Is biotechnology on the verge of a new growth cycle?

After years of uncertainty, the biotechnology sector is showing clear signs of recovery. Policy fears have eased, innovation remains strong, and major drug companies are back on the acquisition trail. With product launches accelerating, valuations compelling and sentiment improving, investors may be witnessing the early stages of a new growth cycle.

Policy clarity restores confidence

What a difference a year makes! Last year the U.S. election cycle added uncertainty, pushing investors to the sidelines and driving the Nasdaq Biotechnology Index (NBI) to multi-year lows. Concerns over U.S. healthcare policy, tariffs, and the operational stability of the FDA weighed heavily on valuations.

Today, that backdrop has changed significantly. Policy uncertainty has lifted, and fundamentals have retaken centre stage. Fears about an under-staffed FDA have proven unfounded: the agency remains fully functional and has delivered approvals at a similar rate to 2024[1]. Tariffs have minimal impact on an industry with structurally high margins, especially as companies continue to invest in U.S. manufacturing capacity.

Drug pricing was the largest overhang, but here clarity has been restored as well. Pfizer set the tone by reaching an agreement with the administration aimed at harmonizing U.S. drug prices with those in other developed markets, while reducing inefficiencies through direct-to-consumer models*. Crucially, this did not require revisions to earnings guidance. This confirms that the pricing power of the industry remains intact, which is crucial in the business model of pharma and biotech companies. Other companies followed, removing the near-term threat of disruptive pricing reform and allowing investors to refocus on fundamentals. This was reflected by a further increase in the share price of Eli Lilly which in their deal also got a favourable price for volume deal on their obesity franchise. This resulted in Eli Lilly crossing the $1trillion market cap mark for the first time for a pharmaceutical company.[2]

From binary outcomes to durable growth stories

Biotechnology investing is often seen through the lens of binary events — clinical readouts, regulatory decisions, or M&A catalysts. Those drivers still matter, but the sector is increasingly defined by companies successfully commercialising their own products and scaling globally.

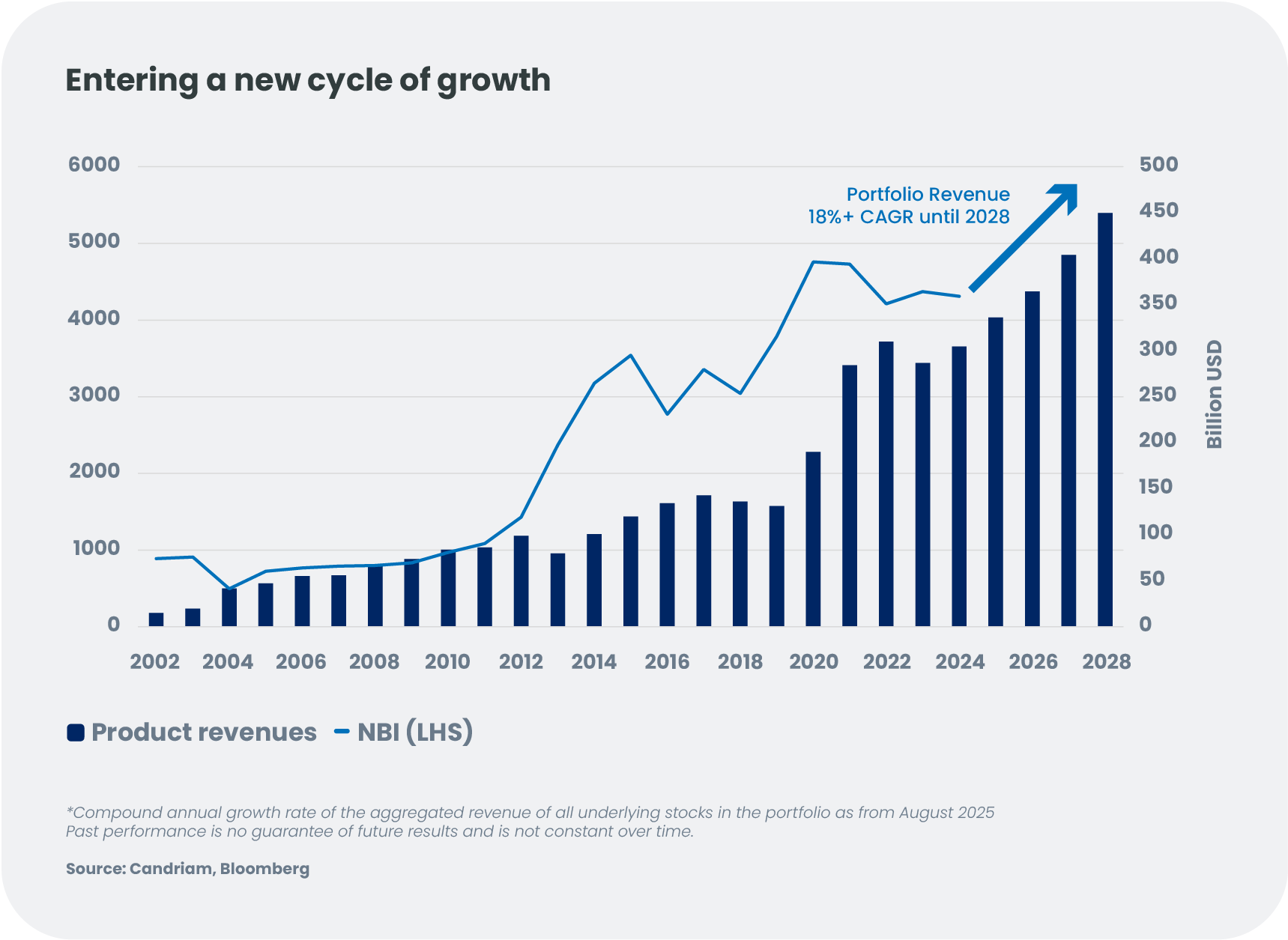

This shift is only just beginning. Today’s cohort of emerging biopharma companies is broader and more diverse than previous generations, with many demonstrating strong launch execution and accelerating revenue growth. In our biotechnology portfolio, consensus estimates point to a high-teens revenue CAGR for the years ahead — growth rarely found elsewhere in public markets.

Several structural changes are supporting this transformation. The rapid adoption of Artificial Intelligence in preclinical discovery and clinical trial development is decreasing the time needed to bring molecules to the market. Advances in digital commercial models allow companies to reach global markets without the heavy fixed-cost burden traditionally associated with large sales forces. Meanwhile, investors have become more disciplined, rewarding companies that prioritise high-value assets and focus on efficient capital allocation. As a result, biotechnology firms are increasingly attracting not only sector specialists but also mainstream growth investors seeking new growth opportunities.

A new wave of M&A: Urgency at the top of big pharma

Biotechnology has been the engine of drug innovation. An estimated 85% of U.S. drug approvals in 2024 originated from biotechnology companies[3]. Unsurprisingly, large pharmaceutical companies — facing roughly USD 400 billion in patent expiries by 2033[4] — are turning aggressively to biotech pipelines to fill the gap.

With policy fears easing, pharma has accelerated deal-making. Recent months have seen a rise in both deal numbers and deal size, including a rare bidding war between Novo Nordisk and Pfizer for Metsera — an illustration of the urgency to secure differentiated assets. Importantly, balance sheets remain exceptionally strong, with up to USD 1.2 trillion in aggregate capacity for acquisitions[5]. Given the magnitude of upcoming patent cliffs, we believe this is only the beginning of an M&A cycle.

A Higher-Quality sector after a four-year shake-out

The sector downturn of the past four years acted as a powerful Darwinian filter. Faced with tighter financial conditions and higher interest rates, companies were forced to streamline pipelines, concentrate resources on their most promising assets, and explore alternative funding channels. Many weaker firms were acquired, merged, or exited the market altogether.

The result is a healthier, more concentrated, and higher-quality opportunity set. Clinical success rates have improved over recent quarters, reflecting a greater focus on late-stage and commercially relevant programmes. In the private markets, venture creation slowed and capital became more selective, funnelling resources toward companies with clearer development paths requiring heavy insider investor support and stronger value creation potential sustained by healthy M&A perspectives and likely opens the path to high quality IPOs in 2026. A similar rationalisation occurred on the investor side, with many “tourists” leaving the sector, contributing to a more stable shareholder base.

So, where do we go from here?

2025 has marked a decisive reversal for biotechnology, with companies rebounding sharply from historically depressed valuations (biotech-equity indices had fallen roughly 55–60%[6] from their 2021 peak to the 2023 trough, before the recent recovery began). With the enterprise value to cash ratios** rebounding from just above one at the end of the first quarter, which was a 25-year low, back to the historical median levels of 2.7[7]. From the re-emergence of policy visibility, combined with sector-wide improvements in scientific productivity and commercial execution, has created fertile ground for a new growth cycle.

Biotechnology stands out as one of the few sectors capable of generating double digit revenue growth that is largely independent of the broader economic cycle. With multiple product launches still in their early phases, a renewed M&A wave gaining momentum, and a structurally improved industry landscape, we believe the sector is well positioned for durable performance in the years ahead.

*Direct-to-consumer models: manufacturers bypass traditional intermediaries such as pharmacy benefit managers (PBMs), traditional insurance, and pharmacy distributors to engage patients directly.

**The enterprise to cash value measures the value investors attribute to the non-cash assets of a biotechnology company. A ratio of 1 means half of the enterprise's value is cash, so very little value is attributed to the pipeline or commercial products. The median over the past 27 years is 2.7.

[2] Eli Lilly becomes first drugmaker to hit $1 trillion in market value | BioPharma Dive

[3] Source: IQVIA

[4] Source: Jeffries

[5] Source: Stifel

[6] Life Sciences 2023 Year End Review / 2024 Outlook - Gibson Dunn - Indices refers to S&P Biotechnology Select Industry Index

[7] Source: Wells Fargo Securities and Factset