Since the end of 2021 and as a result of structural shifts in the economy, from decarbonization to relocation of supply chains and higher geopolitical risks, interest rates entered a new regime. After two years of rates considerably higher than the previous decade, what are the implications for High Yield markets?

Definitely a new era for fixed income markets!

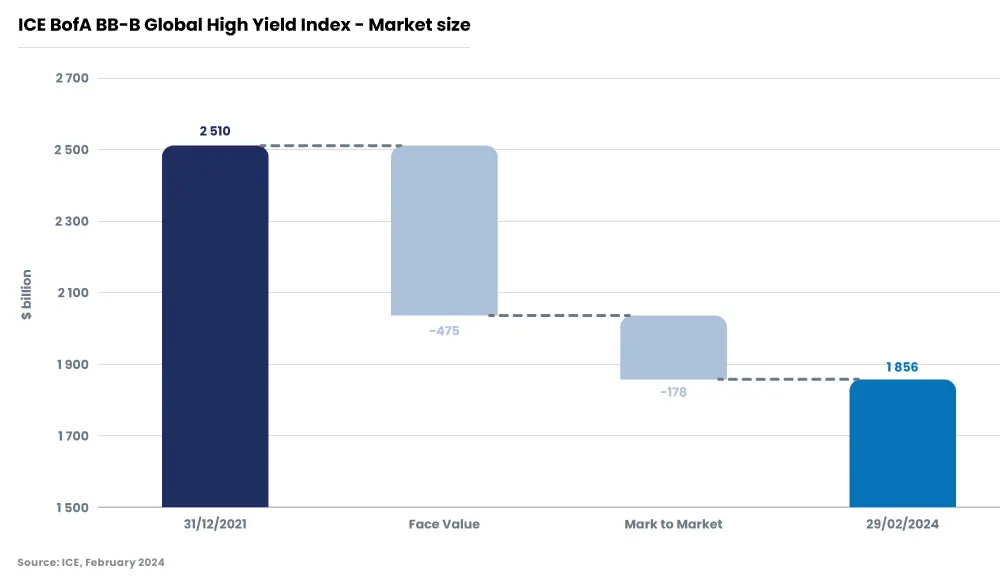

High yield markets are shrinking. Do you know that they have contracted by 25% over the past two years? The ICE BofA BB-B Global High Yield Index has lost $654 billion[1] in value. In the meanwhile, investor demand for credit and high yield has rebounded at the end of last year.

;

;

”Demand for credit has been very strong since Q4 2023, in a shrinking market and amid low credit dispersion. We think it is very important to remain focused on fundamentals and to be prepared for when the tide goes out.

Navigating High Yield Markets

Take also a minute to hear Charudatta Shende our Head of Client Portfolio Management Fixed Income, discuss our investment team’s analysis of the situation on credit markets. You will understand which strengths made the success of our credit team for the past twenty years!

Discover our funds

-

Candriam Bonds Credit Alpha

-

Candriam Bonds Global High Yield