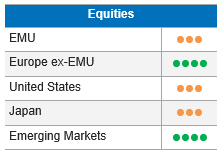

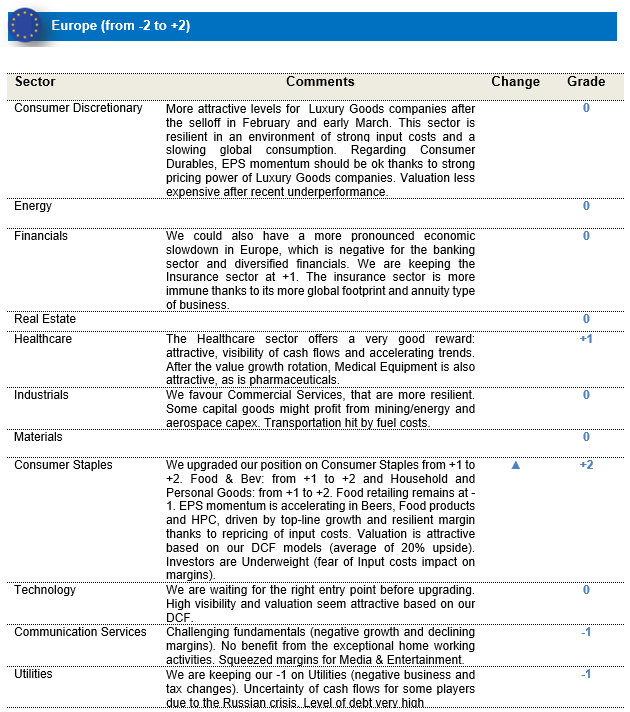

European equities: the labour market continues to be the only bright spot

The first quarter of the year was difficult for investors and April proved no different. The war in Ukraine, lockdowns in China and the prospect of substantially tighter US monetary policy all weighed on sentiment. The global economy entered 2022 with strong tailwinds. While robust labour markets and large amounts of pent-up savings remain supportive, risks to the recovery are building, most notably in Europe. Central bankers face substantial challenges as they look to tighten policy to help bring inflation back down to target without tipping the economy into recession.

Globally, European equities closed the quarter down. April concluded with no sign of a resolution to the war in Ukraine, as fighting in the eastern and southern parts of the country intensified. The impact on energy markets remains particularly notable given the difficulties faced by Europe in reducing its energy dependency on Russia. The impact of the conflict is now starting to become clearer in economic data. Labour markets continue to be the bright spot, with unemployment rates across both the UK and the euro zone sitting close to multi-decade lows. Yet despite strong wage growth, consumer confidence in both the euro zone and the UK has tumbled to levels consistent with a recession.

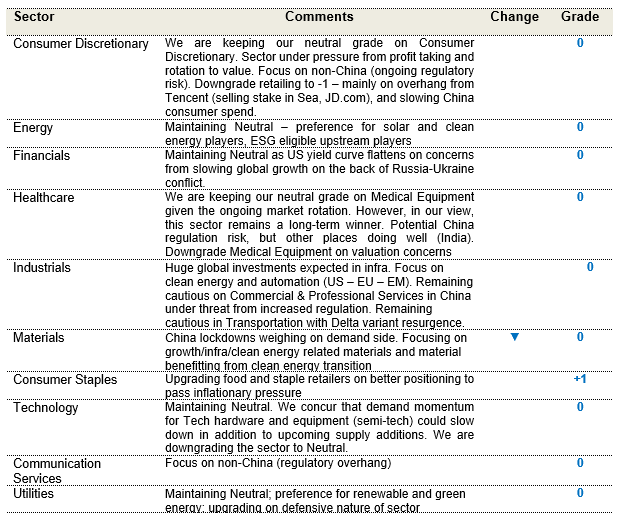

In terms of style performance, over the last 4 weeks, Growth stocks underperformed Value stocks. The worst performer was the Growth Small Cap segment, while Value Large Cap was the best performing segment in relative terms.

Regarding Cyclical vs Defensive stocks, the situation is mixed. It depends sector by sector.

In terms of sector performance, over the last 4 weeks, we can observe that the Energy sector performed best. On the other hand, the Real Estate and IT sectors were the worst performers.

We Upgraded our position on Consumer Staples from +1 to +2.

- We Upgraded our position on Consumer Staples from +1 to +2. Food & Bev: from +1 to +2 and Household and Personal Goods: from +1 to +2. Food retailing remains at -1. EPS momentum is accelerating in Beers, Food products and HPC, driven by top-line growth and resilient margin thanks to repricing of input costs. Valuation is attractive based on our DCF models (average of 20% upside). Investors are Underweight (fear of Input costs impact on margins).

US equities: tough month for the domestic market

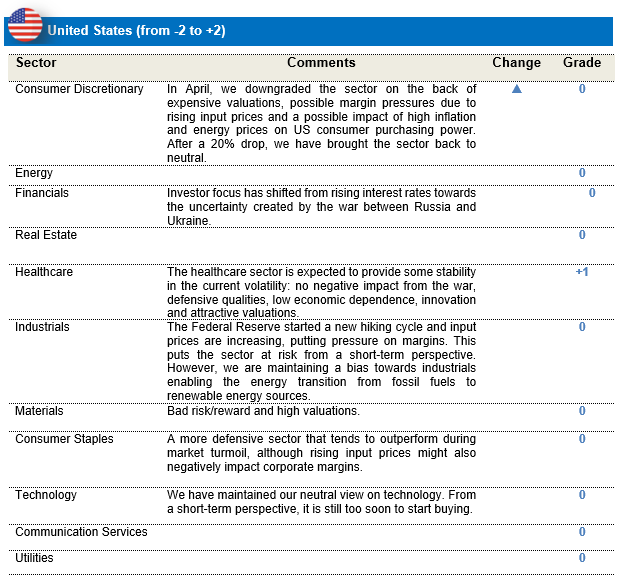

US equity markets dropped more than 8% in April, as investors are still worried about the war in Ukraine, the impact of the Covid-19 lockdowns in China on economic growth, high inflation figures and the prospect of substantially tighter monetary policies. Despite the continuing outperformance of energy and materials on the back of higher commodity prices, defensive sectors, such as consumer staples, utilities and healthcare continued to outperform the broader market, whereas our call to reduce consumer discretionary in early April clearly paid off.

Although equity markets have not been focusing on true equity fundamentals lately, it is worthwhile taking a look at the first quarter earnings season, with over 80% of US companies having reported and nearly 60% in Europe. It appears that earnings growth is coming in a bit lower than during the past quarters in the US. However, despite lower earnings growth, companies have broadly provided positive surprises on the markets, as margins have remained broadly stable despite high inflation figures.

Earnings growth in the energy, materials, industrials and healthcare sectors has been strong, while earnings in both financials and consumer discretionary have generally disappointed, with an earnings decline in the first three months of the year. Companies that have been beating earnings estimates have generally outperformed the broader market, while earnings misses have been severely penalized by equity markets. All in all, first quarter earnings were decent.

In the meantime, as earnings growth remains quite firm up until now and equity markets have experienced a significant correction, valuations have started to become a bit more attractive. The US equity market has been quoted at 18 times expected earnings in the coming twelve months, still above their long-term average though.

Looking for an entry point in technology

Despite a decent earnings season and valuations becoming more attractive, we nevertheless remain cautious and a bit more defensive on the back of high inflation, rising interest rates and a lack of visibility due to the war in Ukraine. Healthcare remains our sole positive sector conviction on top of increasing stock-picking importance, while bearing in mind that responsiveness will nevertheless be crucial in these rapidly evolving market circumstances.

Despite that, we brought our grade on consumer discretionary back to neutral from -1. We downgraded the sector during the previous committee meeting on 5 April on the back of expensive valuations, possible margin pressures due to rising input prices and a possible impact of high inflation and energy prices on US consumer purchasing power. Since the downgrade, the sector has lost around 20% and we believe that the size of the correction is enough to bring the sector back to neutral.

In the meantime, we are tempted to increase our grade on information technology, as valuations are attractive and growth remains strong. In addition, US 10-year yields are starting to approach our target levels. However, given the strong Fed tightening and interest rate volatility, we prefer to wait and see where long-term interest rates are heading.

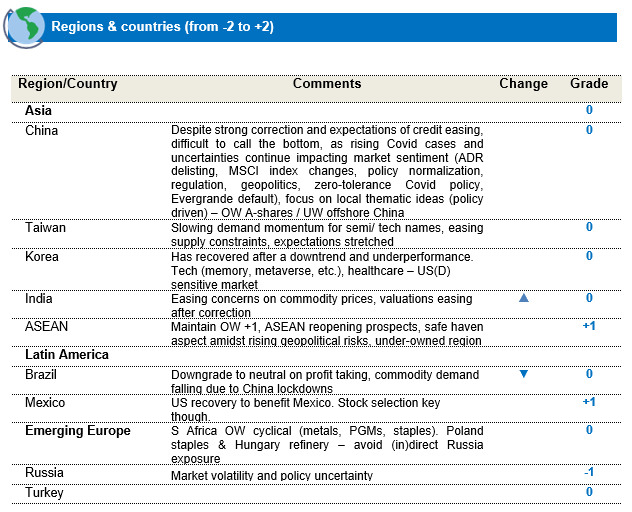

Emerging Markets: risk off continues in Emerging Markets

MSCI Emerging Markets© faced a challenging month in April, with worries around intensifying Covid-19-induced lockdowns in China and expectations of a more hawkish Fed, weighing on EM returns. In a risk off environment, the MSCI Emerging Markets© lost 5.7% for the month, although faring relatively better than the MSCI World© that declined by 8.1%.

Index heavyweight, China remained volatile, as Covid-19-induced lockdowns added to concerns around slowing consumption and manufacturing, but also as policy support remained modest and largely below expectations. Tech heavy Taiwan also saw a significant correction for the month, losing 9.8%, as rising yields and slowing demand pointing to China’s weakness added to concerns about the semiconductor outlook. Korea remained a weak spot in Asia, declining by 6.6% for the month, among concerns of slowing export demand and rising inflation. Indonesia remained resilient, returning 3.4% for the month, while India lost 1.7%.

After a strong first quarter, MSCI Emerging Markets Latin America©, gave up a big part of its YTD gains, as commodity (esp. metal) prices corrected on demand slowdown due to China lockdowns. Brazil saw a sharp correction of 14.9% for the month, on these worries.

In the commodities complex, most metals saw a correction for the month, as China lockdowns put a dent on the demand side. Oil however, ended flat in a volatile month, at $106.6/bbl (Brent Oil). Amidst rising yields, the dollar strengthened against most EM currencies, with the USD (DXY) index gaining 4.7%.

Changes to Regional views: commodity (metals) demand falling due to concerns about China – Downgrade Brazil to Neutral and Upgrade India to Neutral

Downgrade Brazil to Neutral (0):

China’s zero-Covid policy remains a cause of concern not only for China’s economic growth outlook but also for some other LatAm commodity-driven countries like Brazil that are seeing a slowdown following a correction in metal prices. We are moving our position in Brazil to Neutral, based on concerns of slowing metals and related commodity demand.

Upgrade India to Neutral (0):

After the correction in Indian markets, due to concerns around higher energy and commodity prices, we are starting to find valuations becoming more acceptable. Additionally, with metal and commodity prices falling, concerns around higher deficit and inflation should ease. We are upgrading our positioning in India to market neutral on these factors.

Changes in sector ratings:

Downgrade Materials to Neutral (0):

In line with the broader view on slowing China-driven demand, on the back of Covid-induced lockdowns we are downgrading materials to neutral. We continue to prefer materials that are essential for the clean energy transition, (such as copper, lithium, nickel and aluminium).

We continue to maintain a cautious view given the number of uncertainties weighing on EM outlook, from policy tightening to geopolitical risks. For index heavyweight China, we remain cautious, waiting to see more effective policy support, while the concerns around lockdown-driven slowdown continue to linger. Apart from the big question on Covid-19, geopolitical risk is also not completely off the table, as the war in Ukraine continues unabated. In view of such adversities, while valuations have become less demanding, we remain cautious and selective, adding only to highest quality and reasonably valued names. In case however, a reopening of China is eventually announced, it could provide support also to commodity- driven Brazilian equities that saw a drawdown earlier this month.

The overall positioning of the strategy remains balanced between sustainable quality core growth and complemented with commodity and financials exposure as inflation and yields hedge. The strategy also added to some defensive names in view of the uncertain and volatile outlook for parts of market.