With 2024 underway, many bond investors are still wondering how the environment for Emerging Markets debt will differ from that of 2023..

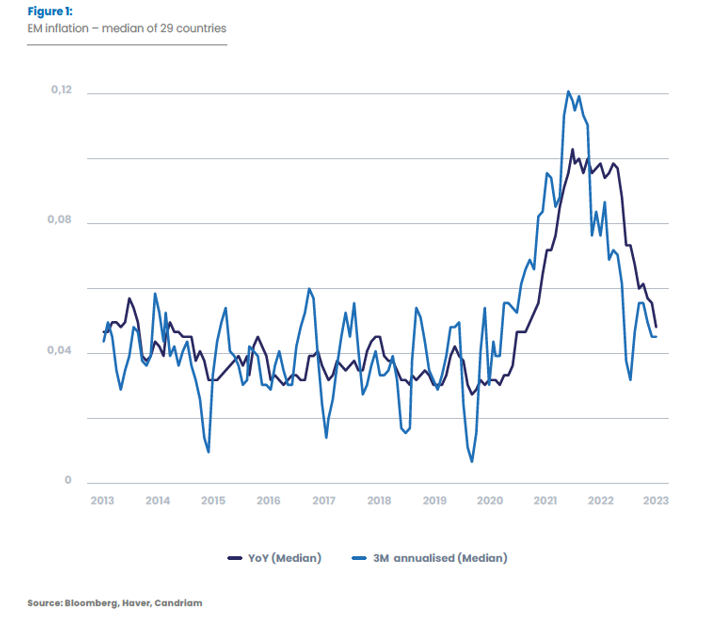

Indeed, it looks more benign for Emerging Market Debt …. But far from simple. Inflation is moderating, and this time around, the Emerging Markets are ahead of the Developed Nations – inflation is slowing sooner, and more rapidly, in EM countries than it is in the US or Eurozone.

So how should you position your EM bond portfolio?

Should the focus be on local currency or hard currency debt? Are valuations and technicals favourable? As active manager, in which sector do we see the best opportunities for us to create alpha for your portfolio? And what can we expect in terms of returns?

Those are probably the questions for which you’re still expecting some answers.

And if the geopolitical situation remains the main risk in our scenario today, what would be the impact of a recession in developed countries?

”Valuations are concentrated in the higher-yielding segments, so differentiation and due diligence of emerging opportunities remains critical to extracting alpha

-

Want to know more?

Read our detailed 2024 EMD outlook here:

-

How different did it seem a year ago?

Look back at our 2023 EMD outlook here:

As always, risks for our Emerging Market Debt strategies include the risk of capital loss, interest rate risk, credit risk, currency risk, emerging market risk, high yield risk, derivative risk, and in some cases, counterparty risk.