Although navigating by the stars can seem brave and adventurous, we would not recommend it on financial markets. Better be equipped with a solid compass ! In a world that is constantly changing, investors need guidance in their asset allocation decision-making. With these long term forecasts, we are enriching their toolbox for portfolio construction.

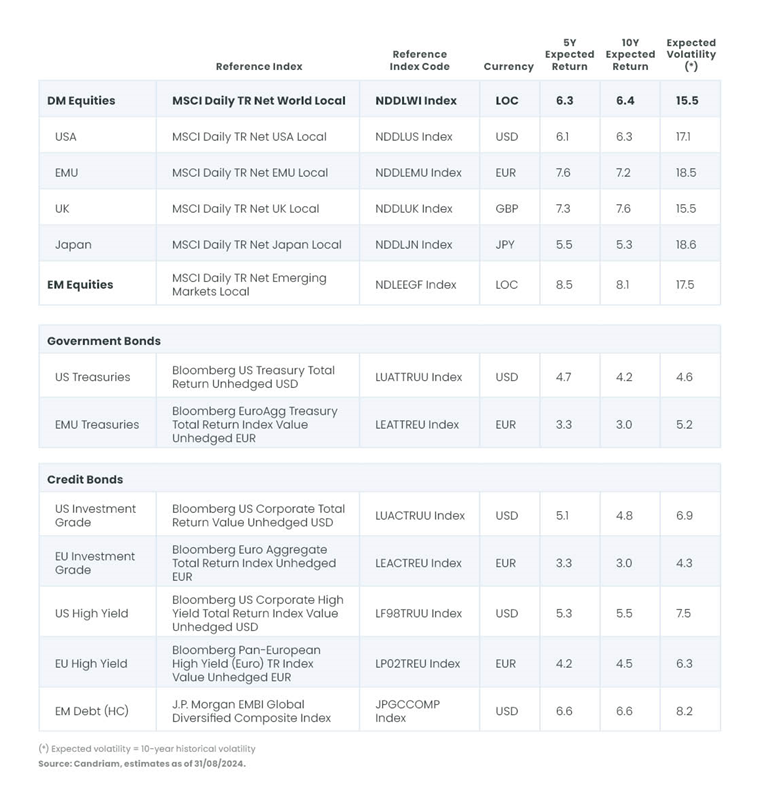

;

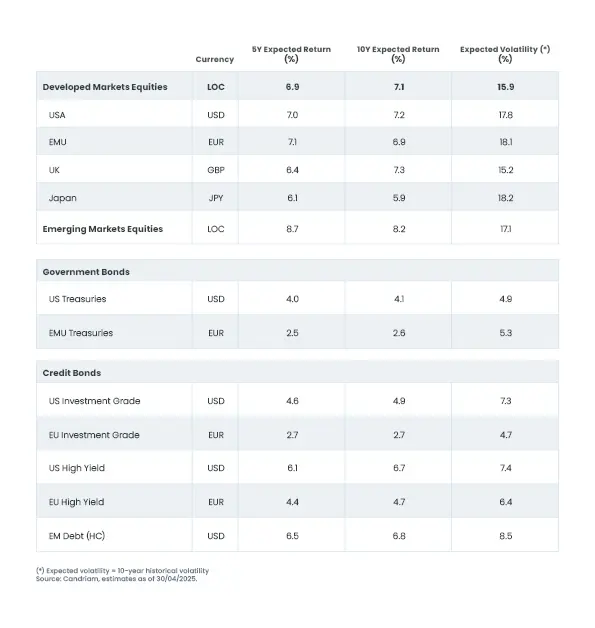

;