European equities: resilient markets

The collapse of the Silicon Valley Bank, the 16th largest bank in the United States, triggered a shockwave through financial markets. Despite their resilience, European equity markets nevertheless also had to give away some ground in this environment. During this correction, and especially since the beginning of March, growth stocks outperformed value stocks, and large caps outperformed small caps.

From a sector perspective, there was no clear performance dispersion between cyclical and defensive sectors. Although not fundamentally impact by the recent events in the US, materials and financials were the main underperformers. In addition, information technology underperformed the broader market. Communication services, energy, industrials and the more defensive consumer staples and utilities sectors outperformed the broader market.

Earnings Expectations & Valuations

In the meantime, fundamentals remain reasonable for European equities. Positive earnings revisions have been supportive for the European market. 12-month forward earnings growth is now close to 1.5%. Consensus expects financials and information technology to be the biggest contributors to that slight growth expectation. Energy and materials are expected to see earnings decline significantly in the coming 12 months.

After the recent correction and considering the above growth forecasts, valuations remain interesting, trading at less than 13 times expected 12-month earnings. European equities remain clearly interesting compared to historical levels.

Balanced With Defensive Tilt

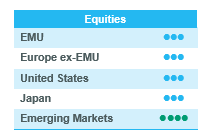

We made no significant strategic changes to our allocation, as we still feel comfortable with our current positioning, which remains tilted towards more defensive sectors, such as consumer staples and healthcare. Both sectors outperformed during the recent market turmoil.

In the meantime, we have kept our +1 on information technology and -1 on energy unchanged, but what about our view on the European banking sector after the bankruptcy of both Silicon Valley Bank and Signature Bank? In the US, the event raised questions over other small regional and less well-regulated banks with vulnerable deposit bases, such as East West Bancorp or UMB Financials, but it doesn’t seem to have had a big financial impact on larger banks.

Investors’ confidence has nevertheless taken a hit and also affected the stock price performance of European banks. Although we cannot exclude individual issues, the problems US regional banks are facing have little impact on the European banking sector. European banks are subject to a much tougher liquidity regulation. As a result, balance sheets look quite strong. In addition, the deposit base of European banks is much more diversified.

However, it should be noted that the recent problems at Credit Suisse are now also causing nervousness on the European markets, resulting in a significant correct of the financial sector. We are neutral on financials. Our exposure to the sector is well balanced on the back of a -1 on diversified financials, a neutral grade on insurance companies and a +1 on retail banks. With this in mind, it is worth noting that stock selection is very important. Our retail bank picks are, and have always been, concentrated on high-quality banks with high solvency and profitability.

The sole change we have made was related to utilities. We increased the sector to neutral from -1. Although we have a negative structural view of the sector on the back of increased competition, margin pressures (due to high capex) and high debt, we recognise that the sector might outperform amid continued market uncertainty. It’s worth noting that the sector has underperformed the broader market since the peak in late 2020 and now might temporarily regain investors’ interest in their search for defensive alternatives.

We are convinced that it makes sense to maintain a balanced approach with a defensive tilt, as cyclicals have become expensive and the expected economic recovery is already priced in.

US equities: slight correction in February

US equities haven’t been able to continue their strong start to the year. The slight correction in February accelerated into March on the back of the collapse of Silicon Valley Bank(SVB), the 16th largest bank in the United States. Contagion fears prompted an investor flight out of equities into safe-haven assets and into more defensive sectors.

Cyclicals and Small Caps Down

In the US, performance dispersion has been high since early February (and especially since the fall of SVB). Growth has started to outperform value, and large caps have outperformed smaller companies that are deemed to be more sensitive to financial system risks and to the economic cycle.

From a sector perspective, cyclical sectors, except for industrials, clearly suffered on the back of the increased uncertainty. It should come as no surprise that financials were hit the most following the bankruptcy of Silicon Valley Bank. Defensive sectors, such as consumer staples, utilities and healthcare were the main outperformers. Meanwhile, information technology also did quite well compared to the broader market.

Reasonable Fundamentals

In the meantime, fundamentals remain reasonable for US equities. Consensus expectations now put earnings growth at close to 0% in 2023 and around 4% in the following 12 months. This is still in line with the current economic scenario.

With this earnings growth in mind and considering the recent market correction, US equities are neither cheap nor expensive.

Let The Dust Settle First

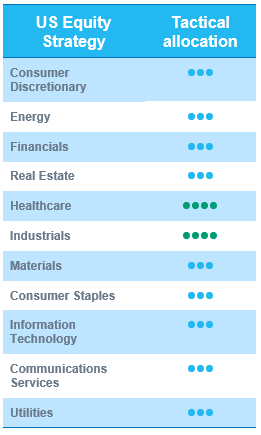

Until now, we have maintained a balanced approach this year while keeping an eye on interesting entry points in the event of a clear cooldown in inflation and a clear end to the Federal Reserve’s rate hike cycle.

The recent collapse of Silicon Valley Bank and the risk on a US banking crisis, although unlikely, has nevertheless impacted our short-term view, which is now basically neutral. US equities’ risk/reward isn’t great, and recent events have created a curtain of fog despite decent fundamentals.

In this context, we do not consider it opportune to make major adjustments to our strategy. We prefer to remain balanced until the dust has settled.

Emerging equities: broad-based correction in February

After a strong start to the year in January, emerging markets witnessed a broad-based correction in February. With US-China tensions resurfacing following the balloon saga, and a reversal of the USD weakening trend, EM equities came under pressure, contracting by 6.5% (underperforming DMs by 4%). For benchmark heavyweight China, a re-escalation of US-China tensions overshadowed any optimism from a faster reopening and strong activity data. Investors took profits on China, which fell by 10% during the month. Onshore China A equities were more resilient versus Hong Kong offshore China shares in the face of these external headwinds. With the Chinese government stepping up efforts to boost domestic digital and IT capabilities, telecoms was the best sector in China. India also continued to correct, but outperformed its Asian peers, with recent inflation figures suggesting an inflationary risk to recovery and rising domestic yields putting pressure on domestic equity inflows. Korea also remained under pressure following the strong January performance, as uncertainty around the slowdown in US demand continued to weigh on sentiment. Taiwan performed relatively better for the month, with optimism over the boost in cloud- and AI-related demand supporting semiconductor supply chain names. Within LatAm, the bright spot was Mexico, which continued to outshine with new investment inflows resulting from US nearshoring efforts. Conversely, Brazil remained under pressure following the correction of commodities in February and concerns around fiscal policy risks. In the commodity complex, most metals underwent a broad-based correction, as optimism around China’s reopening faded and rising inventories raised concerns. Gold prices also lost their shine, as US yields resumed their upward trend.

Outlook and drivers

Macro factors continue to drive EM asset prices in 2023. The repricing of the yield curve in the US postponed the recovery we have been experiencing since November 2022. It is very important to have more clarity on the direction of inflation in the US, and consequently the USD, as we don’t seem to be out of the woods just yet. Monetary signals point to a reduction in excess liquidity in the coming months, with DMs still tightening, which normally has a bad impact on equities. EM countries are in a better shape, however, and valuations are attractive especially vs DMs. Coming out of a period of consecutive years of relative underperformance, a number of factors have evolved positively for EM equities. The key driver has been the pace and scope of economic recovery in China. If February PMI figures are any indication, China’s economic rebound could meaningfully add to the growth differential for EM over DM for 2023. Inflationary dynamics are benign in the case of most EM regions. The spill-over effects of a US/Europe-led slowdown are indeed concerns for export-dominated economies, but there are still supportive tailwinds like supply chain diversification, nearshoring and US IRA-related benefits and economic reforms that could bode well for Mexico, India and South Korea.

Positioning for recovery

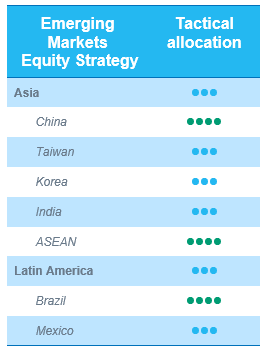

We make no changes to our regional views – maintaining an overweight on China, ASEAN and Brazil, while being neutral on the other markets.

Regional views:

China: February’s manufacturing figures confirm the strong recovery potential for China. The recently concluded Party Congress, however, suggests that the focus will be on economic stability than on the strength of the GDP recovery (official GDP growth targets at 5.0%, slightly below what many expected). Early signs of competition heating up in e-commerce also raise some concerns. We continue to monitor the situation, and hold a more neutral and balanced exposure to China in the funds.

Brazil: Given the market sell-off seen in Brazil in Q4, valuations remain attractive, and macro drivers are broadly supportive. China’s reopening could provide some tailwinds to Brazilian equities.

ASEAN: China’s reopening is supportive for ASEAN countries like Thailand (tourism recovery play) and Indonesia (commodity recovery plays), and thus we maintain an OW in the region.

Mexico: Desptie tailwinds from the US nearshoring thematic, we remain neutral on Mexico, given the strong rally we have seen in Mexican equities last month.

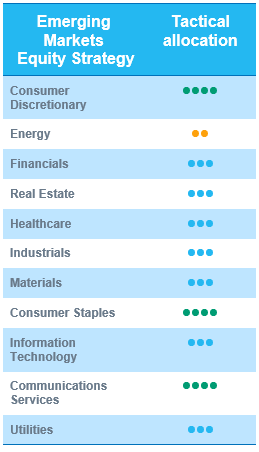

Sector and Industry views:

No changes to sector views. We continue to monitor the semiconductor segment (neutral) where some demand support is coming from AI- and cloud-driven investments, and this could spark a recovery earlier than anticipated.