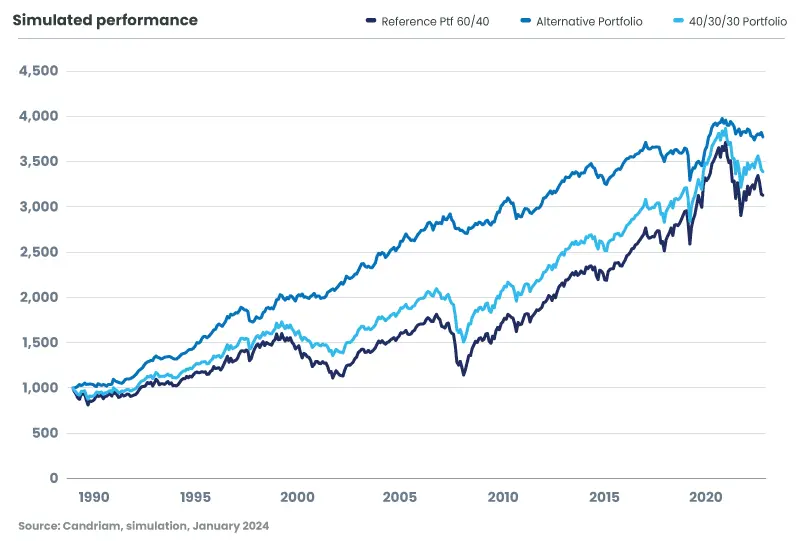

2022 was a landmark year for monetary policy, with Central banks shifting priority from supporting growth to taming inflation. As a result, markets tanked amid high inter-asset class correlation levels, potentially questioning the respective attractiveness of equities vs bonds. Besides, absolute return strategies tend to structurally benefit from a high rate context. Is it time to revisit the traditional 60/40 portfolio?

;

;