European equities: Elections and soft PMIs offset rate cut boost

Global equity markets reached a new all-time high in June, driven once again by the impressive performance of Technology in the US.

Conversely, European markets fell slightly in June, after a solid May, due to soft PMI indicators and political risks (French elections).

On the positive side, the European Central Bank (ECB) started its rate-cutting cycle, with a 25 bps decrease announced on 6 June. A further cut should materialise in September.

What about european markets?

Since the last Committee, Value stocks have slightly outperformed Growth stocks, for both large and mid & small caps.

From a sector perspective, some defensive sectors outperformed the broader market over the past four weeks, especially Utilities and Energy, which rose over the period. Inversely, Consumer Staples posted a negative performance, while Healthcare remained broadly flat.

Within cyclical sectors, Finance was the only sector in the black, while Consumer Discretionary was the clear underperformer. Industrials and Materials posted a slightly negative performance over the period.

Lastly, IT/Communications remained on a positive trend.

Earnings expectations and valuations

Fundamentals remain reasonable for European equities. Positive earnings revisions have been supportive for the European market.

Twelve-month forward earnings are expected to grow by 7.4% and are mainly supported by growth in Technology, Materials, Healthcare, Industrials and Communication Services. On the other hand, Energy and Utilities remain the only sectors dragging down expected earnings, with negative expected growth in the coming months.

European markets are trading at the bottom of their historical range when looking at the 12-month forward price-earnings ratio of 13.6.

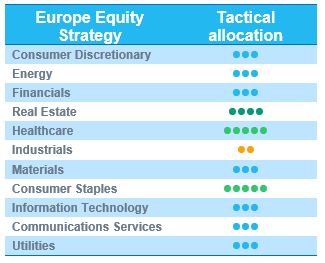

No change to sector allocation

We did not make any structural changes to our sector allocation over the past weeks.

We remain confident in our positive stance (+2) on Consumer Staples, one of our strongest convictions in this uncertain market. Within Consumer Staples, we favour Food & Beverage and Household & Personal Products companies.

We have also maintained our positive (+2) rating on the Healthcare sector, which offers an attractive risk-return profile thanks to reasonable valuations, strong cash flow visibility and projected earnings growth.

We are also positive (+1) on Real Estate (given an attractive valuation due to the fact that the ECB rate-cutting cycle started in June), while remaining selective, as we favour some niche segments (logistics, student houses and retirement homes) and avoid shopping malls and commercial properties.

Please find below the table with all our grades for Europe, sector by sector:

US equities: Large-cap growth stocks continue to lead

Global equity markets reached a new all-time high in June, driven once again by the impressive performance of Information Technology. Investors welcomed a slowdown in economic activity indicators in the US and a continuation of ongoing disinflation. In this context, long-term yields declined, supporting growth over value.

No change in year-to-date trends

US long-term yields have continued to decline over the past few weeks. Since the peak in April, the US 10-year yield has fallen by almost 45 basis points. Consequently, the US equity market has continued the trend started at the beginning of the year, with large-cap growth stocks significantly outperforming.

From a sector perspective, only three sectors outperformed the broader equity market: Information Technology, Communication Services and Consumer Discretionary. Most other sectors have essentially remained flat over the past few weeks. The US market remains highly concentrated.

Valuations: stretched, but not overly expensive

The earnings season kicked off with publications from the US banking giants. Ahead of the earnings season, investors traditionally revise their expectations downwards. Investors now anticipate second-quarter earnings growth (year-on-year) of more than 8% for S&P 500 companies, which would mark the highest year-on-year earnings growth rate reported since the first quarter of 2022.

For the coming 12 months, consensus expectations point to growth in earnings of around 13%, driven by a handful of sectors: Information Technology, Communication Services, Consumer Discretionary, Financials and Healthcare.

With this in mind, US equity market valuations seem somewhat stretched, but not overly expensive. Earnings growth remains firm, the Federal Reserve is about to cut rates and demographics remain supportive.

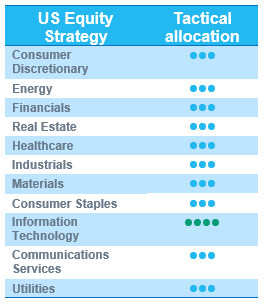

It remains sole conviction

We have not made any structural changes to our sector allocation over the past few weeks. Ahead of the US presidential elections, we believe it remains wise to limit specific sector bets. Stock selection will be the main performance driver until there is more clarity on the outcome of the presidential election.

We have maintained a positive grade of +1 on Information Technology since 17 May, and we see no reason to change it. Long-term yields are still peaking, earnings momentum remains positive, valuations are not overly expensive, and the sector is relatively well insulated from any presidential election outcomes. We remain nevertheless vigilant to any signs of a slowdown in technology growth.

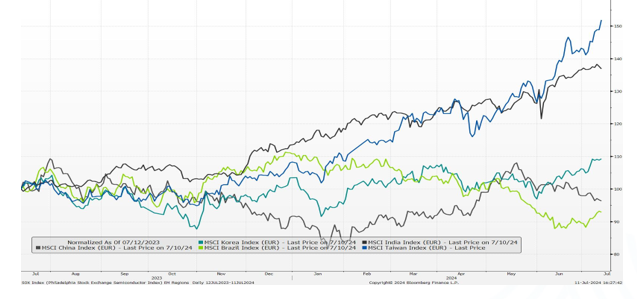

Emerging equities: Ex-China markets show resilience

In June, Emerging Markets (EM) rose by 3.6% (in USD), outperforming Developed Markets (DM) (+1.9%).

In the US, core CPI came in at +3.4% in May, the lowest since August 2021. Meanwhile, the job market showed progressive signs of cooling. The Fed continued to monitor inflation patiently, suggesting that rate cuts could become more appropriate if the deflation trend persists.

China (-2.7%) delivered negative returns. Sentiment is increasingly bearish, as indices enter correction territory. Amidst a tepid economy, the government remained undetermined on meaningful support and launched more tentative measures. For the property market, the central bank initiated a new lending plan for home refinancing and new policy relaxation could be observed in major cities. On the geopolitical front, the EU considered imposing new tariffs on Chinese EVs, which prompted negotiations with Beijing.

Export-oriented Taiwan (+11.8%) and Korea (+8.3%) were among the best performers, being central to AI development. Taiwan’s Computex high-tech show took place in June. Jensen Huang, CEO of Nvidia, was present and gave a speech detailing the AI roadmap. The event boosted the performance of a wide range of AI suppliers based in both countries. In South Korea, manufacturing PMI rose further to 52, while exports have now increased for nine consecutive months.

India (+6.9%) saw Prime Minister Modi sworn in for his third term. The victory was narrower than forecast, posing challenges in building a coalition government and raising short-lived concerns on the stock market. The new government was expected to focus more on social welfare, such as spending in rural areas.

LatAm lagged during the month. Brazil (-4.5%) delivered negative returns. The country’s easing cycle was interrupted, with the fiscal side under pressure. Mexico (-11.3%) underperformed, largely due to election news. The leader of the leftist party, Claudia Sheinbaum, was elected president, with ample power to implement her agenda. In Argentina, President Milei’s pro-business reforms were approved by Congress.

Turkey (+0.1%) booked flattish returns, consolidating strong annual gains. South Africa (+9.4%) formed a new coalition government. The new government is expected to be more oriented towards economic reforms.

Among commodities. crude oil rose by 5.9%. OPEC continued to cut production. The returns on gold were flattish, and silver fell by 4.0%. US yields finished the month at 4.36%.

Outlook and drivers

EM equities have demonstrated a robust recovery this year, with EM countries playing a key role in global economic growth.

Regionally, EM outside China have shown notable resilience. India continues to show a lot of traction in infrastructure investment, global supply chain diversification, the rise in consumer spending, the expansion of financial services and housing growth. The World Bank projects 6.7% growth for India’s GDP in 2024-26.

Taiwan and Korea are collaborating closely with US chip leaders, heralding a new “era of robotics” according to Jensen Huang, Nvidia CEO. Elsewhere, southern Asian countries are also actively positioning themselves as the latest chip hubs.

The IMF has slightly upgraded China’s 2024 GDP outlook. China’s property issues have eased following the government’s more proactive approach. Beijing is mulling policies to help local governments digest excessive housing inventory. More measures are expected at a high-level economic committee planned in July (“Third Plenum”). Nevertheless, recent PMI figures have highlighted an uneven path for China’s recovery, and the need for selectivity regarding investments in the country.

Aligned with our strategy, we dynamically calibrate the portfolio’s risk appetite in response to evolving market dynamics, when maintaining a balanced position. We are awaiting further confirmation of the dovish US rates policy and China’s recovery, contributing to EM differential growth.

Positioning update

We are optimistic about the recovery of EM equities in 2024. We are positive about the tech sector, especially AI.

No change to our region views. China rebounded again, but deflation and property issues continue. We remain positive on India post elections. We remain neutral on Mexico post elections.

No change to our sector views. We are positive on the tech sector, with further support provided by AI development. We are cautious about the valuations and are monitoring rotation possibilities.

Regional views:

No change to region views

India OW – Prime Minister Modi was re-elected. The country’s growth potential remains encouraging. The fast-changing market is revealing many new opportunities. In addition to our existing preferences, we also like themes such as rural recovery and financial inclusion.

China Neutral – The market rebounded on the back of new stimulus. China’s economic issues persist. More policies are expected at the “third plenary session” in July.

Mexico Neutral – The market saw post-election corrections. We maintain our neutral stance on Mexico. We prefer export-oriented business in the country.

Sector and Industry views:

No change to sector views

We remain OW in Tech / AI and are monitoring AI-related names for their rich valuations. We expect to gain more insights from the coming earnings season and are slightly rotating into laggards on the Taiwanese and Korean markets.