European equities: Cyclical rebound

Global equity markets stabilised somewhat in May after the significant correction since the beginning of the year. However, there are not a lot of new elements to digest. The Fed walked the talk and increased its rates. The war in Ukraine is still ongoing, which apart from the human suffering, continues to put pressure on food and energy prices. Investors still fear that the combination of monetary tightening and rising energy prices could lead to stagflation (low growth or even recession, combined with high inflation).

Global equity markets stabilised somewhat in May after the significant correction since the beginning of the year. However, there are not a lot of new elements to digest. The Fed walked the talk and increased its rates. The war in Ukraine is still ongoing, which apart from the human suffering, continues to put pressure on food and energy prices. Investors still fear that the combination of monetary tightening and rising energy prices could lead to stagflation (low growth or even recession, combined with high inflation).

Europe decided to embargo Russian seaborne oil, which raises the risk that Russia might retaliate by further reducing the supply of gas to Europe. Gas prices for winter futures contracts held steady at high levels. Labour markets continued to tighten. UK unemployment fell to its lowest level since 1974, while eurozone unemployment is now the lowest on record. This supported an acceleration in wage growth in both economies, but with inflation very high, real wages remained negative. While still low, European consumer confidence improved in May, and business surveys were resilient. This should give the European Central Bank more confidence in raising rates in the face of inflation.

European equity markets have undergone a cyclical rebound over the past four weeks in a market with a very defensive positioning. The market rebound was led by high beta stocks, such as small caps, energy and financials.

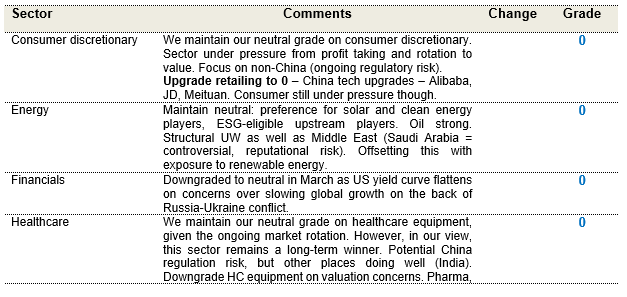

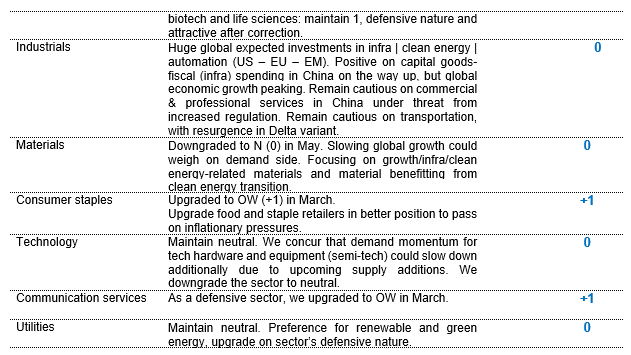

Energy was once again the strongest performer since the beginning of the year, as oil prices continue to rise and analysts are upgrading their earnings expectations.

In terms of defensive sectors, over the last four weeks, we can observe that consumer staples, healthcare, utilities and telecommunications services were the worst performers during the cyclical market rebound.

KEEP A BALANCED APPROACH

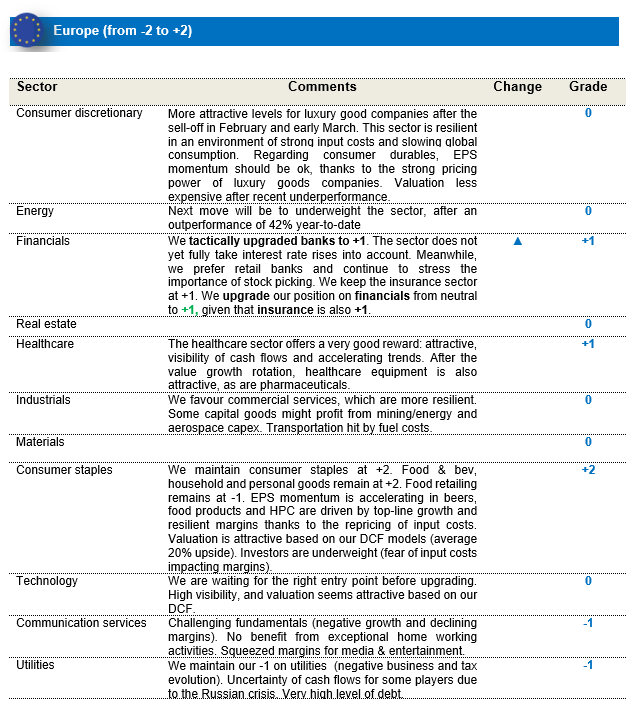

In a context of continuing style and sector rotations and due to the lack of a clear short-term trend, we remain cautious on European equity markets. We maintain a defensive bias with a significant overweight in consumer staples and healthcare.

We nevertheless see an increased probability of a short-term rebound in both automobiles and banks.

- We have tactically upgraded automobiles to neutral from -1. Supply-chain interruptions are gradually easing, and the sector may benefit from Chinese measures to boost the economy, including reduced tax on auto purchases and EV subsidies. In addition, valuations seem attractive.

- We have tactically upgraded banks to +1 from neutral. The sector has not yet fully taken interest rate rises into account. We prefer retail banks and continue to stress the importance of stock picking. Our strategic view is a little more cautious: the first tightening measures and the end of the European Central Bank’s asset purchase programme might lead to a spread widening for certain member states and have a negative impact on European banks’ relative performance. We upgrade our position on financials from neutral to +1, given that insurance is also +1.

US equities: Technical market rebound

US equity markets remained highly volatile in May, due to the lingering uncertainty surrounding the war in Ukraine, the pace of monetary tightening by the Federal Reserve and the negative impact of COVID-19 lockdowns in China. Equity markets dropped significantly in the first couple of weeks of the month, before a technical rebound. Value stocks outperformed growth stocks, which continued to struggle on the back of valuation compression. Defensive sectors, such as consumer staples, underperformed in this context.

Despite the strong sector rotation during the month, energy once again outperformed on the back of higher oil prices, while materials benefited from positive earnings revisions. Financials and healthcare also outperformed or performed in line, whereas consumer discretionary, consumer staples and information technology underperformed the broader market.

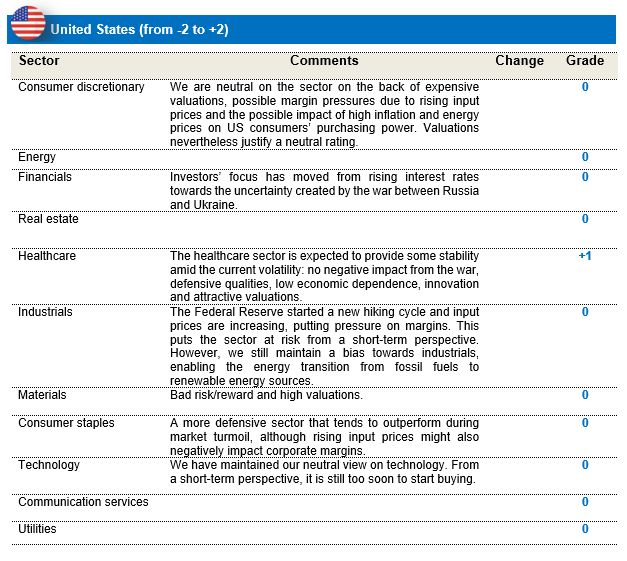

A balanced approach

US markets continue to be led by the evolution of both inflation figures and interest rates. In light of the related continuing style and sector rotations, we have maintained a balanced approach, with healthcare as our sole positive sector conviction, while keeping in mind that reactivity will nevertheless be crucial in these rapidly evolving market circumstances.

In this context, we believe we aren’t far from an attractive entry point in information technology. The sector seems to be technically oversold and close to a bottom, while valuations are becoming attractive. However, despite the fact that the sector might be bottoming out, we prefer to wait and see where long-term interest rates are heading, given the strong Fed tightening and interest rate volatility.

We thus made no strategic changes during last committee, and maintain a semi-defensive bias.

Emerging Markets: Strong gains in Latin America and positive news from China.

Following a rather volatile performance in April, EM equities found some stability in May, ending the month flat (+0.1% in USD returns).

Sentiment in China improved, as COVID-19 numbers started to peak and expectations of lockdown relaxations in Shanghai materialised. Some reassuring comments from the State Council on policy support to cushion the slowdown in economic growth also aided the recovery. From its late-April trough, MSCI China and China A shares both saw a slight recovery over the month. A similar improvement in sentiment prevailed in other regions in North Asia, including in Taiwan, where semiconductor giants led the recovery on receding fears of a global slowdown. South Korea was aided by currency gains following more hawkish comments from the new central bank governor. In India, the sell-off continued in May, with markets declining by 5.9% (in USD terms), as corporate earnings were underwhelming and FII selling pressure resumed, even as the government announced a series of policies to combat inflation.

The brighter spots in EM for the month were in LatAm, where Chile (+18% in USD) and Colombia (+13.4%) posted strong gains. Chile experienced a relief rally as the draft of the new constitution left out the most orthodox policies, whereas Colombia gained as investors welcomed the first-round election results.

Among sectors, IT and industrials were the outperformers, while real estate and healthcare lost on a relative basis. Within the commodities complex, most industrial metals saw a broad-based correction as Chinese demand destruction intensified. However, Brent crude prices remained high as lockdowns in China started to ease.

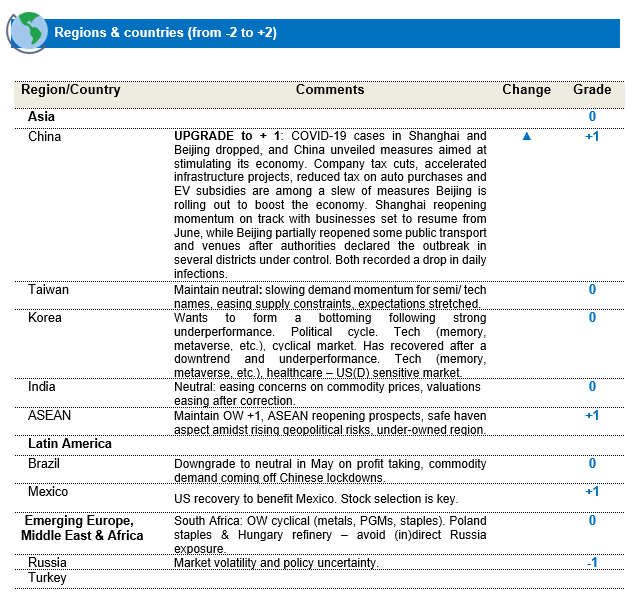

Changes to Regional views:

Upgrade China to OW (+1)

With the COVID-19 situation improving, we see early signs of China reopening and a gradual easing up on lockdown restrictions. Also on the regulatory front, a series of announcements, including lifting a ban on new Didi users and the issuance of new gaming licenses, indicate that the worst might be over on the regulatory front for China tech, which is a significant part of the Chinese index. Finally, some supportive announcements this month on liquidity and monetary stimulus to stabilise and support small enterprises were also construed as positive. We thus upgrade China to +1.

Changes in sector ratings:

Retailing in consumer discretionary – Upgrade to Neutral (0):

Given our more neutral view now on Chinese retailers and Chinese tech, which are significant components of retailing in consumer discretionary, we are upgrading the sector to neutral from UW. Earnings for players like Alibaba, JD.com and Meituan are coming out slightly ahead of depressed expectations, indicating a bottoming out.

While May was anything but extraordinary for EM equities, we are already encouraged by some signs of stabilisation for MSCI EM. In relative (USD) return terms, MSCI EM is slightly ahead of the MSCI AC World, on a YTD basis. This despite EM fund flows remaining negative for a number of months and an indication of a relatively large underweight allocation of global funds on EM equities.

The key unknowns for the market remains inflation, and any fall-out from central banks’ response in tackling it. So far, central bank resolve in tackling inflation indicates that a significant slowdown in demand could likely persist for some time, which keeps us cautious on the outlook for EM equities. On a relative basis however, the decoupling in the economic cycle between China and the US continues to become more visible, as China announces policy support measures on both the fiscal and monetary fronts to stimulate growth.

The strategy maintains a balanced positioning, with core holdings comprised of quality and sustainable growth companies at reasonable valuations in Emerging Markets. This is complemented with positions in materials that add hedges against persistent inflation, as well as a defensive tilt with recently added holdings in telecoms and utilities.