Financial markets witnessed bouts of volatility and mostly negative performance over the month of September as central bank rhetoric turned marginally hawkish on the back of higher inflation data. Indeed, in the latest Fed communication (and Q&A session), Jerome Powell not only suggested that tapering would begin in November, but also hinted that it wouldn’t be contingent on better inflation data or a stronger payroll report. Elsewhere, the Bank of England indicated (to the surprise of investors) that it was now willing to hike rates before it even moved to address its balance sheet, while the ECB announced that it would taper its bond-buying programme over Q4 2021. This context of lower monetary support had an impact on rate markets as core rates moved marginally higher, with the US 10-year ending up at around 1.5% and the German 10-year at -0.1% (up from 1.3% and -0.4% respectively) as at the end of August. Adding to the market volatility was the fear of default surrounding Evergrande Group, the Chinese real estate company (and, incidentally, the second-largest real estate developer in the world) whose problems have spread throughout the industry and into segments of financials like the insurance sector. On the macroeconomic front, supply chain problems continue to worsen across the globe, due to a combination of transportation issues (port jams), increasing demand and fears over COVID variants. Finally, additional fiscal support still doesn’t appear to be forthcoming, as US president Joe Biden’s “Build Back Better” budget proposal is still facing political deadlock. In this scenario, global asset classes posted negative returns over the month of September, with convertibles, equities and emerging debt leading the way. Both investment-grade and high-yield markets also stuttered, led by the real estate and transport sectors, while financials resisted better than the rest. Unsurprisingly, the demand/supply imbalance drove commodity prices upwards, with oil posting double-digit returns and natural gas maintaining its position as the best-performing asset since the beginning of the year.

Our activity cycle analysis continued to indicate a decent picture for the G4 countries, though we do observe some loss in momentum (notably in the US), with countries like the UK and Japan struggling to continue their economic recovery. The inflation cycle, on the other hand, is showing a strong progression across G4 countries, though wage growth appears to be absent from the global inflation picture for the time being. With respect to the monetary cycle, in line with what was mentioned earlier, we are seeing the beginning of policy normalization, with higher forecasted rates for the G4 and marginally lower levels of bond purchases (QE). Globally, we are seeing an increasing number of central banks hiking rates (especially in EM).

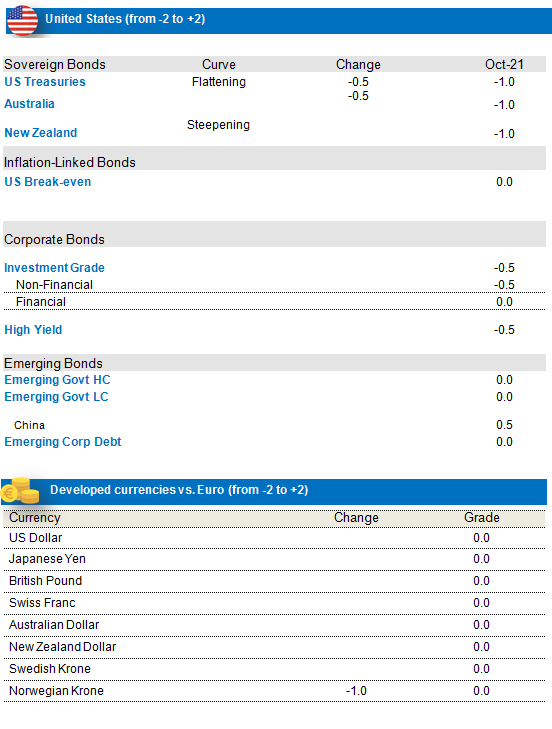

Increased negative stance on US rates and dollar bloc; long position initiated on AUD break-evens

The business cycle has been slowing somewhat in the US, mostly as a result of the slowdown in the consumption cycle (retail and wholesale sales) and the stagnation in the labour cycle. We are, however, seeing some recovery in the unemployment rates, where we appear to have reached pre-COVID levels. However, the participation rate recovery has been slower and non-farm payrolls were again disappointing. The inflation cycle remains very strong, supported by all segments except the labour markets (wages), which remain the weakest link. We do, however, see some optimism on wages, as small business indicators are showing material improvement. On the monetary front, the dot plots now indicate a hike factored in by 2022 (though by a fragile 1-vote margin), while seven further hikes are still expected by 2024. On the market-positioning front, the previously reduced short positions on US rates (on the 2-5-year portion, in particular) have been reversed to previous level though the positioning on the 10-year remains long. In this context, we maintain a short position on US rates, particularly on the long end of the curve (30 years).

Our negative exposure to New Zealand rates continues, on the back of more positive economic data and tapering of monetary support in the form of scale backs in central-bank asset purchases. We expect the curve to further steepen in the near term. In Australia, the central bank has given their pre-commitment to the new tapered QE rate holding until February 2022. However, vaccine coverage has improved and the re-opening of certain regions is imminent. In this context, we maintain a negative stance on Australian rates. We also hold a long position on Australian inflation-linked bonds. The inflation cycle is experiencing a significant rebound and could continue to move higher. AUD inflation expectations for the 3rd quarter had fallen as a result of lockdowns but a lot of the bad news is now priced in. From a valuations perspective, Australian break-evens appear to be quite cheap (particularly vs US). Finally, QE in Australia didn’t include inflation-linked bonds and therefore tapering shouldn’t have the same negative technical impact. We also hold an underweight on Canadian rates. We foresee strong labour data alongside higher inflation, with a jump in commodity markets and a central bank that has already announced tapering of its QE programme.

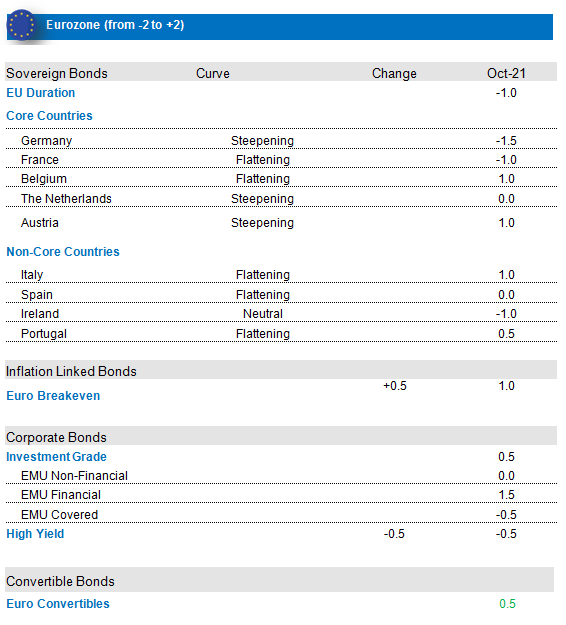

Short position on German rates, increased our long stance on EUR break-evens

The overall framework appears to be less negative for the Eurozone than for other areas of the G10, thanks primarily to monetary policy and flow dynamics. The ECB unanimously decided to conduct PEPP purchases at a moderately lower pace in Q4, while leaving the bulk of policy decisions and important changes until December 2021. The governing council dismissed the recent upside surprises in inflation, maintaining its view that the rise in inflation will be temporary. In their revised 2023 inflation forecasts, they continue to see inflation markedly below 2% (1.5%). Therefore, for now, QE programmes should remain considerable and supportive. In terms of supply dynamics, we see a negative flow picture, with some countries having a large portion of their supply targets already covered; this is supportive in relative terms for euro bond markets. Furthermore, for 2022, despite lower CB purchases, the decline in European Government Bonds (EGB) issuance should help to keep net flows slightly negative. Strong ECB easing, as well as fiscal support, has led to a strong activity rebound that we expect to continue for the remainder of 2021 in the Eurozone. We are monitoring investor positioning, where long duration has modestly increased while non-core exposure has decreased. Finally, on the political front, the German elections have led to the possibility of a “traffic light” coalition between the SPD (Social Democrats), the FDP (Liberals) and the Greens. Overall, In light of the improving growth and inflation numbers, we expect core rates to rise, especially given the extremely tight valuations that they are exhibiting, thereby justifying our negative stance. Non-Core/Peripheral markets continue to be supported by the ECB’s monetary policy and increased European solidarity.

We maintain and have again increased our positive stance on EU break-evens, through our long positions in French and German 5 year linkers. Inflation levels are rising and we expect inflation to trend further up in Q4. This translates into a higher carry on the long position, which is supportive of the asset class. Performance has been very strong and most drivers remain positive. We hence remain positive on break-evens, specifically on the 5-year portion, taking into account valuations, ST inflation dynamics, carry, our break-even model and monetary policy.

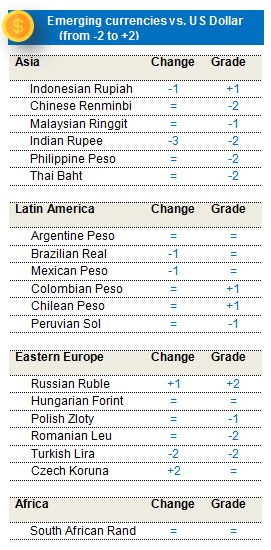

Currencies: Profit-taking on Long NOK Stance

We held a long position on the NOK. Norges Bank has adopted a hawkish stance, on the back of the output gap turning positive and the risk of financial imbalances due to a low interest-rate policy, paving the way to a potential hike in rates by the end of the year. However, the rate path and the good recovery of the Norwegian economy are quite well priced now and we prefer to take profit on it.

Credit: Favouring European Investment Grade and Convertibles

EU IG: We maintain a positive stance on € IG, with a preference for Financials. Some headwinds could challenge the current economic environment. As we reach a turning point in monetary policy, and with the possibility of inflation pressures lasting longer than anticipated, central banks could be forced to act sooner. Moreover, the China slowdown and its regulatory policy could create uncertainty and derail the global growth trajectory. However, we continue to favour EUR IG credit within the euro aggregate universe, as it should benefit from the still-accommodative monetary policy of the ECB, supportive technicals and good credit quality. But dispersion is increasing amid issuers’ profiles, as companies are acting differently at this juncture, some benefiting from pricing power, some consolidating their industry ranking by making acquisitions and others suffering from growing costs. Selectivity remains key throughout our rigorous in-house bottom-up analysis. Financials remains an interesting asset class that is relatively immune to the supply crunch and the energy crisis. In absolute terms, valuations are rich but, with European real rates so deep into negative territory and the lack of supply, investors have no other choice but to maintain their returns run.

EU HY: We have seen some repricing in the segment, though we feel that it is too early to turn positive on the asset class on the basis of valuations which are still not an adequate buffer against the volatile rate environment. Furthermore, European High Yield is facing a less favourable technical environment. Year-to-date, the High-Yield net supply is positive by € 89 billion, which could increase to € 120 billion. In this context, we prefer to adopt an underweight position as we wait for better entry points into the asset class.

US IG: We hold a neutral view on US IG, whereas US credit appears to be the most expensive credit market from a valuations standpoint. Furthermore, with the FED expected to lean more on the hawkish side, monetary support should be lower than in the past. We remain underweight on the US HY segment. Though our earnings expectations on US credit remain strong, we expect more dispersion in the future resulting from input cost inflation and labour inflation as well as supply chain disruption. This could widen the separation between those companies with high pricing power and those with low pricing power. Net supply is positive and the refinancing risk from mergers & acquisitions could extend the expected supply.

We also think EUR Convertibles should benefit from positive dynamics such as the coordinated action from the EU Next Generation Recovery Fund, the Delta wave receding. We note, nonetheless, that, despite the less supportive dynamic, European valuations are still attractive, certainly in a context of inflationary pressures.