Last week in a nutshell

- Euro zone manufacturing and services business activities indicated a sixth consecutive month of contracting activity.

- Some surveys are showing that US and European consumers are expecting that interest rates might start to go down as inflation continues to slow down.

- Communication from the US Federal Reserve Bank and the president of the European Central Bank were rather supportive for financial markets.

- On the earnings front, Nvidia surprised on the top and bottom lines, and on its projections for Q4, but Wall Street was less impressed with the report on China export fears.

What’s next?

- Fed Chair Jerome Powell, ECB President Christine Lagarde and BoE Governor Andrew Bailey will hold speeches, giving more insights into their respective guidance into the final meetings of the year.

- With the start of the holiday shopping season, the US will release preliminary data on their activity, covering ISM indexes, GDP and PCE prices growth, and real consumer spending.

- The euro zone will release the preliminary November CPI reports, as well as the year-on-year evolution of loans to companies and to households.

- Further stabilisation in manufacturing and services activity is expected from Chinese PMIs.

- The OPEC+ group is meeting amid oil price volatility while the COP28 climate summit will kick-off in Dubai.

Investment convictions

Core scenario

- The desynchronisation growth continues. The US economy is growing on a softening trend as well as inflation, backing the last Federal Reserve bank’s decision to pause monetary tightening and keep interest rate high for long.

- Europe remains in the worst fundamental situation, with economic and inflation data coming in below expectations (negative surprises). This does, however, take some of the pressure off the ECB, which should regain its easing capacity more quickly than expected in 2024 if necessary.

- In China, economic activity and the evolution of prices have shown some timid signs of stabilisation.

- The perception of a softer bias from developed countries’ central banks has led to a significant downward repricing in bond yields. Meanwhile, China’s likelihood to export deflation to the world is fading only slowly.

- The decline in real rates has been a tailwind for equity valuations since the November FOMC while the deceleration of economic growth and positive real wages will likely weigh on profits.

Risks

- Risks to the outlook for global growth remain tilted to the downside as geopolitical developments unfold.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- US inflation needs a credible Federal Reserve as inflation breakeven anticipations have not decreased yet while the European Central Bank must be mindful of the peripheral countries.

- Oil price, US yields and USD are the key variables to watch.

Cross asset strategy

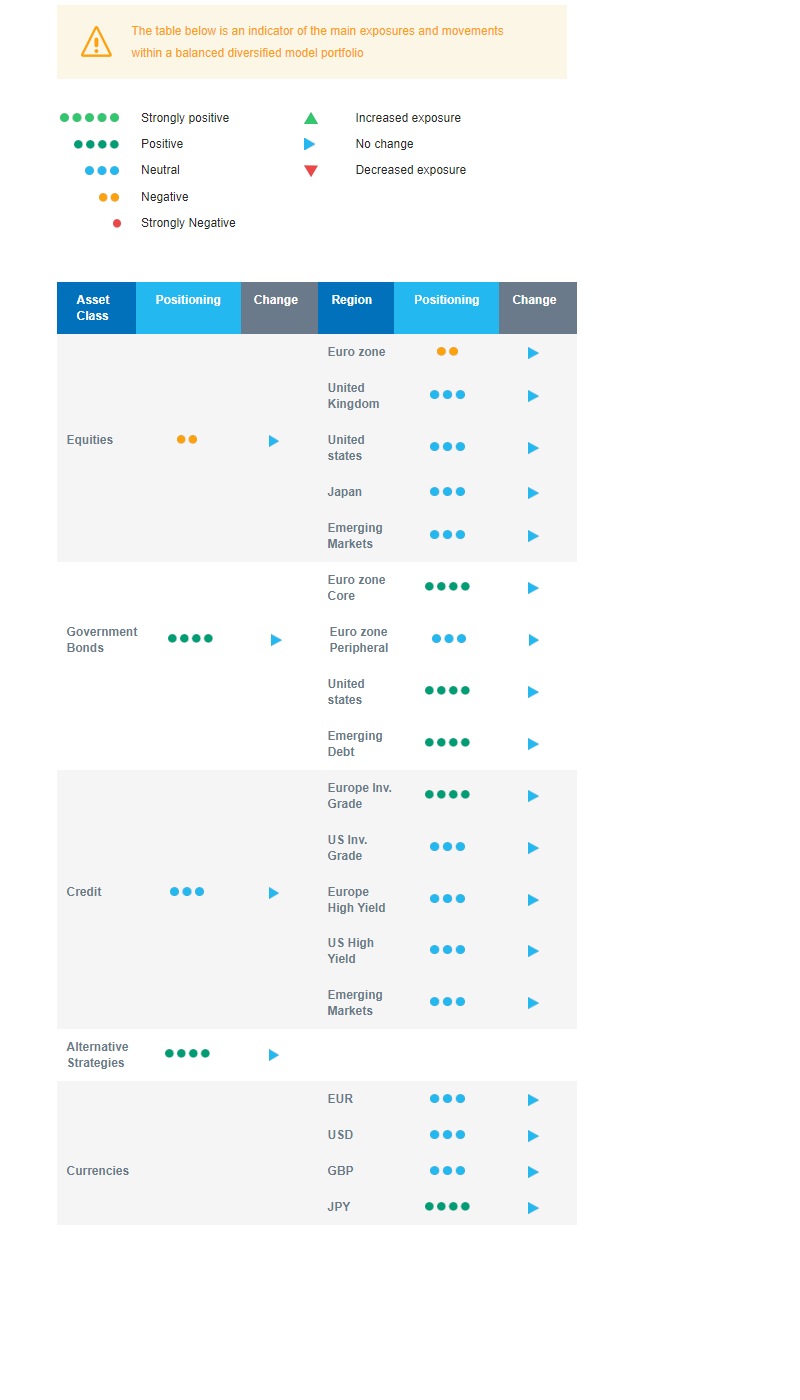

- Our asset allocation shows a relative preference for bonds over equities as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We are overall slightly underweight equities.

- In terms of regional allocation, we are underweight euro zone equities, as the likelihood of a contraction in activity has increased.

- We are neutral US, Japan and Emerging markets.

- We keep a preference for defensive, late-cycle, sectors. Given our expected gradual decline in bond yields and proven earnings resilience, we have become more constructive on the US Technology sector.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European and American government bonds with the objective to benefit from the rise in interest rates and bond yields in a context of slowing economic activity and cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

With equities being relatively less attractive, we maintain a slight underweight positioning on equities and a long bond duration. Regionally, we are underweight euro zone and neutral on Japan, Emerging markets, and US equities. In the fixed income bucket, our focus is on credit that brings carry, i.e., investment grade and emerging debt. In terms of sectors, given our expected gradual decline in bond yields and proven earnings resilience, we are constructive on the US Technology sector. Beyond this, we stick to our defensive preference for Health Care and Consumer Staples and take into account that central banks are at the end of their hiking cycle.