Uncertainties on US and European financials have replaced the better economic growth outlook in investor’s minds. Suddenly, the improvement in activity is now mitigated by financial vulnerabilities and inflation stickiness. Empirical evidence reminds us that financial stress is part of tightening cycles and central banks will adjust their monetary tightening to financial developments. Central banks therefore face a difficult task as there is no easy trade-off in their role of ensuring both financial stability and price stability. In this volatile market context, we continue to navigate using the following guidelines: after reducing our equity positioning to neutral in February, we have increased fixed income duration to neutral in March. In the case of complacent financial markets, we would stand ready to reduce risk further. On the other hand, a pronounced market sell-off would likely open new investment opportunities in the medium term.

A question of confidence and of central bank credibility

The action of the authorities to maintain public confidence in the banking system and the speed with which the recent crisis is resolved are key for our investment scenario. While we continue to believe that our main scenario (i.e. slow growth, both in the US and euro area) remains the most likely, we must acknowledge that the risk of a much more adverse scenario has increased.

- In Europe, Credit Suisse was the weak link. While the bank was systemically important globally (G-SIB), its situation was known to be unrepresentative of the banking sector in Europe. Contagion risk should now be limited following its acquisition over the weekend. The swift takeover by UBS was the only short-term solution. A muddle-through would have caused more stress and uncertainty on financial markets and could have led to a bank resolution, the worst-case scenario for markets.

- In the US, the stress on small banks increases the risk of recession but does not yet appear to be systemic. The impact on the economy will of course depend on the depth and length of the shock. Broadly speaking, declines in bank credit via tighter lending conditions could amount to 0.5-1% of GDP).

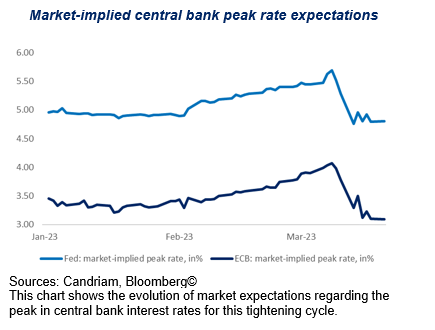

Central banks will adjust their monetary tightening to financial developments. While their determination to fight inflation remains untouched, the current trade-off between inflation and financial stability should lead them to slow the pace of their tightening – or even stop tightening – as long as financial turbulences are ongoing. This is what the market is telling us.

Financial worries cap monetary tightening

In our fixed income allocation, we have increased the duration of our portfolios and now have an overall neutral duration. We maintain a preference for Investment Grade credit but are more cautious on High Yield bonds.

Central banks face a difficult task, as there is no easy trade-off in their role of ensuring both financial stability and price stability. While disinflation – and favourable base effects – are underway, there is still “more work to do” as inflation numbers remain stubbornly high.

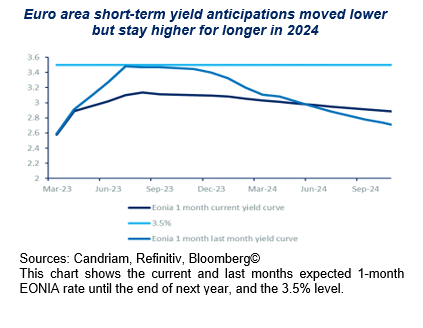

We have already noted market pricing of a lower central bank terminal rate on both sides of the Atlantic compared to recent months, as central banks try to manage price and financial stability risks simultaneously. Ultimately, this should help cap the level of rates and underlying volatility and therefore support fixed income markets. Also, central banks will now focus on evaluating the lags between policy-tightening and the real economy.

Both upside and downside risks in a binary situation

In our multi-asset allocation, we maintain a neutral view on equities, considering both upside and downside risks.

Regarding style allocation, we have a preference for quality in the markets. Investors will prefer structural growth over cyclicity for now, given the risks financial vulnerability poses to growth. We shall therefore prefer the following sectors: Healthcare (globally and particularly US) and Staples (with European leaders). We also favour innovative companies and/or quality (profitability, visibility and solid solvency).

Regarding the banking sector, we still prefer European banks with very high solvency and high profitability. These two buffers allow them to withstand higher shocks. We also have a focus on retail banks, particularly because a higher proportion of retail deposits offers better stability and a higher liquidity than investment banking models. We note that higher short-term rates provide the sector with a higher profitability, even accounting for higher potential solvency requirements.

Our regional equity allocation maintains a preference for Emerging markets. We continue to expect emerging markets to outperform, as valuations remains relatively more attractive while Asia continues to have superior long-term growth prospects vs developed markets. The reopening is unfolding in China, with significant pent-up demand and household excess savings to be deployed, and should drive emerging markets. This implies that we expect a potential positive spill-over on inflation and commodity prices. Last but not least in the current context of financial vulnerabilities, there is no monetary headwind ahead in the region.

In our view, US equities have already priced in a better economic outcome than the slow growth we expect. Valuation is currently not supportive and restrictive financial conditions could weigh on growth prospects, which is increasingly reflected in downward revisions for profit growth. Upcoming economic data and Fed guidance will be key triggers going forward.

In Europe, valuation and upward earnings revisions have now largely repriced the positive newsflow of recent months, including lower energy prices, Chinese reopening and easing of bottlenecks.

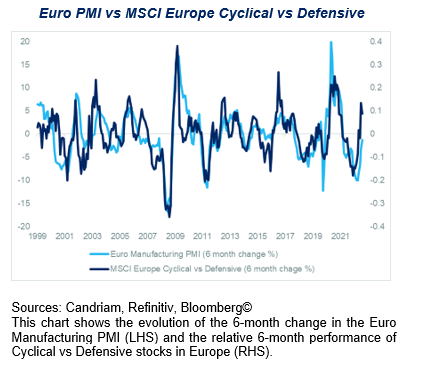

A striking illustration of the extent the European recovery is now priced in is the relative performance of cyclical vs defensive stocks: The recent outperformance implies a Euro Manufacturing PMI around 55 points, from its current level of 48.5. Clearly, we would need new positive catalysts to pull market valuations higher.