After an uncertain and relatively volatile summer, September brought some good news for investors. The Fed delivered a 50 basis points rate cut that positively surprised the market, giving a boost to the bull camp. Another major event was the package of measures announced by China to support its economy. The market has reacted very positively to the news, but is still waiting to see if it will produce the expected results.

After an uncertain and relatively volatile summer, September brought some good news for investors. The Fed delivered a 50 basis points rate cut that positively surprised the market, giving a boost to the bull camp. Another major event was the package of measures announced by China to support its economy. The market has reacted very positively to the news, but is still waiting to see if it will produce the expected results.

The equity markets of major economies recovered nicely during September and ended slightly up, following the initial selloff at the beginning of the month. However, the clear outperformer was China’s onshore and offshore equity market, which posted positive high double-digit returns. Korean and Japanese equities, as well energy-heavy indices, underperformed during the period. At sector level, consumer discretionary, utilities and materials outperformed the market, while healthcare and energy were at the other end of the spectrum. Sovereign yields and credit spreads eased during the month, incorporating rate cuts.

The HFRX Global Hedge Fund EUR returned +0.82% over the month.

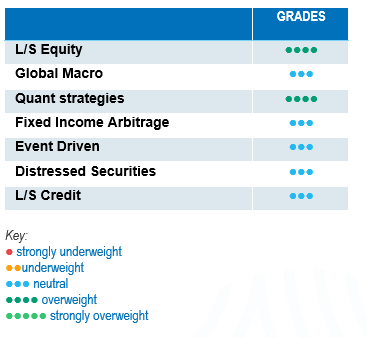

Long-Short Equity

On average, Long-Short Equity did well during the month. These strategies averaged positive low single-digit returns, but did much better on a relative basis. Long-Short funds captured almost all the upside of traditional equity indices in the United States and Asia, and did much better in Europe, outperforming European equity indices in absolute terms. Within the Long-Short Equity universe, directional strategies outperformed market neutral managers, benefiting from the beta tailwind. Long-Short managers have been able to generate strong levels of alpha on both their long and short books since the start of the year, benefiting from increasing sector dispersion and a broadening of market performance. The Long-Short Equity universe is very rich in terms of opportunities and diversified in terms of styles. These strategies have more tools than traditional long-only strategies to help them navigate market volatility.

Global Macro

On average, Global Macro strategies did very well during the period, benefiting from an eventful month. Directional and relative value trades on rates were the main performance drivers for the period. Investment trades in foreign exchange came a close second in terms of positive contributions. Equity directional positions tended to carry lower levels of risk considering the calendar of events and low conviction levels across managers. It is interesting to note that contributions to performance have tended to be well diversified across regions. Global Macro managers have had a challenging year so far in terms of performance, but they are starting to reap the benefits of economic decoupling across the major economic regional powerhouses. We expect the current and foreseeable environment to offer interesting investment opportunities for Global Macro.

Quant strategies

Quantitative strategies performed well during the month. On average, Trend Followers outperformed Multi-Strategy strategies, benefiting from the trends in equities, currencies and rates. Contributions from commodities were mixed as gains in precious metals and oil were offset by losses in natural gas, grains and base metals. Multi-Strategy Quantitative models put in a more modest than CTAs during the month, but have been more consistent performers since the start of the year.

Fixed Income Arbitrage

After months of uncertainty about the persistence of inflation and the strength of the economy, central bankers have shifted towards a more dovish stance, recognising the need to implement rate cuts. While the extent of these cuts is still to be determined, this shift has clearly paved the way for a sustained bond rally. Although many directional managers were caught off guard by the reversal in interest rate trends—except in Japan, where a consensus view prevails—this latest shift has been favourable for fixed income arbitrage funds.

Risk arbitrage – Event-driven

Performances continued to be uninspiring during the month of September. Managers within the space have been frustrated with the level of performance generated since rate hikes came to take the punch bowl away from the party. According to specialists, M&A volumes are still below normal averages, but expectations are building up for the next few quarters. Rates have initiated a downward cycle, which could help trigger corporate board decisions and history tells us that a period of low M&A activity is always followed by a strong rebound in merger activity. The arbitrage community seems to see the US elections as a catalyst to get things moving. The FTC led by Lina Kahn has been of the cause of some instability for the strategy, bringing to court several surprise lawsuits against announced mergers. The merger community does not expect her to be reappointed by the newly-elected administration whoever the winning candidate is, but on that, only time will tell. While it is true that the Republican Party is usually less interventionist, in the Democrat camp, there are some strong business leaders who support Harris and would like the FTC to adopt a more business-friendly attitude.

Distressed

During the last 18 months, expectations for distressed opportunities have evolved significantly. Coming into the end of 2022, the red-hot inflation levels and rapid rate hike cycle were indicators of a distressed cycle bonanza not seen since the Great Financial Crisis. These expectations dwindled during 2023 as the economy and job market remained resilient. The opportunity set during the year was opportunistic in nature. Currently, default levels have started to increase, although expectations remain contained considering most corporations opportunistically refinanced their outstanding debt at lower rates during the period 2020-2021 and that consumer financial health remains relatively strong. While strategy specialists remain largely on the sidelines focusing on idiosyncratic opportunities, they remain cautious about investing in high-yield issuers and have identified cracks in specific areas such as the loan market. Some market participants have taken on large debt loads through loans, which are usually floating rate issues, without anticipating such a meteoric rise in short-term rates.

Long short credit

Base interest rates remain varied, offering credit investors decent yields. However, corporate spreads are close to all-time lows. We may wonder if investors are being appropriately remunerated for the risk taken. Managers have concentrated their portfolios in their highest fundamental convictions, increased the level of hedges and lowered strategy directionality. Conversely, such a rich market generates numerous opportunities for alpha shorts. Although rates are at the beginning of a cutting cycle, they remain at high levels, which favours alpha generation both on long and short positions as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance with the increase of idiosyncratic risks and geopolitical uncertainty. Risk diversification is important and should be an integral part of the investment allocation process.