During October, markets moved to price in a return of Donald Trump to the White House – and were ultimately proved right. While the odds of some market prediction tools looked somewhat extreme, many of the managers within the hedge fund community we spoke to were of the opinion that Trump would take home the 47th presidential election. Did their predictions result from a thorough analytical process or the hope of a more business-friendly administration? It is hard to say.

Among financial assets, movements on US sovereign rates and the US Dollar versus other main currencies probably best reflected market expectations regarding the US election. US rates widened, factoring in promised action by the new President likely to push up inflation.

Equity markets sold off during the month on the back of economic and political uncertainties. European and Chinese equities lagged US equities as the threat of additional tariffs imposed by a new Trump administration became much more likely. At a sector level, Financials and Energy outperformed over the period.

The HFRX Global Hedge Fund EUR returned -0.80% over the month.

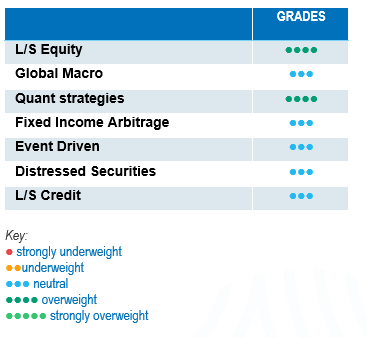

Long-Short Equity

Long-Short Equity managers did well during October. According to Morgan Stanley Prime Brokerage, the strategy performed well on average relative to world equities, outperforming due to alpha generation on long positions. Europe- and Asia-focused Long-Short funds’ average performance captured only a small percentage of the market downside. US focused long-short strategies generated a positive average absolute performance over the period. Market neutral strategies outperformed directional strategies this month due to a positive performance spread between long and short positions. Long-Short managers have been able to generate strong levels of alpha on both their long and short books since the start of the year, benefiting from increasing sector dispersion and market performance broadening. The Long-Short Equity universe is very rich in terms of opportunities and diversified in terms of styles. These strategies have more tools than traditional long-only strategies to help them navigate market volatility.

Global Macro

Performances were dispersed during October. The market moved during the month, although correctly calling timing and directionality was important to achieving a good monthly return. Considering October’s market volatility, managers who lowered their portfolio and recentered risk around their strongest convictions tended to perform a bit better than average. Relative value trades on rates were among the best performance drivers for the month. Energy-market volatility due to increasing geopolitical stress did not make life easy for Global Macro managers. Strategies holding long duration trades in the US were surprised by the market reaction, which quickly priced in Trump’s inflationary policies. The market environment may be a bit too choppy at the moment to confidently raise portfolio risk. However, the economic decoupling across the major economic regional powerhouses offers interesting investment opportunities for Global Macro managers.

Quant strategies

Trend following strategies had a challenging month in October, generating negative mid-to-high single-digit returns depending on the strategy’s risk target. On average, trend followers lost money across all asset classes. The biggest negative drivers of performance were long positions in long-term sovereign issues and short positions in energy futures. Multi-Strategy Quantitative programmes did well during the month.

Fixed Income Arbitrage

After months of uncertainty surrounding inflation persistence and economic strength, central banks moved toward a more dovish stance, acknowledging the need for rate cuts as inflation normalises downward. While the extent of these rate cuts is yet to be determined, this shift has created a variety of opportunities, with market movements differing significantly across regions. In the US, the bond market has trended higher and the yield curve has steepened. Meanwhile, the spreads between the 10-year European bond yield and both the US and UK 10-year yields have reached historically high levels. This environment has been very supportive for the Fixed Income space, both relative value and directional, although some directional managers were caught off guard by the US interest-rate spike.

Risk arbitrage – Event-driven

October was tough for Merger Arbitrage strategies. Two very well owned deals broke during the month, weighing down significantly on performances. The first relates to the $8.5 billion acquisition of Capri by its rival Tapestry which was blocked by a federal judge. This decision gave a win to the Federal Trade Commission chair Lina Kahn, who opposed the deal on the basis that it would harm competition in the affordable luxury bag segment. Following the decision, the companies have decided to abandon the plans to merge. The second deal, which was a bit less crowded, is the acquisition of Traditional Chinese Medicine by Sinopharm, which did not get the required regulatory approvals. According to specialists, M&A volumes are still below normal averages, although expectations are building for following quarters. Rates have initiated a downward cycle, which could help trigger corporate board decisions, and history tells us that a period of low M&A activity is always followed by a strong rebound in merger activity. The arbitrage community seems to see the US elections as a catalyst for movement. The FTC under Lina Kahn was a factor of instability for the strategy, bringing several surprise lawsuits against planned mergers. The merger community does not expect her to be reappointed by the newly elected administration.

Distressed

Default rates have started to tick upwards recently but, overall, defaults remain concentrated in specific sectors such as office real-estate and logistics companies that levered up during the COVID crisis to meet rising demand in e-commerce. Most corporations were able to opportunistically refinance their outstanding debt at lower rates during the period 2020-2021. Distressed specialists remain focused on idiosyncratic opportunities, remaining cautious about high yield issues as spreads are close to all-time lows, and have identified cracks in specific areas of the loan market. Stressed debt strategies were able to source interesting opportunities in balance sheet restructuring and liquidity provision to specific market participants.

Long short credit

Base interest rates remain varied, offering credit investors decent yields. However, corporate spreads are close to all-time lows. We may wonder if investors are being appropriately remunerated for the risk taken. Managers have concentrated their portfolios in their highest fundamental convictions, increased the level of hedges and lowered strategy directionality. Conversely, such a rich market generates numerous opportunities for alpha shorts. Although rates are at the beginning of a cutting cycle, they remain at high levels, which favours alpha generation both on long and short positions as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance with the increase of idiosyncratic risks and geopolitical uncertainty. Risk diversification is important and should be an integral part of the investment allocation process.