After five months of gains, equities finished down in April in a relatively volatile market. Although the EPS beat/raise has been high, markets focused more on top-down factors than micro news-flow. The Fed was once again the focal point of attention as US economic data showed higher than expected inflation, creating a change in interest-rate expectations and some factor and sector rotation towards value-driven sectors. The “bad news is good news” dynamic was once again in play as investors continue to worry about the disinflation path. European equities outperformed US markets, as they did last month. In contrast, Chinese equities finished the month strongly up, while Taiwanese equities fell in response to global tech weakness. In Europe, Energy and Healthcare were strong outperformers while IT and Consumer Discretionary struggled. In the US, the only resilient sector was Utilities, while Energy also limited the downside.

The bond markets also suffered: US 10yr Treasury bond yields rose by 42 bps to 4.62% as markets saw higher chances of delayed rate cuts by the Fed.

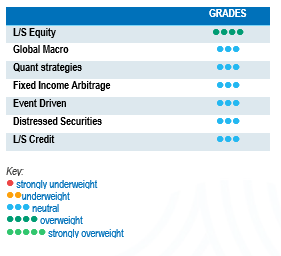

Long-Short Equity

Long-Short Equity funds were down on average in April, although they significantly outperformed market indices. Losses overall came from beta and were mitigated by positive alpha, notably on the short side. This month saw a continuation of the very strong alpha generation trend for Long-Short Equity funds and, according to Morgan Stanley Prime Brokerage, 2024 shows the best start to a year since they began tracking the data in 2010. Asia long-short funds outperformed significantly on the back of rebounding Asian markets.

In the current environment of higher rates, a well-balanced Long-Short Equity selection is an excellent tool to benefit from the opportunities offered by inter- and intra-sector dispersion. These strategies have more tools than traditional long-only strategies, to help navigate market volatility should the consensus scenario of moderate growth for 2024 hit a road bump.

Global Macro

Performances for Global Macro funds were generally positive over the month. Fixed income positions were generally rewarding due to short positions on US 10yr, as many funds were well positioned for a bond sell-off. Latin American countries have offered a contrasting trend in this rate cycle as Chile, Columbia and Peru cut rates in April, showing the increasing policy divergences that are currently in place. FX was also positive thanks to a rewarding short in the JPY and continued USD strength. Within commodities, contributions were mixed: metals dominated as a sub-sector, with double-digit percentage gains for most industrial metals on the back of strong demand. We expect the current and foreseeable environment to offer interesting investment opportunities for Global Macro.

Quant strategies

Quantitative strategies performed well during the month, driven by positive alpha. In terms of factors, value worked well at the expense of most other factors including momentum. For trend followers, gains in FX, fixed income and commodities outpaced losses in equities. Funds benefitted in particular from the rising USD trend, a generally short position in bonds and rising copper and zinc. The strategy has experienced a strong period since the start of the year.

Fixed Income Arbitrage

Since the start of the year, Central Banks have become more reliant on data than ever before, with every minor economic indicator having the potential to influence interest-rate decisions or alter the shape of yield curves. Consequently, market volatility has significantly decreased compared to 2023 and bond prices have been range-bound. However, unexpectedly strong inflation figures caused markets to abruptly shift from a “wait and see” approach to a realisation that “perhaps we misunderstood inflation”, resulting in global spikes in interest rates. As a result, many directional fixed-income investors were caught off-guard by the sudden surge, while relative-value traders took advantage of this volatility spike. Ultimately, potential Federal Reserve rate-cuts are now expected to be delayed until after the US election, while the ECB could potentially push the trigger earlier if need be.

Risk arbitrage – Event-driven

Event-Driven strategies, on average, were negative during the month. Merger Arbitrage strategies generally performed negatively as many spreads widened. Some stock-specific events also impacted performance, as the US FTC announced that it is suing to block the Capri Holdings/Tapestry Inc transaction, arguing that the deal would reduce competition in the affordable handbags segment. US Steel (under a bid by Nippon Steel) also drifted lower after political speeches had a negative influence on the deal spread. On a positive note, there was a pick-up in new deal-flow both in the US and in Europe as some opportunities start to offer attractive deal spreads to adjust for increased regulatory risk.

Distressed

During the last 18 months, the expectations for distressed opportunities have evolved significantly. Towards the end of 2022, the red-hot inflation levels and rapid rate-hike cycle were indicators of a distressed cycle bonanza not seen since the Great Financial Crisis. These expectations dwindled during 2023 as the economy and job market remained resilient. The opportunity set during the year was opportunistic in nature, taking advantage of specific events such as the banking crisis in the US during Q1 2023 as well as idiosyncratic situations. Currently, default levels have started to increase although expectations remain contained considering that most corporations opportunistically refinanced their outstanding debt at lower rates during the 2020-2021 period and consumers’ financial health remains relatively strong. While strategy specialists remain largely on the sidelines focusing on idiosyncratic opportunities, they remain cautious about investing in high-yield issuers and have identified cracks in specific areas such as the loan market. Some market participants have taken large debt loads through loans, usually floating-rate issues, without anticipating such a meteoric rise in short-term rates.

Long short credit

Interest rates remain wide and offer interesting opportunities on an absolute and relative basis. Strategy specialists currently have portfolios with a long bias as economic fundamentals remain resilient, Central Banks may move closer to pivot and yields across credit markets are offering equity-like returns with a higher degree of safety. Shorts are mainly used to hedge specific issuers or sectors and target certain areas of the market displaying some kind of fragility. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance as positions in AT1 issues have generated significant volatility and market losses for the investment community. It is a fact that yields have widened, restoring fixed income’s seat at the Asset Allocation table. However, risk diversification is particularly important, as recent events have demonstrated, and should be an integral part of the investment allocation process.