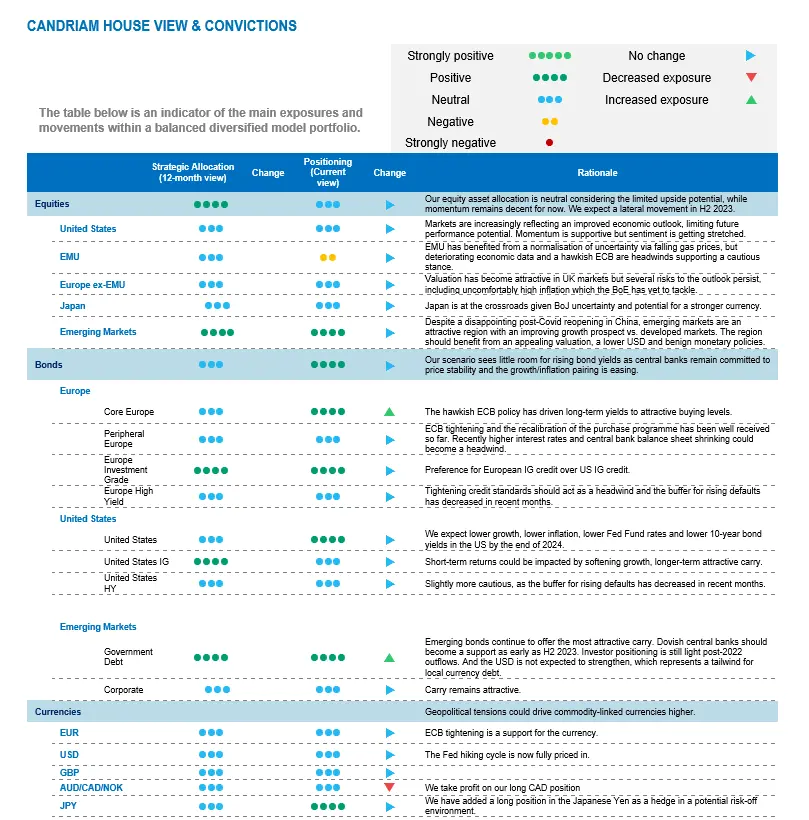

The markets appear to be having second thoughts on the “terminal rate” of several central banks in developed markets, as their restrictive job is likely not finished yet. This repricing of upcoming expected monetary policy decisions encapsulates one simple implication: the risk to the outlook for growth is tilted to the downside. The steepest monetary tightening of the past four decades has already led to significant tightening in financial conditions and financial stability risks could return. Naturally, we have adopted a more cautious equities allocation than during the first half of the year, considering the limited upside potential. Our scenario sees little room for rising bond yields as central banks remain committed to price stability and the growth/inflation pairing is easing. Hawkish ECB policy has driven long-term yields to attractive buying levels. How tight is too tight? We will find out in the coming months.

An economic scenario of weak growth and falling inflation

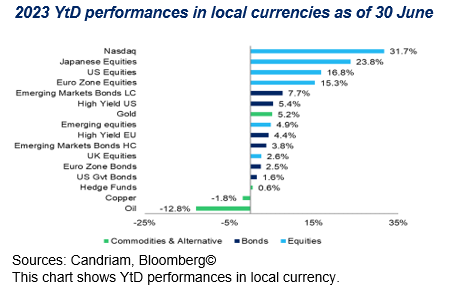

Equity/bond performances have recovered from last year’s annus horribilis: most equity and bond markets returned positive performances during the first half of the year. While the starting point was exceptional, we now expect global growth to be relatively weak in 2023 and to accelerate only slightly in 2024. Investors may have been positively surprised in H1. Sentiment is now more positive, with the consensus now anticipating a soft landing in the US economy and no upturn in inflation.

More cautious on equities while harvesting carry

The risk is now more asymmetrical on the downside. Positive surprises may give way to disappointments: higher Fed and/or ECB terminal rates, stronger deceleration in developed economies and underlying inflation more resilient than expected.

We are therefore more cautious on developed-market equities, positioning ourselves for economic deceleration by favouring defensive sectors. In this context, we prefer government bonds and high-quality credit as sources of carry and have chosen to remain exposed to emerging countries (debt and equities) to benefit from the desynchronisation of their monetary and fiscal cycles.

Restrictive monetary policies will spread throughout the economies of developed countries, and inflation is likely to decelerate gradually. We expect global growth to be relatively weak for H2 and accelerate only slightly in 2024. While emerging Asia is the exception, business in most other regions remain sluggish. In most economies, inflation should continue to fall, but persistent core inflation and tight labour markets in developed regions will likely prompt central banks to maintain a restrictive policy for several quarters to come.

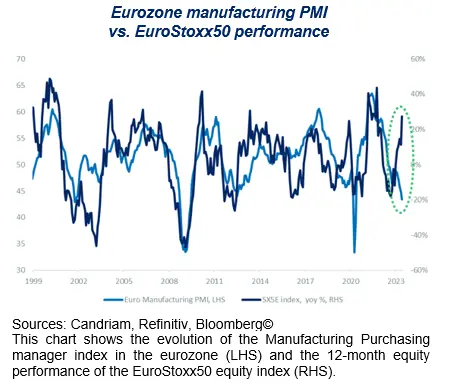

We note that the internals of European equities are further disconnected from the economic environment. While the eurozone manufacturing PMI has fallen to 43.4 points, the benchmark EuroStoxx50 blue chip index is implicitly pricing in a steep recovery.

We said previously that either activity will recover sharply over the summer months or equities will have to price in a more sober outlook. For the moment, we note a poor outlook based on incoming soft and hard data. As the ECB says that it has “more ground to cover” as inflation remains uncomfortably high, we expect EMU equities to underperform in the foreseeable future.

Regional and style equity allocation

Within our regional equity allocation, we have a negative stance on EMU while maintaining our positive stance on emerging markets. We also prefer defensives over cyclicals.

Despite a disappointing post-Covid reopening in China, emerging markets are an attractive region with improving growth prospects vs. developed markets. The region should benefit from an appealing valuation, a lower USD and benign monetary policies.

In the US, the risk/reward is not particularly attractive. We acknowledge that despite expensive valuations, the current momentum, which is driven by Artificial Intelligence investment themes, could further support the region.

Recent performances have been led by multiple expansion, as P/E valuation has risen from 18x to more than 19x. We note that the disconnection from real yield levels is still present and should not be supportive going forward.

At this stage of the cycle, with Cyclicals pricing a strong recovery in the economic environment, we prefer Defensives over Cyclicals through Health Care, Utilities and Staples sectors.

Buying US and EU duration

Our fixed income allocation has been adapted this month, as we added further to duration via European sovereign bonds. We have an overall overweight duration in our portfolios.

Our scenario sees little room for rising bond yields as central banks remain committed to price stability and we expect the growth/inflation pairing to ease further during the second half of 2023. Hence, we see limited room for rising bond yields, also given that central banks remain committed to price stability.

In particular, we have seized the opportunity as the hawkish ECB policy has driven long-term yields to attractive buying levels. We will find out in the coming months how tight monetary policy can be before becoming too restrictive and provoking collateral financial damage.

We also maintain a positive view on IG credit for now, but are a little more cautious on global high yield bonds. We note that spreads remain above historical average levels, given the tightening of the bank credit channel.

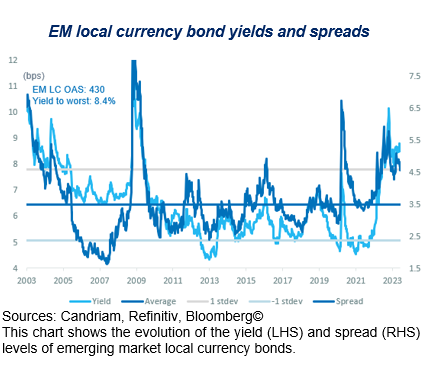

We expect emerging bonds to outperform based on fundamental aspects:

- Valuations remain attractive, and the region has an improving growth differential prospect vs. developed markets.

- Furthermore, emerging bonds continue to offer the most attractive carry.

- Dovish central banks should become a support as early as H2 2023.

- Investor positioning is still light post-2022 outflows.

- And the USD is not expected to strengthen, which represents a tailwind for local currency debt.