] Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance do not predict future returns.