Investing in water: a no-brainer for the future

Why launch a dedicated water strategy?

Demand for water has increased steadily since the Second World War. Population growth, increasing industrial needs and growing food production are all factors driving this demand. Progress in improving the way water is used has done little to halt this trend. But resources are limited, exacerbating the imbalance between supply and demand. Today, we can see that water shortages are becoming more acute in certain regions and at certain times of the year.

Against this backdrop, the ecosystem of companies operating in the global water market remains highly dynamic. All the more so because our water needs are constantly evolving in line with regulatory changes, climatic challenges and, unfortunately, new sources of pollution. We have therefore adopted a strategy aimed at capturing the opportunities presented by this theme by investing in companies that offer innovative solutions to the challenge of water management. We invest in companies that offer solutions to improve our water supply, as well as those that are committed to using this resource more efficiently.

What is your outlook on this issue?

It is reasonable to expect that water consumption will continue to grow, as the main factors that have driven water demand since the Second World War are still in place: urbanisation, demographics, agricultural demand, business needs, and so on. The world's urban population facing water scarcity will increase sharply, from 933 million in 2016 to between 1.7 and 2.4 billion by 2050[1]. What's more, the expected tightening of regulations related to climate change will encourage companies to change their water management practices, even though no one is currently paying the true price for this resource.

As a result, the global water market is expected to grow at an average rate of 5% per year between 2022 and 2030, surpassing the $1.1 trillion mark[2]. Some segments of this market have even higher growth potential: around 12% per year between 2022 and 2027 for smart water meters, between +10% and +20% by 2030 for desalination, and an increase of 15% per year by 2030 for activities that enable cities to transition to smart water management systems, including infrastructure monitoring, conservation and leak detection[3].

What companies do you invest in?

Our investment strategy goes beyond the usual focus on Water Utilities and Industrial Equipment. We screen the entire value chain, from

- Treating Water (Analysis, Filtration, Certification…),

- Supplying Water (Networks, Equipments …),

- Protecting Water (Smart Agriculture, Water energy solutions…)

- Using Water (ie the most efficient companies that integrate water management into their risk strategy and significantly improve the use of this resource in their industrial processes)

This has the advantage of providing a wider and more diversified set of investment opportunities, from Utilities to Pharmaceuticals, Chemicals or Semiconductor manufacturing.

How do you choose which stocks to invest in?

We carry out in-depth proprietary research using a wide range of tools. In order not to miss any opportunities, we have set up a systematic screeningprocess, using artificial intelligence, notably for companies active in the water treatment, distribution and conservation. In close cooperation with our Environmental, Social and Governance (ESG) Team we have developed powerful proprietary analysis tools allowing a precise mapping of companies’ water risks, notably through GPS coordinates, in order to select the water efficiency leaders across different sectors

We narrow down this initial selection through a detailed review of their activities, engaging with management teams whenever required to better appraise their relevance to the theme. As a result, we have developed a highly-targeted universe of stocks that are relevant to our investment theme. These companies are selected on the basis of their value creation potential, risk profile, management quality and growth prospects. Our strategy has a long-term perspective, which makes a low-turnover buy-and-hold approach[4] most appropriate for this theme.

Are water-related companies profitable?

The companies at the heart of this theme have below-average sensitivity to economic cycles. As a result, their financial results are less volatile. What's more, the sustainability of this investment theme over several decades means that companies can implement prof itable investment plans to better meet growing demand f or their products or services. Our aim is to invest in companies that are not only at the heart of the issues, but are also prof itable.

Our aim is to invest in companies that are not only at the heart of the issues, but also demonstrate both sound ESG characteristics and an attractive financial profile, with our fundamental analysis attaching great importance to value creation.

What makes Candriam different in this respect?

First, Candriam has recognised expertise in managing thematic and ESG investment strategies. We capitalise on the know-how of our expert teams.

We use this know-how and our expertise in this water theme with the latest tech innovation like Artificial Intelligence and GPS mapping of companies’ water risks.

Another distinctive element of our strategy is the diversification effect of the ‘efficiency leaders’ category.

We also invest in small caps companies operating in specific areas related to water management, which cannot be included in very large strategies.

lorem ipsum

Investing in water: a no-brainer for the future

Bastien Dublanc, Tanguy Cornet and Anaelle Stamatiou, managers of Candriam’s water investment strategy, explain why they invest in this theme, how they select their stocks, and what differentiates Candriam from other investment managers in this area.

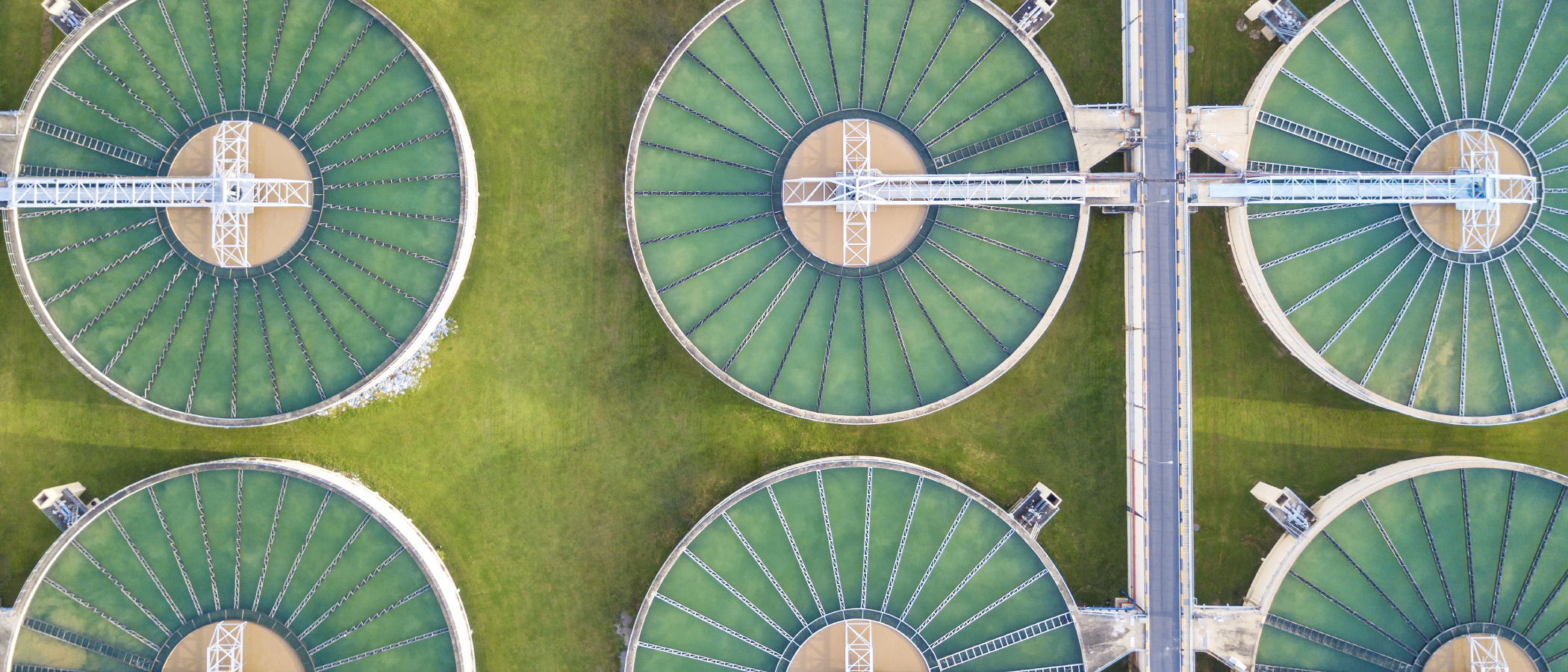

Water: preserving the flow of life

[1] The United Nations World Water Development Report (2023).

[2] Verified Market Research, Statista 2023, BCC Research, August 2021

[3] Energy Recovery Inc, WISE Freshwater (2023), Kang et al. (2017), Puust et al. (2010), MarketsandMarkets

[4] An investment strategy in which an investor buys securities and holds them for a long period of time.