The healthcare and biotechnology sectors have experienced a downturn following the unexpected nomination of Robert F. Kennedy Jr. as Secretary of the Department of Health and Human Services (HHS). This key position oversees a $1.7 trillion budget, more than 80,000 employees and critical agencies such as the FDA, CDC, NIH and CMS (Medicare/Medicaid). Kennedy's nomination, which requires Senate confirmation, creates significant uncertainty due to his critical stance on some segments of the drug and food industries, although his specific policy impact remains unclear.

Market Reaction: Defensive Moves Amidst Uncertainty

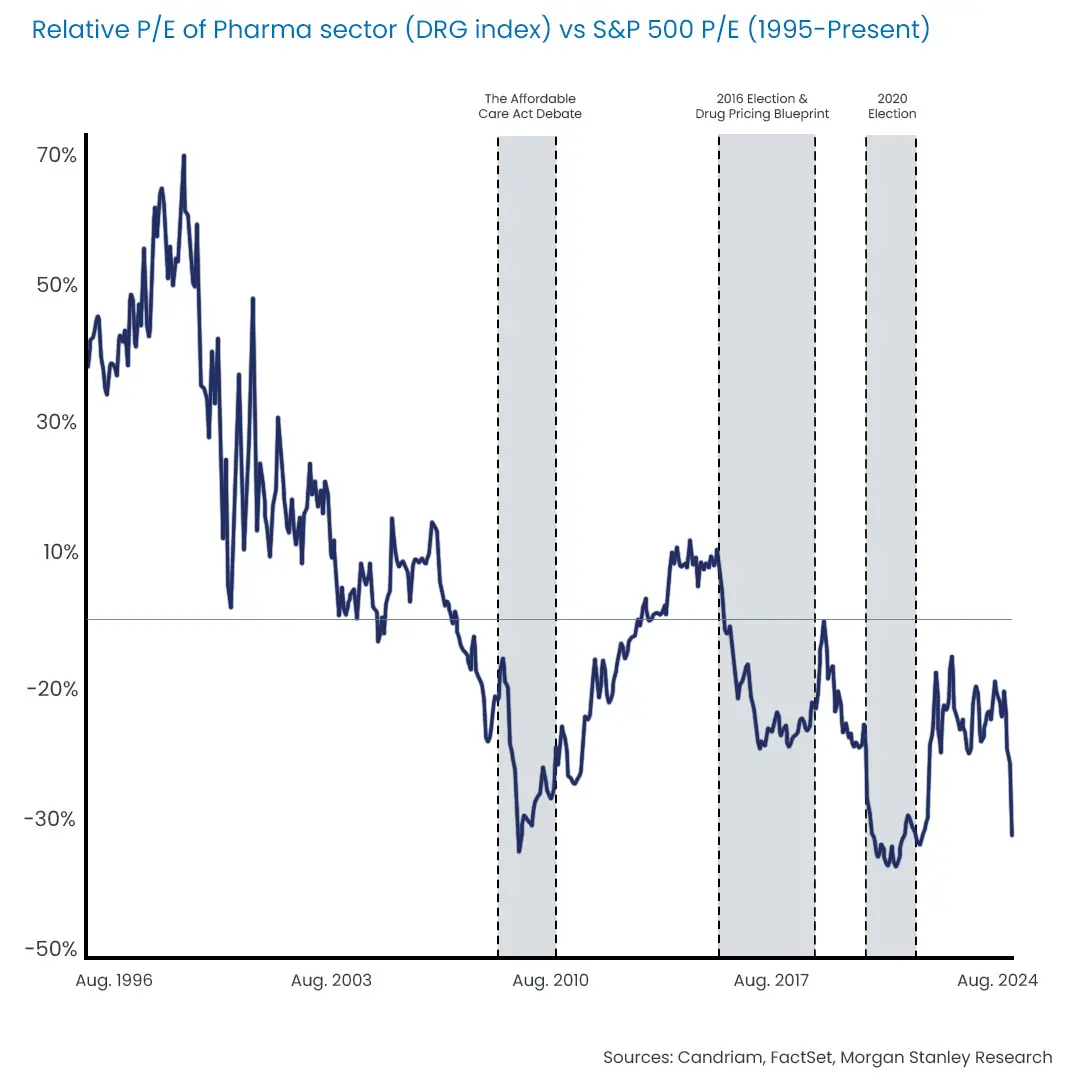

In times of uncertainty, markets tend to react defensively. Investors have de-risked their positions and adopted a "shoot first, think later" approach. However, it's important to remember that healthcare and biopharmaceuticals are vital sectors for the US economy and provide significant employment. Historically, the sector has reacted strongly to potential policy changes, as seen during Trump's election in 2016. However, initial fears often do not translate into long-term impacts as severe as feared.

Senate Confirmation Prospects

Kennedy's confirmation is uncertain. Although the Republican Party holds a majority in the Senate, some Republican senators may oppose his views, leading to a potentially close vote. An alternative, though unlikely, route could be a recess appointment, but this faces significant legal challenges, as seen during the Obama administration.

Timeline for Clarity

We expect the Trump administration to move quickly after taking office on 20 January 2025, with a Senate vote likely to follow within one to two months. In the meantime, we may learn which Republican senators may oppose confirmation.

Kennedy's Healthcare Priorities

Kennedy has outlined his healthcare priorities on the Make America Healthy Again (MAHA) website and in a Wall Street Journal editorial. Key issues include:

- Addressing the chronic disease epidemic: Emphasising prevention by addressing environmental toxins, poor nutrition and inadequate health care.

- Aiming for greater transparency in government agencies and reducing the influence of industry. He points to a number of specific measures, such as no longer allowing industry to pay a fee for submitting drugs to the FDA and funding the FDA in other ways, or ensuring that members of advisory committees do not receive significant income from industry.

- Promote sustainable agriculture and environmental health: Linking these areas to overall health improvements.

- Ensuring fair drug pricing: Continuing efforts to make drugs affordable and more in line with other developed countries, a focus also seen in the Biden administration.

He has been critical of vaccines, although he recently stated that he would not deny vaccines to anyone.

Valuation Opportunities in Pharmaceuticals

Amid this period of uncertainty, the pharmaceutical sector may offer a potential silver lining. As the chart below shows, the NYSE Arca Pharmaceutical Index is trading near historic lows in terms of price-to-earnings ratios relative to the S&P 500 Index. This could provide an attractive entry point for investors seeking value in a historically resilient sector.

Past performance is not a guide to future performance

Focus on Oncology Strategy

Our Oncology strategy performed in line with the healthcare sector until the announcement of RFK as HHS Secretary. Thereafter, the Biopharma segment, which is overweight in the Oncology strategy, underperformed the broader healthcare sector. However, within biopharma, oncology names were not disproportionately affected and performed similarly to the rest of the segment.

We continue to see oncology as an attractive opportunity within biopharma. As the largest segment in the industry, it attracts around 30% of R&D investment and has robust growth prospects. According to IQVIA, the oncology segment is expected to grow in the mid-teens.

Looking Ahead

Although the healthcare and biotechnology sectors are currently experiencing a period of heightened uncertainty, history shows that initial fears often give way to more measured responses. Markets are reacting defensively and this uncertainty may persist for several months. However, if we look back to 2016, markets initially reacted negatively to Trump's healthcare policy announcements, only to rebound strongly the following year. While history doesn't exactly repeat itself, it often rhymes, suggesting that the current administration is likely to take into account the sector's critical role in the US economy.