European equities: Cyclical sectors slightly outperformed the broader market

In August, European equities closed the month a bit higher despite some volatility. The composite PMI (Purchasing Managers’ Index) came in higher than expected but the overall economic backdrop remained weak and earnings from cyclical companies disappointed.

In August, European equities closed the month a bit higher despite some volatility. The composite PMI (Purchasing Managers’ Index) came in higher than expected but the overall economic backdrop remained weak and earnings from cyclical companies disappointed.

Excluding the Olympics, euro zone core inflation stood at 2.8% and, despite weakness in growth, the labour market looks remarkably stable. This should lead the ECB to continue its rate-cutting cycle that started in early June.

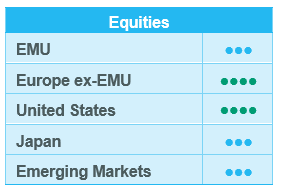

Since our last committee in August, European equities have risen, with no strong performance dispersion between small/mid and large caps. Within large caps, Value stocks outperformed Growth stocks, while there was no real difference within small and mid-caps.

Cyclical sectors slightly outperformed the broader market, with a positive performance across all sectors. The biggest outperformer was Financials, followed by Industrials, Materials and Consumer Discretionary.

Within Defensives, the Utilities sector was the clear outperformer, followed by Consumer Staples and Healthcare which were both on a good trend, while Energy remained the laggard, with a negative performance.

Finally, Information Technology was the worst underperformer, due to the continued weakness of the semiconductor segment. On the contrary, Communication Services posted a strong performance.

Earning expectations and valuations

Fundamentals remain reasonable for European equities, which benefited from positive earnings revisions.

Twelve-month forward earnings are expected to grow by c.8% and are mainly supported by growth in Technology, Materials, Healthcare, Industrials and Communication Services. On the other hand, Energy and Utilities remain the only sectors with a negative earnings growth expected in the coming months.

European markets trade at the bottom of their historical range when looking at the 12-month forward price-earnings ratio of 13.7.

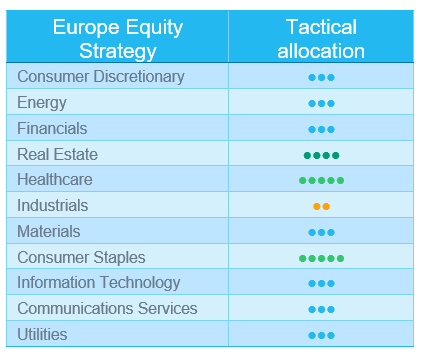

No change to sector allocation

We did not make any structural changes to our sector allocation over the past weeks.

We confirm our positive stance (+2) on Consumer staples, one of our strongest convictions in this uncertain market. Within consumer staples, we favour food & beverage and household & personal products companies. We remain cautious on food & staples retailing but last month we upgraded our rating on this sub-segment from -2 to -1 on the back of resilient EPS momentum.

We also maintain our positive (+2) rating on the Healthcare sector, as it offers an attractive risk-return profile thanks to reasonable valuations, strong cash flow visibility, and projected earnings growth.

We are also positive (+1) on Real estate (given an attractive valuation due to the ongoing rate-cutting cycle), while remaining selective, as we favour some niche segments (logistics, student houses and retirement homes) and avoid shopping malls and commercial properties.

Given the current market conditions, we believe maintaining a balanced portfolio with a defensive tilt is still the best approach.

US equities: Volatility continues into September

Despite a V-shaped recovery in August, US equity market volatility persists into September. With traditionally weak seasonal trends and the Federal Reserve's monetary policy path under scrutiny, investor focus has shifted towards potential interest rate cuts, influenced by softer labour market data and inflation readings. Given these factors and the upcoming US elections, a more neutral sector allocation, except for Healthcare, remains appropriate.

Considerable sector performance dispersion

Despite a recent downturn, U.S. equity markets have demonstrated resilience over the past few weeks, driven largely by the performance of large-cap stocks. While small caps have lagged the broader market amid persistent concerns about a potential economic downturn, sector-specific performance has been notably varied.

Consumer Discretionary, Financials, Healthcare, and to a lesser extent, Utilities, have emerged as the top-performing sectors. Conversely, communication services, materials, and energy have underperformed. While there has been a notable dispersion in sector performance, the traditional value vs. growth or cyclical vs. defensive distinctions have been less pronounced.

Healthcare and IT drive US earnings

The second quarter earnings season has been quite good in the US with over 85% of S&P 500 companies reporting higher than expected earnings growth. Finally, earnings growth came in at around 8% and for the first time in five quarters. Earnings growth was also positive when excluding the Magnificent 7.

Following those results, earnings revisions have remained positive. Investors now count on around 10% earnings growth this year and almost 16% next year, which might seem a tad too optimistic considering an economic growth slowdown next year.

It is nevertheless fair to notice that the expected earnings growth mainly comes from two sectors, namely Information Technology and Healthcare. The latter had a decent earnings season and confirmed our stance that the reset in terms of earnings expectations following the end of the Covid-19 pandemic is done. Q2 earnings for health care surprised positively, more than any other sector.

In this context, US equity market valuations have remained broadly stable.

Pre-election indecision

Since our decision to downgrade Technology to neutral and upgrade Healthcare to +1 on July 25, we have maintained our sector allocation. Despite strong technology earnings that often exceeded expectations, the market's reaction has been muted. These companies now face a higher bar for positive surprises, and disappointments are met with significant selling pressure.

Given the recent presidential polls indicating a tight race between Kamala Harris and Donald Trump, we anticipate a generally neutral market environment. In this context, our overweight position in Healthcare remains our primary conviction. This is supported by the completion of post-pandemic normalisation, realistic earnings growth expectations, the sector's defensive characteristics, and ongoing innovation.

Emerging equities

In August, EM delivered +1.4% returns (in USD) and underperformed DM (+2.5%).

The month began with a sell-off triggered by the strengthening of the Japanese Yen following the Bank of Japan’s sudden rate hike. Furthermore, July employment data in the US were weaker than expected, intensifying the fears for a hard landing scenario. The market overreactions proved to be short-lived, and Powell’s Jackson Hole speech helped ease the sentiment. He highlighted the Fed’s commitment to avoiding a weaker US job market, and “the time has come for policy to adjust”, indicating a possible rate cut in September.

China (+1.0%) continued to grapple with growth pressure. The July CPI increased by 0.5%, higher than expectations, but export growth slowed. At the end of the month, the Chinese market gained momentum on the positive anticipations in the property sector: Chinese homeowners are likely to refinance their mortgages at lower rates. On the geopolitical front, Sullivan, the US National Security Adviser, met the Chinese president in Beijing. Topics were diverse, and both emphasised the importance of maintaining a stable bilateral relationship.

Taiwan (+3.2%) and Korea (-2.8%) posted mixed results in the semiconductor sectors, but related names largely remained neutral to Nvidia’s results release, which offered few surprises. Moreover, Taiwan saw growing consumption and investments, and Korea was encouraged by resilient export growth and more positive news on the Value-up program.

India (+0.8%) maintained robust growth, gaining increased weight over China in the benchmark. The country made notable progress in rural development and is set to launch a platform to facilitate micro-credit across sectors, as part of the central bank’s digitization efforts. India benefits from one of the fastest growth rates in mobile payment worldwide, thanks to a unified platform managed by its central bank.

In LatAm, Brazil (+5.5%) saw improvement in industrial production and services, although concerns over fiscal health persist. Argentina’s economic reforms have sparked optimism about a potential reclassification into the MSCI EM benchmark.

US yields finished the month at 3.91%. In commodities, crude declined by -2.4%, while gold was up by +2.3%.

Outlook and drivers

EM equities have demonstrated a robust recovery this year, with EM countries playing a crucial role in global economic growth.

As for the Fed’s next move, Powell’s dovish stance encouraged expectations for the first rate cut in September, which can create a more accommodative environment for EM central banks to roll out easing policies.

Regionally, EM outside China have been showing notable resilience. India continues to show a lot of traction in infrastructure investments, global supply chain diversification, rise in consumption spending, expansion of financial services and housing growth. Elsewhere in EM, South Africa delivered gains on the reform expectations, and Mexico is waiting for an opportunity to be reclassified into the MSCI EM benchmark.

Taiwan and Korea are collaborating closely with US chip leaders. Despite near-term volatilities seen on the market, the demand for AI investments in the long term remains solid.

China continues to struggle with its economic outlook. The government’s guidelines remain high level, and local governments’ bond issuance proves to be lower than scheduled. The sustained deflationary trend indicates an uneven path for China’s recovery, which necessitates selectivity regarding investments in the country.

Aligned with our strategy, we dynamically calibrate the portfolio’s risk appetite in response to evolving market dynamics, when maintaining a balanced position. We are awaiting further confirmation of the US’ dovish rates policy and China’s recovery, contributing to the differential growth of EM.

Positioning update

We are optimistic on the recovery of EM equities in 2024. Fed’s potential rate and cuts and consequently a weaker USD can be supportive.

No change to our region views. China’s weakness continues, and incremental policies are perceived as insufficient. We remain positive on India for its resilience and long-term growth.

No change to our sector views. We are positive on the tech sector, being further aided by the AI development for positive revisions.

Regional views

No change to our regional views

India OW – Valuations are high, but with strong upward revisions, supported by growth and high potential returns.

China Neutral – Uncertainties over property risk, economic slowdown, and geopolitics. The market is macro-driven but the government’s accumulating small stimulus is not enough. Valuations remain attractive and selectivity is required for investment.

Sector and Industry views

No change to sector views

We remain OW in Tech / AI in the long term and diversified our exposure in the sector.