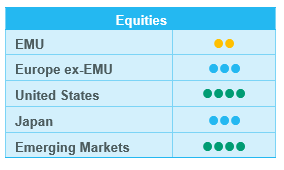

European equities: Cyclical sectors outperforming the broader market

In October, European equities closed the month lower.

European headline inflation was revised down to 1.7% year-on-year in September (from the preliminary 1.8%). The October reading however picked up to 2.0%, although this was mainly driven by energy base effects. The ECB acknowledged signs of weakening economic momentum in Europe, particularly in the manufacturing sector, while the service sector continued to see signs of solid demand.

Consequently, the ECB announced the third 25 bps rate cut of the year, taking the deposit facility rate to 3.25%.

Since our last Committee meeting in October, European Large Caps have been on a downward trend, while Mid & Small Caps have remained almost flat.

Value stocks outperformed Growth stocks, for both Large and Mid & Small Caps.

Cyclical sectors outperformed the broader market, with two sectors reporting a positive performance (Financials and Industrials), while Consumer Discretionary and Materials were slightly down.

By contrast, all Defensive sectors were in red territory, especially Healthcare, Utilities and Consumer Staples, but also Energy, which had resisted well in the previous month.

The worst performance across all sectors came from Information Technology, while Communication Services remained broadly flat.

Earning expectations and valuations

Fundamentals remain well oriented for European equities, which continued to benefit from positive earnings revisions for 2025 and 2026 in all sectors.

Twelve-month forward earnings are expected to grow by c.7% and are mainly supported by growth in Technology, Healthcare, Materials, Communication Services and Industrials. Energy and Utilities remain the only sectors with negative earnings growth expected in the coming months.

European markets are trading at the bottom of their historical range when looking at the 12-month forward price-earnings ratio of 13.8 (stable vs last month). Technology and Industrials are the most expensive sectors (P/E of 25.1x and 18.8x respectively) while Energy and Financials are the cheapest (8.0x and 9.1x respectively).

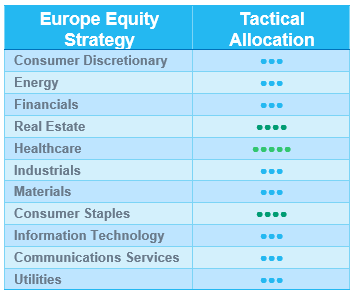

Several changes in European grades

On 6 November, we upgraded European Industrials to Neutral from -1, given the US Election results. Within this sector, we have also upgraded the Capital Goods segment to Neutral from -1. A more positive grade is not justified due to the expensive valuation of some names.

We also made the following changes during the Committee meeting (8 November):

- Consumer Staples: Downgrade to +1 from +2 due to the exposure to higher US tariffs and the potential trade war. Within this sector, we have downgraded the Food & Beverage segment to +1 from +2 and the HPC segment to Neutral from +1.

- Financials: We are keeping the sector grade at Neutral, but we have downgraded Banks to -1 from Neutral as they are fully valued and will continue to face rate cuts from the ECB. On the other hand, we have upgraded Insurance to +1 from Neutral, as this segment is more immune to the economic slowdown in Europe and benefits from strong cash-flow generation.

We have maintained our positive (+2) rating on the Healthcare sector, since it offers an attractive risk-return profile thanks to reasonable valuations, strong cash-flow visibility and projected earnings growth.

We have also kept the current grade (+1) on Real Estate, while remaining selective. We continue to favour certain niche segments (logistics, student houses and retirement homes), while avoiding shopping malls and commercial properties.

US equities: Trump to fuel shift to cyclicals

Following Donald Trump’s election as the 47th President of the United States, US equity markets surged to new all-time highs. Investors are embracing his pro-growth policies and the potential for corporate tax cuts, which would boost after-tax profits for companies. Combined with a resilient economy, monetary easing and continued earnings growth, these factors support a positive outlook on US equities and a shift toward increased exposure to cyclical stocks.

Investors rotate out of defensives

The US Presidential election has been the main market driver over the past few weeks. The outcome – Donald Trump as President and a strong showing for Republicans – has shifted investor focus from defensive stocks to cyclicals. Growth stocks outperformed value stocks, while small caps outpaced their larger counterparts.

In this environment, cyclical companies have led the way, with Consumer Discretionary and Financials outperforming. Information Technology and Communication Services also performed well, while Industrials benefited from the election of a pro-growth president.

Meanwhile, defensive sectors underperformed. Consumer Staples saw the largest underperformance, with Healthcare and Utilities also trailing the broader market. Energy fared well, however, driven by Trump’s pledge to boost oil and gas production.

Solid Q3 earnings Season

With the Presidential election in focus, the third-quarter earnings season, now entering its final weeks, may have been somewhat overlooked. Recent statistics show that nearly 85% of S&P 500 companies that have reported so far exceeded earnings estimates, achieving aggregated earnings growth of more than 7% year-on-year. As a result, earnings revisions have improved, though they remain slightly negative.

Earnings growth is mainly driven by Consumer Discretionary, Communication Services and Healthcare. Healthcare is rebounding from previous headwinds, including post-pandemic destocking, a high comparison base, supply chain disruptions and reduced vaccine production. Only three sectors –energy, industrials and materials – reported a decline in earnings.

Looking ahead, the next 12 months’ outlook may still be somewhat optimistic, with earnings expected to increase by 14%, led by Information Technology, Communication Services, Healthcare and Industrials. Not a single sector is anticipated to report a decline in earnings over the coming year.

Given these factors, valuations appear stretched but not excessively so. The estimated 12-month forward price-to-earnings ratio stands at 22, above both the five- and 10-year averages.

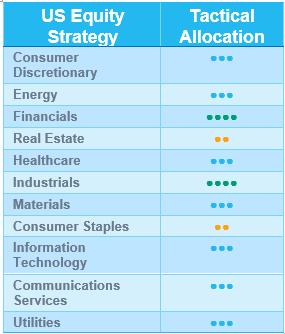

Post-election rebalancing

In light of recent market developments, we have adjusted our sector positioning.

Firstly, we have increased exposure to cyclical sectors:

- Industrials: We increased exposure to this sector, which is likely to benefit from ongoing reshoring trends and potential tax cuts following Trump’s election. Industrials should also gain from a potentially stronger economy. We hold a slight preference for capital goods.

- Financials: We also increased our exposure to US Financials. The sector may benefit from looser regulation, easier M&A activity, higher long-term rates and potentially more shareholder-friendly policies (e.g. dividends and capital returns). Valuations remain reasonable and financials are supported by solid earnings.

Secondly, we reduced our exposure to defensive sectors:

- Healthcare (reduced to neutral): While we maintain a positive long-term outlook, we have taken a neutral stance on Healthcare due to our more cyclical positioning and higher long-term rates.

- Consumer Staples: We reduced exposure to US Consumer Staples, as rising tariffs could impact the affordability of many consumer goods. Additionally, potential retaliatory measures may significantly affect US Consumer Staples companies, which on average derive 40% of their revenue from outside the US.

Finally, we also reduced Real Estate to underweight, as we believe the changing interest-rate scenario is a drag on the sector.

Emerging equities: Emerging Markets retain a crucial role in world economic growth

In October, Emerging Markets delivered negative returns (-4.4% in USD) and underperformed Developed Markets (-2.0%). Global equities were dragged by US election uncertainties, which weighed especially on Emerging Markets for geopolitics and USD strength.

The US economy retained resilience while the job market showed weakening signs. Markets expected a modest cut from the Fed in November to protect employment. A soft-landing scenario became more plausible yet not definitive given the tariff discussions raised in election campaigns.

China (-6.0%) detracted as the government refrained from detailing additional stimulus measures. Beijing reiterated support for the property market while the finance ministry indicated potential fiscal expansion. More details were expected to be announced at the NPC meeting at the beginning of November. Key economic indicators showed signs of stability, with Q3 GDP growth at +4.6% (slightly above expectations), manufacturing PMI returning to expansion and new home sales marking their first growth this year.

Exporters such as Taiwan (+3.9%) and Korea (-6.8%) experienced headwinds from weaker manufacturing orders amid geopolitical concerns. Nevertheless, Taiwan saw significant recovery, helped by robust AI demand following short-term volatilities in Q3. Korea’s inflation eased and its central bank announced a 25 bps rate cut, the first in over four years.

India (-7.8%) underperformed on investors’ redirected interest in China stimulus, with heavy selling by foreign institutional investors. In terms of the economy, the Indian government saw increasing rural demand and the Indian central bank’s dovish stance raised expectations of rate cuts in the near term. On the tech front, Nvidia signed a partnership with Reliance Industries to scale up AI infrastructure in India.

In LatAM (-5.2%), negative performance extended. Brazil (-5.6%) underperformed due to unsolved fiscal worries and rising inflation expectations (accompanied by likely higher interest rates). Mexico (-5.2%) detracted ahead of the US elections. Argentina (+14.9%) continued a positive trend, being the best market in LatAm YTD.

US yields finished the month at 4.28%. In commodities, Brent crude gained +1.9%, and gold rose by +4.2%.

Outlook and drivers

Emerging Markets equities have demonstrated a robust recovery this year, with Emerging Markets countries playing a crucial role in world economic growth. The implications of Donald Trump’s victory in the US, however, introduce potential volatility, with higher tariffs likely. The dollar uptick remains an overhang for Emerging Markets currencies. Overall, the re-elected president’s policies could exert a profound influence, not only on Emerging Markets but the broader global economy.

In China, authorities reverted to a usual approach of issuing high-level guidelines. The strong stock market rebound was welcomed but did not hold up without further details on stimulus. The wait-and-see stance could reflect an intention to be better prepared for the outcome of the US elections. More concrete messages regarding the size of the stimulus should be disclosed following an exceptional week-long meeting of the National People’s Congress – the exclusive authority in China for confirming new legislation – held in Beijing.

India is being used as a source of funding for China, but we remain confident in the country’s prospects. India continues to gain momentum through infrastructure investments, supply chain diversification and rising consumption, while Indonesia and South Africa have begun easing cycles, adding to the resilience of Emerging Markets.

In the tech sector, Nvidia is to be included in the Dow Jones Industrial Average, a milestone for AI recognition. Taiwan and Korea, both leaders in semiconductors, are collaborating with US chipmakers. Despite short-term market volatility and being a funding resource for China, the long-term demand for AI investments remains strong, reinforcing our positive outlook for these regions.

Aligned with our strategy, we are dynamically calibrating the portfolio’s risk appetite in response to evolving market dynamics, when maintaining a balanced position. We are monitoring US policy, as well as China’s potential economic recovery – fundamental factors for the outperformance of Emerging Markets.

Positioning update

No change to our regional views. We remain neutral on China and are following the progress of stimulus and the impact of the elections.

No change to our sector views. We are positive on the tech sector due to resilient demand.

Regional views:

No change to our regional views

China Neutral – China launched new stimulus including debt-raising and more support for the property market. In line with expectations. Trump impact to be monitored.

Sector and Industry views:

No change to sector views

We remain OW in Tech/AI in the long term. SK Hynix is accelerating its chip development in close cooperation with Nvidia.