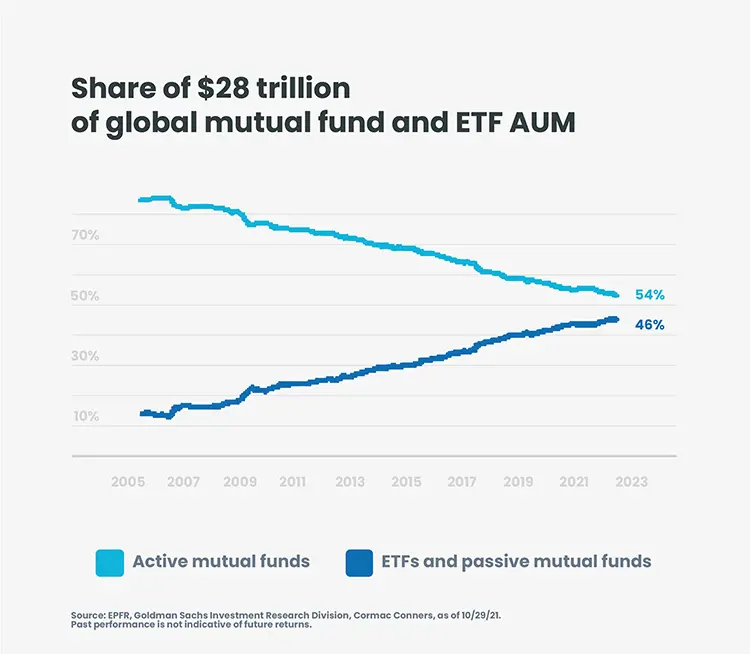

Index investing continues its “unstoppable” rise and is expected to overtake active investing by 2026 at the latest, according to Bloomberg1. This trend can be utilised by some equity market neutral strategies to generate returns uncorrelated either to bonds or equities.

Index funds have become increasingly popular with investors who want to have a cost-effective exposure to a specific market. They have a particularly significant presence in the most efficient equity markets – they make up over a half of fund assets investing in the US, for example2. Most equity index funds aim to replicate a particular equity index.

Global equities: Passive vs Active

Source: EPFR, Goldman Sachs Investment Research Division, Cormac Conners, as of 10/29/21.

Source: EPFR, Goldman Sachs Investment Research Division, Cormac Conners, as of 10/29/21.

Index funds have become a hugely important force in financial markets. Because of the enormous size of assets under their management, their trading activity can have measurable effect on stock prices.

Always catching up to be instep

Index funds’ key objective is to replicate their underlying indices as closely as possible. To achieve that, they tend to rebalance their funds at particular times to coincide with the regular changes in the composition of their underlying indexes.

As we mentioned before, the funds’ large trades often affect equity prices, particularly at times when liquidity is limited. We believe that market neutral strategies have the ability to generate lowly correlated returns by providing liquidity to index funds.

Index funds have had huge success evidenced by impressive asset growth and yet, given their very specific objectives, their ways of operation remain unchanged. They are governed by very strict rules as to what securities they can buy, how many and when. This means that they have the same trading schedule and constraints but with more assets to trade. That is why they increasingly require other market participants to accompany them in their growth.

The importance of liquidity

For any major equity index, there are several very large index funds that aim to replicate it. This means that every time a constituent company leaves an index, or a new company enters it, it triggers a number of large simultaneous trades by all those index funds - either all to buy, or all to sell.

Typically index funds need to complete their transactions within a limited period of time, usually during the day of the effective addition. For example, when the index admits a new constituent stock, buy instructions issued by index funds that replicate it create a local and strong demand pressure. In turn, this often leads to a significant increase in the stock’s share price if buyers cannot easily find available shares to buy. Similarly, when a stock has to exit an index, large sell orders executed around the same time can result in a significant, albeit temporary, drop in the price of that stock.

How can equity market neutral strategies profit?

Depending on the market and the timing of the index change, a market neutral strategy can provide liquidity by taking specific positions by the day of the effective change in the index. The aim of the exercise is to dispose of the maximum capacity to match the trading flows of index funds on the “D-day”.

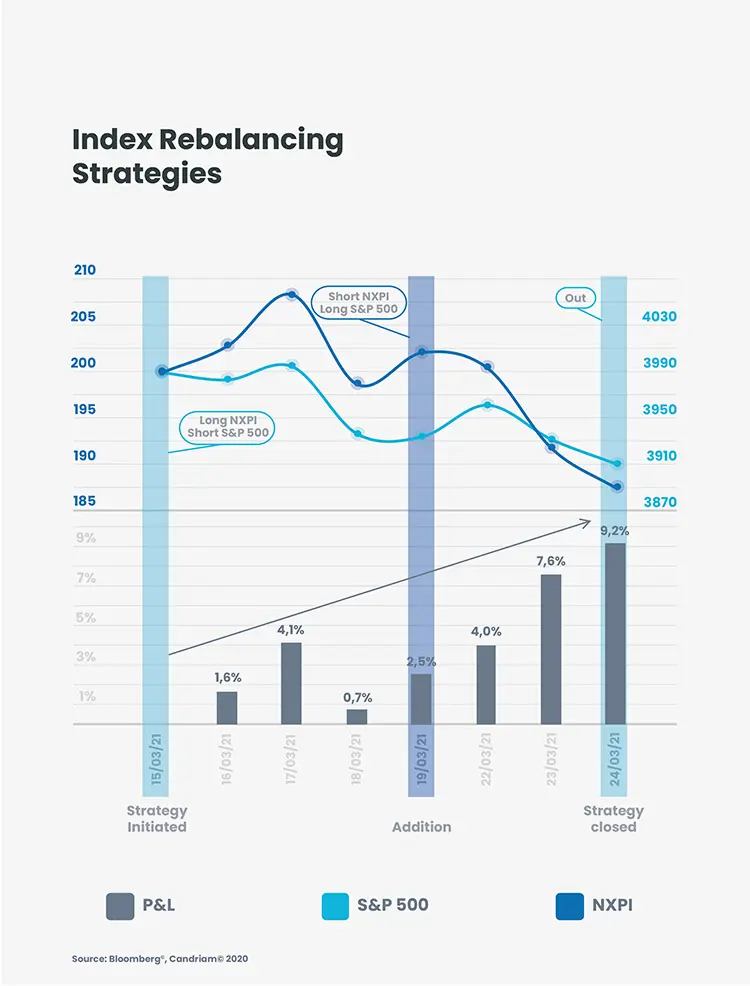

For an illustration, we took a case study of a recent addition to the S&P 500. As the addition of the stock is effective on 19 March, most of the passive funds that replicate the S&P 500 had to buy the stock on the same day. Investors providing liquidity sold the stock to meet that demand. An equity market neutral strategy utilised this in two ways. First, it unwound its long position and, second, opened a short position on the same date. This ensured that equity market neutral strategy was able to balance the pressure that index funds were exercising on the stock.

Market neutral strategies will always neutralise their market exposure by maintaining an appropriate hedge either against a whole index or particular stocks. This way they are able to benefit from their specific long or short positions without being dependent on market direction.

Case study

Announcement of NXP Semiconductors© addition in the S&P© 500 on 12 March 2021

Effective addition on 19th March 2021

Example of strategy implementation

March 15th long NXPI© / short S&P 500©

March 19th short NXPI© / long S&P 500©

March 24th strategy closed

Source: Candriam, December 2021.

Source: Candriam, December 2021.

The stock we used as an illustration in this case study is a typical example of the kind of market situations that we see throughout the year, involving different types of companies from every sector. Hence, in the course of a full year, our strategies would have typically had a broad and diversified exposure across our different markets and sectors.

Over the coming years, we expect index investing continue to growth and so we are confident that equity market neutral strategies will retain their relevance for investors.

1 https://www.bloomberg.com/professional/blog/passive-likely-overtakes-active-by-2026-earlier-if-bear-market/

2 https://www.bloomberg.com/news/articles/2021-11-24/active-v-passive-why-it-s-not-that-simple-anymore-quicktake