This article was produced in conjunction with Karan Patole, Associate Director at Kartesia

The lower-mid-market segment of Private Debt offers potentially attractive returns and the ability to manage risk through greater selectivity and better control. Yet, success requires experience and market presence.

Are these ‘Goldilocks’-sized borrowers?

Lower-mid-market companies, those with revenues of €10 million to €200 million,[1] are likely to find some shelter from the volatile economic effects of developing trade wars and geopolitics. The reason? Mainly, because they largely address domestic markets, they are less exposed to tariffs, and when they do have to import raw materials, the supply chains tend not to be as long. With politics now driving economics rather than the other way around,[2] this could become an important stabilizer for profit and cash flow forecasts.

Accompanying the ‘Growth Spurt’ of Adolescent Companies

In this niche segment, borrowers are often too small to attract the attention of a large bank or private debt investment manager. Companies of this size may often be ‘sponsorless’, that is, they do not have the backing or involvement of a private equity firm or large bank. Founders may prefer to avoid the dilution of more equity.

Yet they often have specialized needs. For example, their business may be local today, but may be scalable across other national markets in Europe. A local private debt advisor might not be large enough to advise them as they expand across national borders, or to provide more debt as they grow. Especially when these firms are sponsorless, they have a greater need for relationship, advice, and a financing partner who can help them both today, and with their future financing rounds.

At Candriam, we and our partner Kartesia have an established private debt presence – and local offices -- in growing private debt markets, such as the UK, France, Spain, Italy, the Benelux, Switzerland and Germany. We are able to expand our lending and our scope along with the needs of the growing company. Initially, a local lower-mid-market borrower may come to us for a loan of €20 or €40 million. As they grow, we can supply continued financing needs through the €80 or €100 million range, beyond that of local-only in their home countries. Candriam and Kartesia have ‘boots on the ground’ in many of the countries in which these borrowers hope to expand, and can offer guidance and funding for the next phase of their growth.

Potential Return - Pricing power in a Niche Market

Overall, private debt returns may be attractive for structural reasons. Without the competition of larger banks or public offerings, yields are a bit more generous for the investor. Further, as an illiquid asset, this is compensated by a potentially more attractive yield than liquid debt of the same quality.

Within private debt, the lower-mid-market benefits from two additional elements of potential return. As investor demand for private debt grows, and even as more investors enter this sector, this niche is still underserved by the broader private debt market, and therefore returns are less impacted by the global margin compression trend in lending rates. Second, the large absolute number of borrowers offers investors greater selectivity and choice, potentially improving the risk-adjusted return potential.

Risk Control Through Partnership

Risk management in private debt can be quite strong, if the manager has the skill to analyse the business thoroughly, and the ability to customise the deal structure to the specifics of the borrower. Oversight can be even stronger in the sponsorless deals which are often found in the lower-mid-market.

A private debt manager has a more direct relationship with the borrower than most other types of credit, and this is particularly true for lower-mid-market companies. With the right match, this is beneficial to both parties, offering early knowledge for the private debt investor and more customization for the specialised needs of growing firms.

The large number of enterprises in the lower-mid-market sector provides investors greater choice, selectivity, and diversification. The local presence of Kartesia in these markets provides well-established local networks to discover these sometimes hard-to-identify sponsorless borrowers. Our partner focuses on deals with defensive, cash-generative businesses, and grows with them.

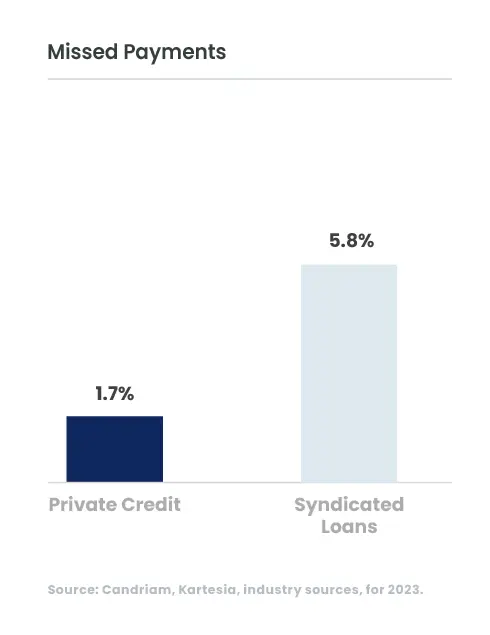

In this lesser-banked geography and sector, we can tailor the structure to the benefit of both the borrower and the investor. A single senior loan can be easier to structure and monitor. This simplicity can also make it easier to increase the debt as the borrower’s business grows. The covenants can be more specific to the business, more meaningful to the lender, and less restrictive on the borrower’s ability to grow. While Figure 1 shows a fairly low picture of missed payments for the broad category, it is only half the story. How much of any troubled debt is recovered? What is the actual loss? Fewer creditors (only one in the case of Kartesia) can mean a faster agreement and higher chance of a partial or complete recovery of the debt in a shorter period of time.

Conclusion: Deal Selection for Return and Risk Management

The lower-mid-market offers the potential for both better return and careful risk management, but it requires agility and specialised knowledge on the part of the private debt investment firm. The best risk-adjusted returns can be generated by selecting quality companies, identifying the specific risks so that terms can be customised, and holding strong representation. With smaller and particularly sponsorless companies, the balance sheet can be structured with a single tranche of first-lien debt. This means fewer parties involved in decision-making for new loans, and a better position in case of an underperforming business.

Our multiple geographic offices allow us the network to find the right borrowers and grow with them. We can customize covenants and structures rather than following a centralized ‘recipe’. Our disciplined approach offers careful deal selection and precise risk management to generate risk-adjusted returns.

[1] For illustration, mid market private borrowers can be thought of as companies with revenues up to €500 million or perhaps more.

[2] Katherine Neiss, PRIM Fixed Income, Private Debt Investor, 15 May, 2025, accessed 8 September 2025. Five takeaways from PDI Europe