European equities: Value stocks still leading

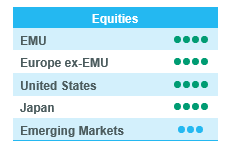

Global stock markets had a tough time in April, after a stellar performance in the first quarter of 2024. Worse than expected inflation numbers in the US, coupled with a resilient consumer, make a rate cut from the FED very unlikely anytime soon.

However, the euro zone shows a less inflationary environment, combined with the prospect of stable but slow growth, means that markets are more confident in the prospects for rate cuts from the European Central Bank (ECB) than from the Federal Reserve. The first cut from the ECB is still expected in June though there are already three cuts anticipated by year-end.

Value stocks have continued to lead European equity markets since early March by outperforming growth stocks. This value bias has been the main driver of the recent market advance.

From a sector perspective, defensive sectors outperformed the broader market over the past 4 weeks. Utilities was the top performer, followed by Consumer Staples. Separately, Healthcare also did quite well.

Within cyclical sectors, the two strongest segments were Financials and Aerospace and Defence, while Consumer Discretionary was the worst performer.

Earning expectations and valuations

In the meantime, the earnings season is soon coming to an end. Several companies in the Stoxx Europe 600 have already reported Q1 results. According to JP Morgan data, 54% of those companies was able to beat consensus revenue expectations. Consensus expectations point to an earnings growth of 6% in the coming twelve months.

On the one hand, Energy remains the only sector dragging down expected earnings with a negative expected growth in the coming months. On the other hand, Materials, Industrials, and Healthcare are leading the pack with high single-digit growth projections.

European markets are trading at the bottom of their historical range when looking at the 12-month forwards price-earnings ratio of 13.6.

Committee decisions

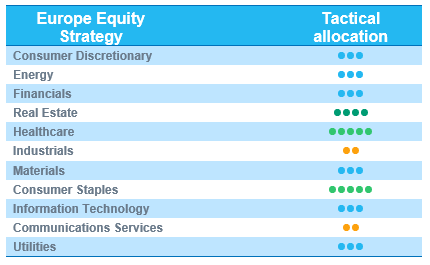

We decided to upgrade two sectors: Media & Entertainment, from -1 to neutral (due to Publicis and UMG) and Real Estate, from neutral to +1 (given an attractive valuation assuming upcoming ECB rate cuts). Note that within Real Estate, we remain selective, favouring some niche segments (logistics, student accommodation and retirement homes) and avoiding shopping centres and commercial properties.

We still remain confident in our positive stance on Consumer Staples, one of our strongest convictions in this uncertain market. Within Consumer Staples, we favour food & beverage and household & personal products companies. The Q1 earnings season has been very positive for this sector.

We have also maintained our positive (+2) rating on the Healthcare sector. European healthcare offers an attractive risk-return profile thanks to reasonable valuations, strong cash flow visibility, and projected earnings growth.

US equities: US stocks lost ground

The US equity market gave back some of its year-to-date performance, with a slight decrease in April.

This was due to higher-than-expected US inflation data, which sparked concerns in markets that the Fed might delay monetary policy easing, contrary to earlier expectations. Markets now expect only one single rate cut by the Federal Reserve this year, compared to at least three rate cuts at the end of the first quarter. As a result, the US 10-year yield increased another 30 basis points to more than 4.6%, the highest level since November 2023.

More positively, first quarter earnings were fairly good as most of the S&P500 companies have beaten earnings estimates. Communication services and Utilities were the more robust sectors, while Commodity sectors, Consumer Discretionary and Real Estate were weaker. The latter mainly suffered from the increase in long-term rates.

No clear bias between growth and defensive stocks

Since the last Equity Committee in early April, there has been no clear trend between growth and value stocks. Among large caps, growth stocks have outperformed value, while small and mid-cap value stocks did less worse than growth stocks.

All cyclical sectors have reported negative performance. The worst performance came from Materials and, to a lesser extent, Financials.

Among defensive sectors, Utilities and Consumer Staples were the clear outperformers, with a positive performance for both. Healthcare suffered from the strong underperformance of smaller biotechnology companies.

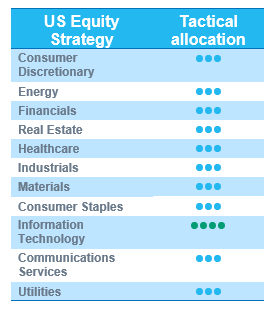

Maintained a balanced approach

We made no strategic adjustments over the last month.

As a reminder, we downgraded the Healthcare sector to neutral in early April. That decision was based purely on a top-down view, considering the current US economic strength may limit the sector’s near-term outperformance. Despite that tactical shift, our long-term view on Healthcare remains positive (drug approvals at record highs, strong M&A activity, attractive valuations appear attractive).

Emerging equities: Flat returns but outperforming Developed Markets

In April, Emerging Markets booked flat returns (+0.3% in USD), largely outperforming Developed Markets (-3.9%).

Despite a cooling economy, the latest inflation figure in the US surpassed expectations, a pressure on the Fed’s potential to cut rates. However, the Fed maintained its dovish stance, judging that the current rates were sufficiently restrictive.

China (+6.5%) posted mixed economic indicators, including stronger-than-expected Q1 GDP growth and softer-than-expected March CPI. Meanwhile, the rating agency Fitch, downgraded the country’s outlook from “stable” to “negative”. During the month, Beijing hosted a new round of visits from global leaders, including German Chancellor Scholz and US officials Yellen and Blinken. Despite Blinken’s speech about seeking stability in US-China relations, the US legislation urged China to divest from TikTok. Regarding the Chinese stock market, the performance rallied on the government’s new measures aiming at enhancing “capital market quality”.

Taiwan (-2.5%) was hit by a major earthquake and several aftershocks. Fortunately, its semiconductor hub remained largely unscathed, being far away from the epicentre. Companies such as TSMC only experienced minimal impact. South Korea (-6.0%) faced political challenges, as legislative elections put the president in an unfavourable position. Meanwhile, the Korean government is committed to pushing forward with the “Value-up” programme, releasing a complete guideline.

India (+2.2%) continued its robust performance. The country’s PMI expanded at the fastest rate in 15 years, and the IMF upgraded India’s growth rate to 6.8% for 2024-25. The Prime Minister Modi pursues a third term with an ambitious economic plan.

LatAm was particularly impacted by the Fed’s policy during the month, with both Brazil (-4.8%) and Mexico (-4.0%) posting mixed economic indicators. Brazil saw less inflation pressure, but Mexico’s further rate cutting could be a difficult decision.

Greece (+1.7%) saw its outlook raised by S&P from “stable” to “positive”. The country is leading the economic expansion in the euro zone. Turkey (+12.4%) grappled with persistently high inflation.

Outlook and drivers

Emerging Markets equities have demonstrated a robust recovery this year, while Emerging Markets countries strengthen their roles as key contributors to global economic growth.

The Fed’s plan for rate cuts is on hold due to sticky high inflation in the US. However, Jerome Powell suggests that the next rate move is “unlikely” to be a hike.

India maintains a strong growth track supported by public capital expenditure and favourable demographics. Both IMF and the Indian central bank raised the country’s growth forecast for this year. The ASEAN region, on the other hand, is shaping itself as a new hub for semiconductors, fuelled by the development of AI.

China sees signs of a possible recovery, with its manufacturing PMI expanding for a two-month streak. However, challenges persist, including the property crisis and a deflationary trend. To address these issues, Beijing plans to convene its most important economic committee in July. Concerning the stock market, the Chinese government has announced new reforms, and objectives, which, include enhancing IPO qualifications, improving corporate governance, among others.

Aligned with our strategy, we dynamically calibrate the portfolio’s risk appetite in response to evolving market dynamics, while maintaining a balanced position. We are awaiting further confirmation of the US’s dovish rates policy and China’s recovery, contributing to the differential growth of the Emerging Markets.

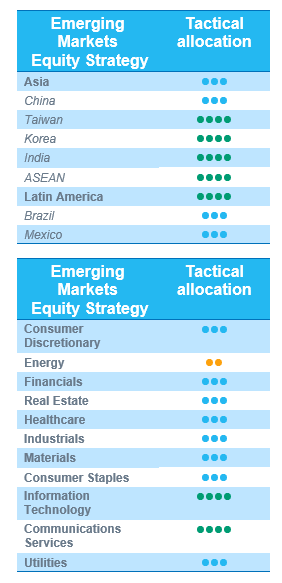

Positioning update

We are more optimistic on the outlook for Emerging Markets equities, given receding headwinds, peaking Fed rates, a weaker USD and the better performance of growth as an investment style.

Regional view: We are downgrading Brazil to Neutral. We continue to monitor Brazil as the country is under pressure as US yields remain high.

No change to our sector views. We are positive on the semiconductor recovery, which is further aided by the AI development.

Regional views

We are downgrading Brazil to Neutral

Brazil – Neutral: Brazil showed near-term weakness, negatively impacted by the higher-for-longer US rates. The easing cycle is supportive, and CPI figures are in line. GDP revisions are postive and domestic valuations are attractive. We continue to like the country.

Taiwan – Overweight: TSMC has delivered a strong performance, with Q1 sales growth beating expectaions. The company realised more progress in US capacity expansion, indicating a strong demand from US customers. TSMC also won more subsidies from the US government.

Korea – Overweight: Positive on Korean techs. We will monitor the elections and the potential impact.

India – Overwieght: Positive on the country’s long-term growth.

China – Neutral: The manufacturing PMI surpassed 50 in March, the first time in six months. The Chinese government also announced more investment in technology R&D.

Sector and Industry views

No change to sector views

We remain OW in tech and are monitoring cyclical evolution of semiconductors. We are positive on TSMC’s US expansion progress and the confirmed US subsidies.