Some see swap spreads as market indicators. We see them as asset allocators.

You want to talk about euro swap spreads versus US swap spreads?[1] We watch that, too. But to be honest, that graph is one of the last things we look at when managing euro fixed income aggregate portfolios. So if you want to see it, you’ll have to read all the rest of this page first.

Want the pictures behind the picture?

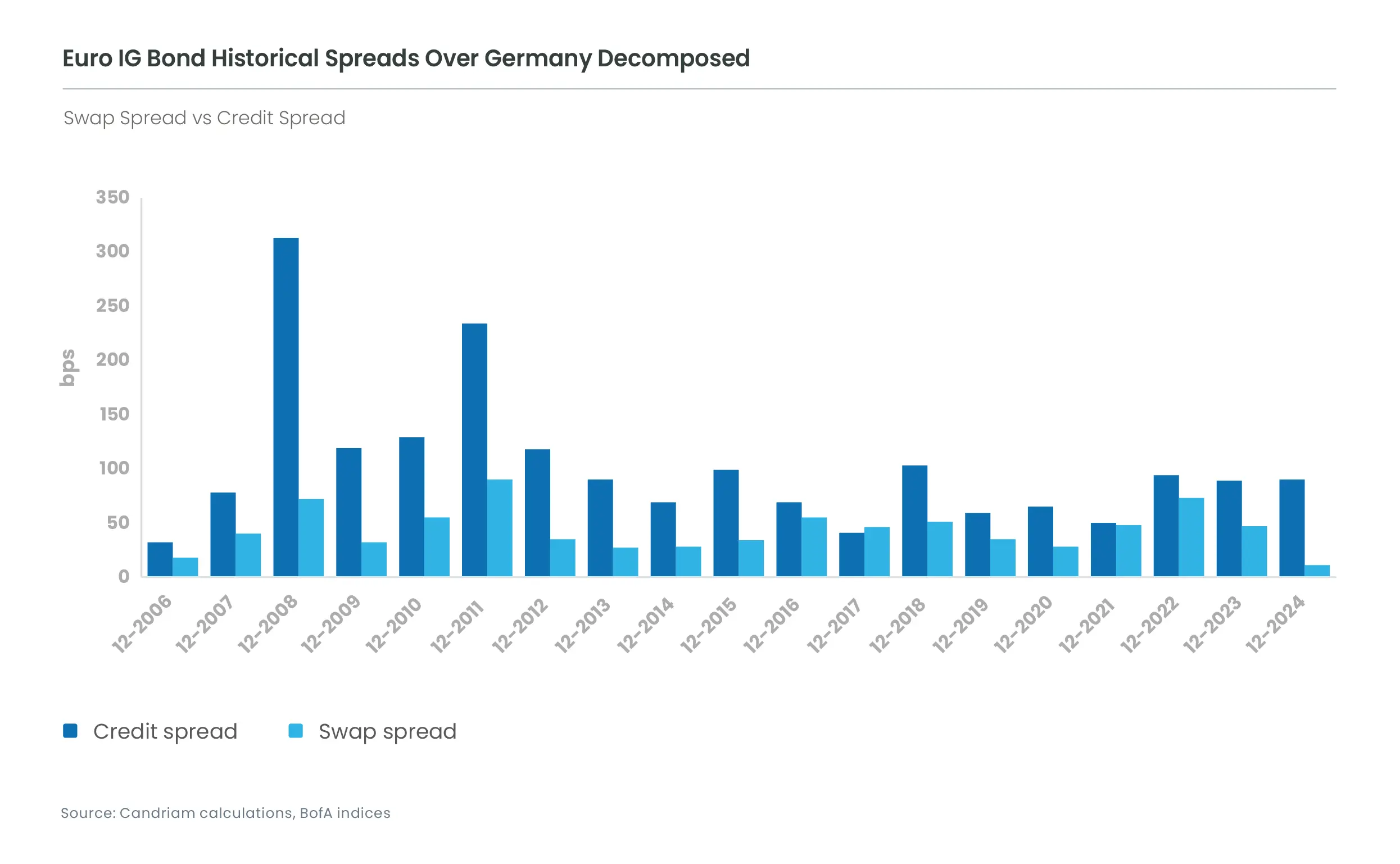

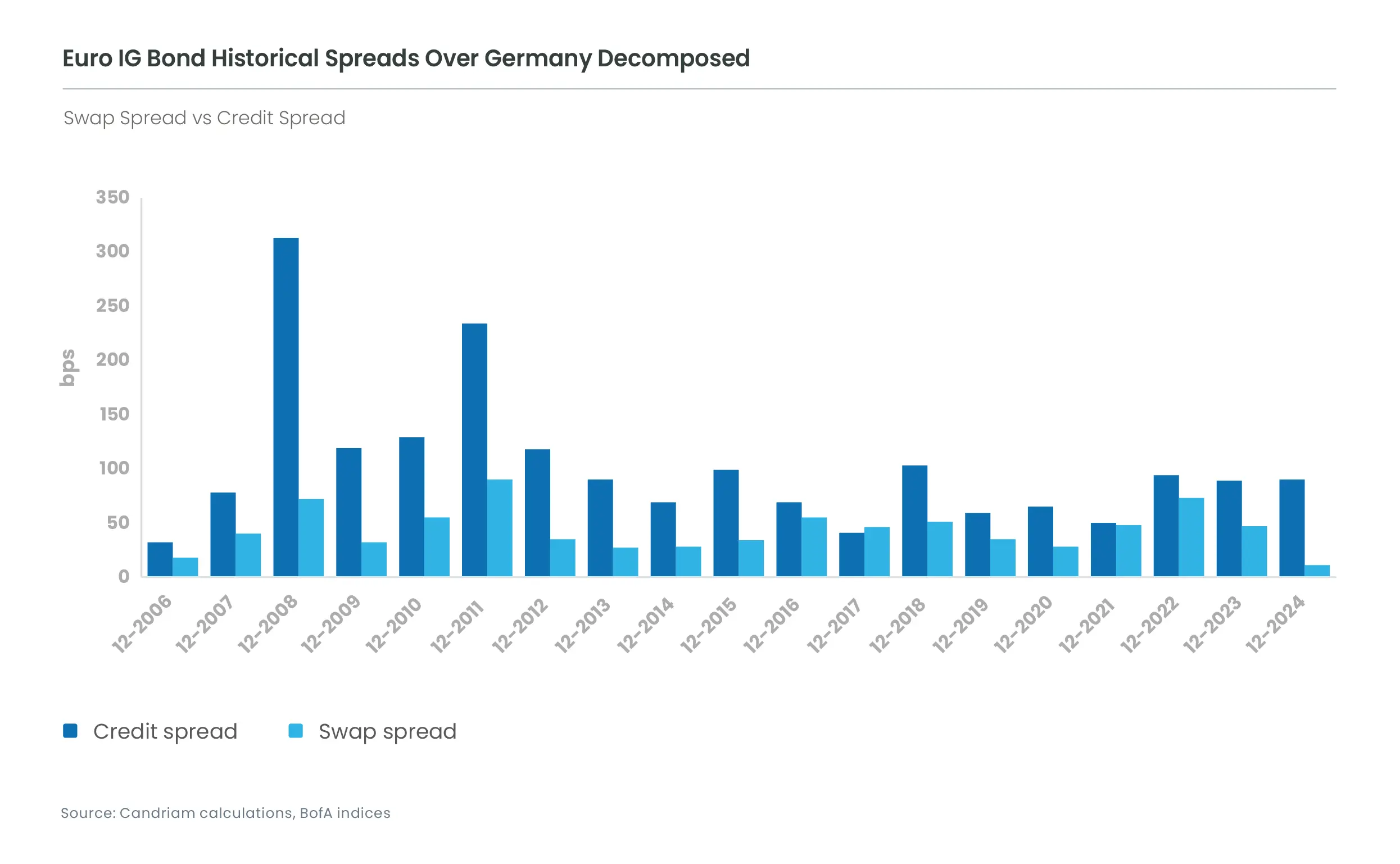

Let’s get down to business. Within the euro fixed income segments, which one is attractive today? Which is flashing good value? Which is signalling overvalued, or high risk? We try to harness the swap spread element of spreads between segments and sovereigns.

Looking at a spread versus German governments (Bunds), we try to break out the element which is applicable to the actual credit difference, and how much to the swap spread. Within our universe, this helps us value corporate bonds relative to quasi-government bonds (supras) or sovereigns.

We believe these analyses help us identify risks, and performance opportunities. In other words – active management.

Will new pictures emerge?

Perhaps we were a bit too flippant; we do watch the overall swap spread, of course. There is reason to believe that we could be entering a new regime, with euro swap spreads returning to pre-Great Financial Crisis levels. The supply of safe haven euro government bonds is increasing because of Germany’s more expansive fiscal policy, while demand is decreasing because of the reversal of the ECB’s quantitative easing programme. But all is not lost for our efforts. The years of managing through these crises, and analysing the factors behind the swap spread, should still allow portfolio managers to harness a portion of its volatility for valuing euro fixed income sectors.

Next?

Investment management is part science, part art. How much? Can a quantitative model capture more of these anomalies, or do we have to keep squinting at the graphs? We’ll let you know when our financial engineers emerge from their lair and unwrap their model!

And just for the sake of completion, the graph you were expecting :

[1] The spread of a corporate bond over its reference (eg, German Bund), often thought of as the credit spread, can include elements other than just the difference in credit risk. In the euro markets, this spread notably incorporates an element relating to the price of swapping fixed rates for floating rates: the euro swap spread.