The investment landscape is evolving against a backdrop of rising economic uncertainties and a cautious market environment, further complicated by geopolitical tensions and upcoming elections. In this context, the traditionally defensive healthcare sector is likely to attract investor interest. As the challenges posed by the peak of the pandemic recede, new opportunities are emerging, particularly in the fast-developing field of oncology.

Here are five compelling reasons to consider investing in the oncology market today:

1. Thriving in a Defensive Market:

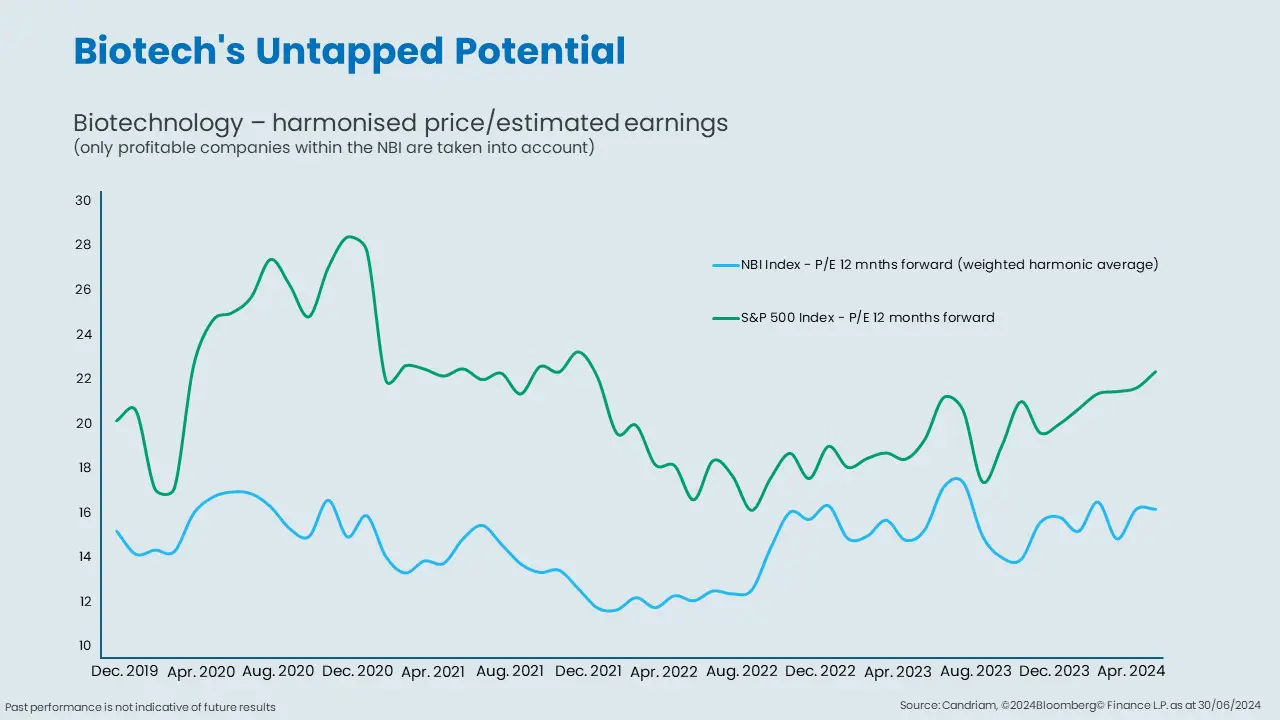

Historically, the healthcare sector has demonstrated stable earnings growth with little sensitivity to the macroeconomic environment. As the economic tide turns, the defensive nature of healthcare is likely to become potentially more attractive to investors seeking stability. Historical data at an industry level broadly suggests that biotechnology companies tend to perform relatively well during periods of Federal Reserve interest rate cuts, though individual company performance can vary[1].

2. Innovation Ignites Growth:

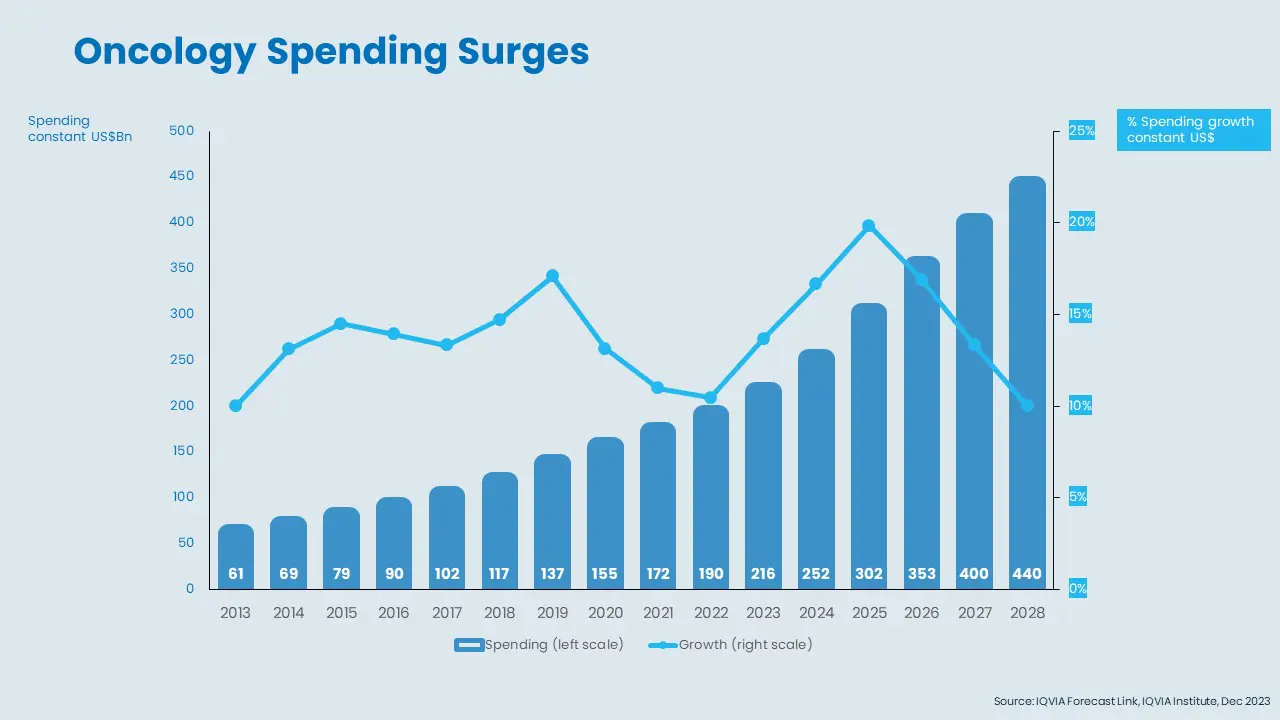

Oncology tends to be a powerhouse in healthcare, already the largest therapeutic area. It is forecast to grow at an annual rate of 15% to reach $440 billion by 2028[2]. This robust growth is being driven by a large pipeline of promising new drugs and increasing demand for personalised treatment options. Investors seeking exposure to breakthrough advances will find fertile ground in the oncology market.

3. Mergers & Acquisitions Fuel Momentum:

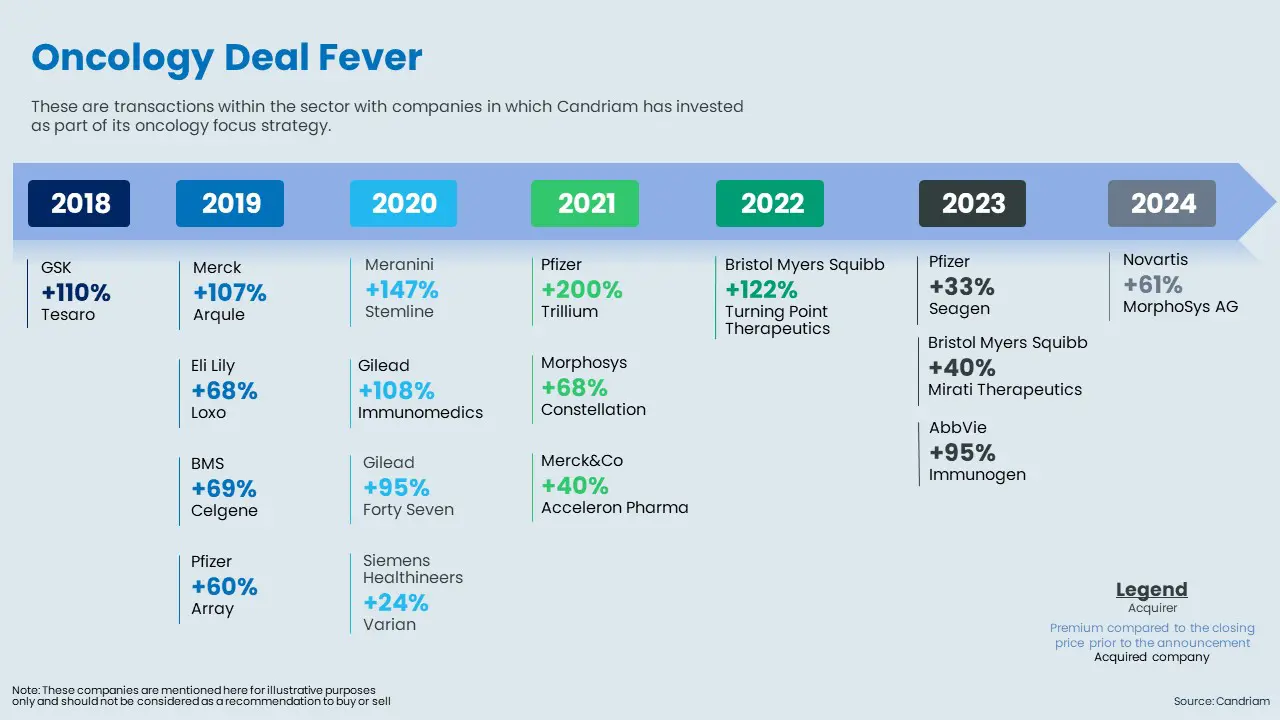

The oncology market continues to be the leading therapeutic are for M&A activity[3]. This deal flow is indicative of the immense potential and strategic value that established players see in the space, as exponential growth in demand could see a steady stream of new assets come to market, providing potential prime deal opportunities for biopharmaceutical companies looking to replenish lost revenue streams in anticipation of impending patent expirations. Investors could capitalise on this trend by focusing on companies well positioned as potential targets.

4. Attractive Valuations Across the Spectrum:

While the broader market may face valuation concerns, the oncology sector tends to present an opportunity. Device companies and smaller biotechnology companies are particularly attractive.

5. Long-Term Trends Remain Unwavering:

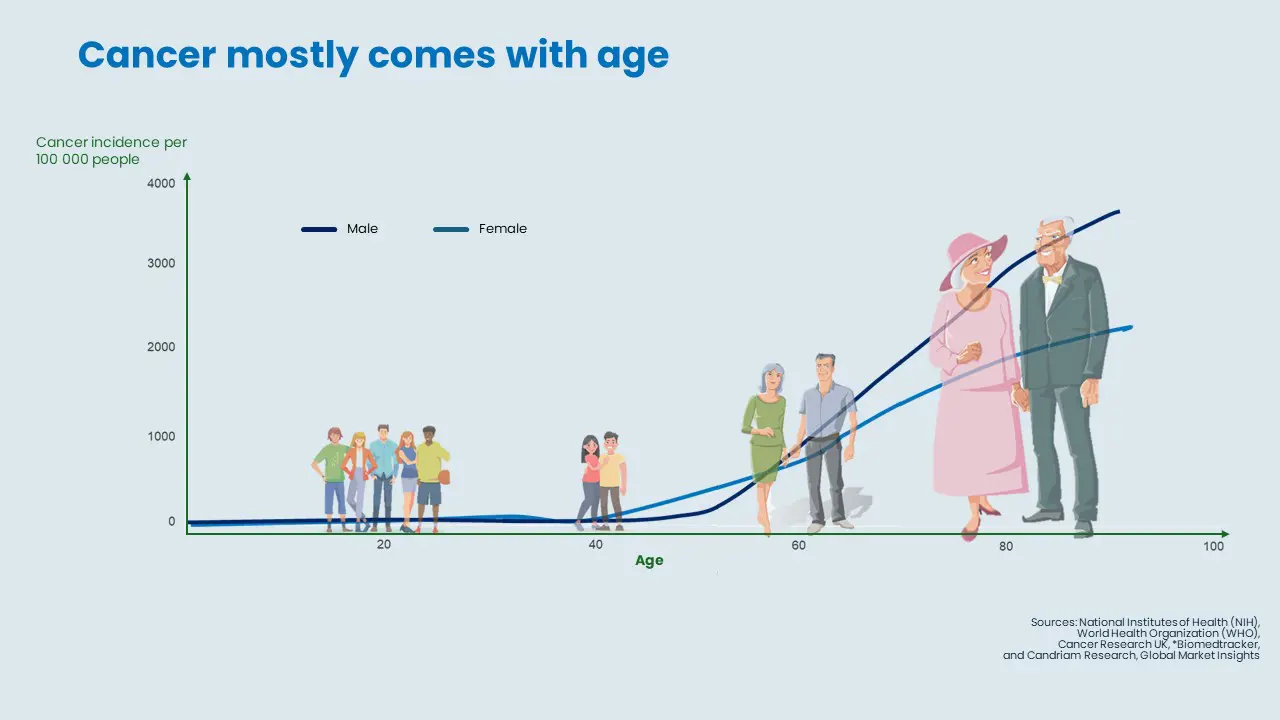

The fundamental drivers of the oncology market remain firmly in place. As the global population ages and lifestyle-related diseases become more prevalent, the demand for effective cancer therapies will only increase. This long-term growth story provides investors with a solid basis for their investment decisions.

The investment headwinds of the pandemic era, such as the high comparator base, temporary supply chain issues and a decline in vaccine production, are beginning to fade. While the technological advances of recent years will undoubtedly be incorporated into the future of medical care, the core drivers of the oncology market - an ageing population and continued innovation - will return to centre stage in the mid-term. This could be an opportunity for investors to position themselves for long-term success in this dynamic and life-saving sector.

Looking for a oncology fund ?

Our expertise

-

Want to Learn More About Oncology?

Dive deeper into our oncology expertise on our dedicated webpage

-

Candriam Institute

Want to know more about our fight against cancer?