In our economic and market scenarios, the next stage points to lower growth and gradually lower inflation in the US by the end of 2024. Consequently, lower interest rates should follow, and we keep a long duration bias in fixed income. We expect a soft landing and are buyers of Investment grade credit and Emerging market debt since the carry is attractive in this outcome. Regarding equities, we keep a neutral stance considering the limited upside potential as several uncertainties weigh on the outlook. If risks to the outlook materialise or markets become too complacent, we would stand ready to reduce exposure.

Activity readings are deteriorating

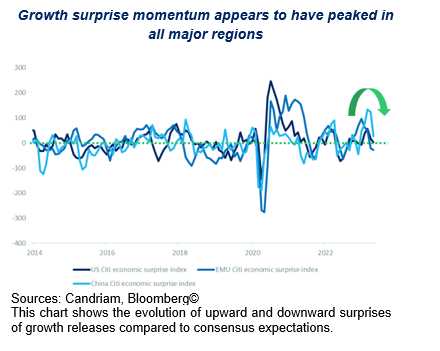

During May, it appears that the growth surprise momentum has peaked in all major regions, form the US to China via the Euro area. The start of the year was marked by a set of good news as European energy prices fell, China reopened from lockdowns and the US economy created nearly 300k jobs per month in the first quarter. This lucky streak translated into positive financial market performances as profit growth was stronger than expected.

Last month, we noted that global activity indicators have been holding up better than expected by market participants while inflation readings have decelerated as expected. While it is early to assess with certainty state that the tide has turned, we note that the recent news flow is deteriorating.

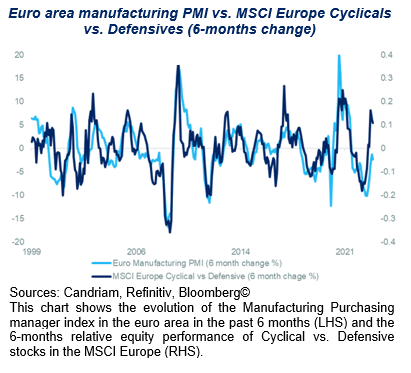

In Europe, we believe the risks on growth are on the downside, either because stickier inflation forces the ECB to hike more or because of tighter credit conditions. We register the first negative print in Economic surprises in the Euro area since early-October 2022: industrial production in France, Germany and Italy disappointed and German factory orders declined by 10.7% YoY, the most since the pandemic in April 2020, led by the car and car parts.

In the US too, several consumer and business activity indicators have started to slow, which is just what the doctor ordered: the steepest monetary tightening of the past four decades has led to a significant tightening in financial conditions in the US. Financial stability risks have resurfaced recently and represent an additional macro risk for the next stage.

At the current stage, central banks face a narrow path and will have to navigate between three constraints:

- price stability – a need to keep rates at a restrictive level for longer than currently priced to anchor inflation expectations,

- financial stability – take decisive action swiftly to avoid materialisation of systemic risk,

- economic stability – achieving a soft landing of the economy and avoid a contraction.

Keep a defensive equity bias in our portfolio

In our multi-asset allocation, we keep a neutral view on equities considering both upside and downside risks at the next stage.

We stay neutral on equities, considering the limited upside potential. Among the fundamental factors we are looking at we note rather unsupportive valuation combined with already positive EPS expectations despite an ongoing financial tightening, unseen in recent history. Hence, a constructive economic scenario seems already priced for equities, capping further upside.

On the other hand, the magnitude of the downside risk will depend on the economic slowdown. In our central economic scenario, it should be relatively limited and remain within a trading range, where last year’s low points are holding up as support.

Within our regional equity allocation, we keep a preference for Emerging markets. We expect emerging markets to outperform based on fundamental aspects. Valuations remain relatively more attractive, and Asia keeps superior long-term growth prospects vs. developed markets.

Regarding China, we acknowledge the fact that performance has been disappointing since February and the initial re-opening phase. The political risk premium has risen sharply, and the valuation of Chinese equities does not fully reflect the improvement in fundamentals this year as EPS have risen by more than 15%. Foreign direct investment flows remain negative. However, we believe that in case of additional stimulus from the Chinese government, the upside could be substantial and recover towards to end-January levels.

We are also monitoring key technical support levels on the MSCI China index, which have gotten closer, and which would lead us to reassess the investment case. To sum up, this favourable asymmetry leads us to keep our positive stance on China for now.

Harvesting carry

In our fixed income allocation, we have recently increased the duration of our portfolios and have now an overall slightly overweight duration. Our scenario sees little room for rising bond yields as central banks remain committed on price stability and the growth/inflation couple eases.

As inflation is decelerating as broadly expected, we are getting closer to the end of the rate hiking cycle. We expect that central banks will monitor carefully if household inflation expectations become entrenched before declaring their price stability mission accomplished.

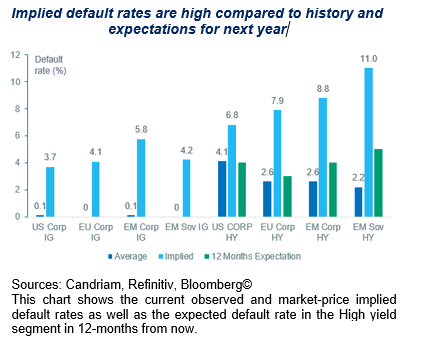

In our fixed income allocation, we are neutral on EMU duration, positive on US duration, positive on IG credit but still cautious on HY bonds. We are buyers of Emerging market bonds which continue to offer the most attractive carry and the USD is not strengthening.

We note that spreads are above historical average levels following the US banking turmoil and the tightening of the bank credit channel. It is of interest that European Investment Grade showed a strong resilience during that phase, benefiting from carry and duration.