Liberation Day was a shock for investors, causing a tremendous impact on financial markets. Hard-data economic indicators continue to hold up but are pointing to a deceleration. However, soft-data indicators have significantly deteriorated and board-room decisions are coming to a halt, as the final damage caused to the economy by the tariffs is very difficult to assess.

After a steep equity sell-off in early April, markets recovered a good part of their losses as the US Administration was advised to delay implementation of its tariffs. Brazil and India equities were among the top performers during the period, ending the month up a little over 3%. Hong-Kong and China equities were among the worst performers due to ongoing pressure from the trade war. Defensive sectors were the obvious beneficiaries of the current environment. The Vix reached its second highest level over the last 10 years, ending the month at nearly 25.

US long-term sovereign rates were extremely volatile over the course of April, affected by several strong market dynamics. The natural flight to safe-haven assets following the announcement on 2 April was counter-balanced by Institutional investors selling significant amounts of US debt, hedge-fund trades deleveraging, a weak Treasury auction, as well as investors questioning the future of the dollar as a reserve currency. European sovereign rates continued to trend lower.

The HFRX Global Hedge Fund EUR returned -0.56% over the month.

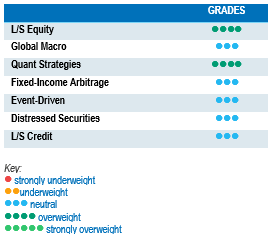

Long-Short Equity

Long-Short Equity strategies navigated April’s choppy market conditions well, averaging positive low single-digit returns over the month. Managers came into Liberation Day with low risk levels after lowering exposures during March’s momentum reversal, as well as for risk management reasons as uncertainty levels were very high. After the equity sell-off, the net selling of global equities that had been going on for two months came to an end, driven by short covers. Returns from fundamental strategies by region were dispersed, with Europe-focused managers generating gains and China-focused managers experiencing losses. According to Prime Brokers, there is no evidence yet of a significant rotation of hedge funds from US equities to non-US equity trades. Overall, Long-Short Equity managers are keeping net exposures low until there is more hard data on whether or not there will be a future recession. Investment visibility has been substantially reduced since late January 2025, leading managers to reduce their gross and net exposure. Fully diversified capital allocations to Long-Short Equity strategies have proven resilient during market drawdowns and able to generate strong risk-adjusted returns over time. In a world of sustained uncertainty and diverging economic performance, Long-Short Equities are able to extract alpha from increasing market dispersion.

Global Macro

Performances for Global Macro strategies were very dispersed over the month. On average, managers kept their risk exposures on the lower end of their investment ranges since the start of the year. Over the course of April, other than buying gold, there were few places to hide, especially when the status of US dollar as reserve currency is being put to the test. Shorting the US dollar was one of the most profitable trades during the month as the trend initiated in March continued to play out. Long Emerging Markets rates, long European long-term sovereign bonds and long gold were also trades contributing positively to performance. The ability to navigate markets has been challenged by the hyperactivity of the new Trump Administration, which has driven heightened volatility across asset classes. At the same time, this volatility has been a significant source of opportunity. The economic decoupling of major regional powerhouses has accelerated since the beginning of the year, offering attractive opportunities for macro managers to deploy capital and generate strong returns. However, caution is warranted over short-time horizons due to the unpredictability of the US administration's policy agenda.

Quant strategies

On average, quantitative strategies generated negative returns during the month, although the dispersion of returns was greatest across the different hedge fund strategies. Trend followers lagged Multi-Strategy Quantitative programmes due to losses accumulated in equities, foreign exchange and commodities. Short-term models managed to contribute positively to performance but were negatively balanced by losses on medium- and long-term models. Long equity positions in Europe, short US dollar positions against several main currencies and energy futures were among the biggest detractors. Once again, Multi-Strategy Quantitative programmes outperformed during the period, benefiting from a wider variety of programmes to perform.

Fixed Income Arbitrage

April was a challenging month for fixed income arbitrage strategies due to a violent spike on long-term US Treasury yields. The US 30-year issue dropped 30 basis points, touching 4.46% coming into Liberation Day, as investors sought safety. US long-term yields then increased by close to 50 basis points when significant institutional holders of US debt sold assets into the market and the credibility of US assets as safe haven was called into question. The consequence of these moves was detrimental to US swap spread trades as Treasuries spreads to swap rates narrowed instead of widening, highlighting the sudden lack of confidence in the US bond market. Although the current environment commands strong risk management implementation across strategies, it has been providing the fixed income space with numerous trading opportunities in several areas (cross country, RV, directional).

Risk arbitrage – Event-driven

Event-driven strategies performed well during the month, generating positive low single-digit returns. On average, hard and soft-catalyst books have contributed positively to returns. This outcome in a high volatility context was positive for the strategy, catching up the performance gap relative to other strategies. In the current market environment, managers are shifting into defence mode, reducing risk and refocusing their portfolios on their higher conviction positions. Some had alpha shorting the deal spreads of mergers that could be at risk. Early year predictions of a rich opportunity set for mergers has not yet materialised for obvious reasons. Deal volumes are below expectations and decelerating. On the other hand, merger spreads are richer. Policy-driven uncertainty will have to cool before a clearer picture can emerge of the opportunity set for the remainder of 2025.

Distressed

Since the start of the year, credit markets had been relatively immune to equity-market volatility until corporate credit spreads spiked significantly in early April. Spreads then progressively eased through the month as tariff tensions began to partially de-escalate. High Yields spreads are now almost 100 basis points wider compared to the beginning of the year, reflecting the accrued risks for the corporate world of deteriorating economic fundamentals. Prior to the hard tariff disclosures, managers were relatively constructive regarding the credit market. Future positioning and opportunity set will depend on the US Administration’s policy decisions and the next quarters of hard data. One of the market’s current weak spots seems to be the leverage loan market. Over the last 12 months, the number of US High Yield Bond issuers being upgraded is 20% higher than those being downgraded. For US loan issuers, upgrades are 40% lower than downgrades. Also, according to the JP Morgan Default Monitor, over the last 12 months the percentage of loan defaults including liability management exercises has reached 3.9%, which is treble the level of high yield defaults during the same period.

Long short credit

Corporate credit spreads have widened upon increased levels of uncertainty, but they will probably move higher if the fears of economic recession materialise. Managers have concentrated their portfolio on their highest fundamental convictions, increased the level of hedges and lowered strategy directionality. On the other hand, such a rich market generates numerous opportunities for alpha shorts. Absolute return or hedged investment approaches have gained more relevance with the increase of idiosyncratic risks and geopolitical uncertainty. Risk diversification is important and should be an integral part of the investment allocation process.