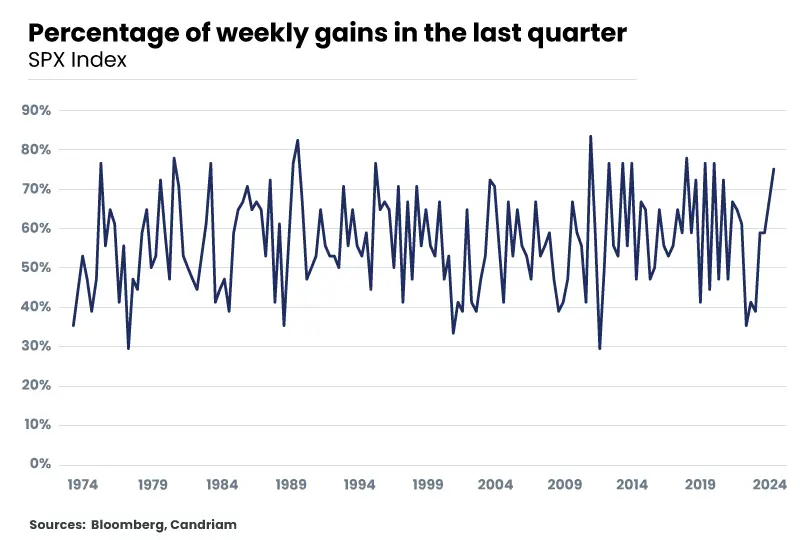

The US market rally since October is exceptional compared to historical observations. Only once in the last 50 years, in 1989, has the S&P 500 Index risen in 15 of the last 17 weeks. The current momentum may continue, but after this exceptional number of successive rises, the probability of a short term consolidation has risen. The rally is all the more exceptional in that it has occurred independently of movements in interest rates. It started at the end of October 2023 with the anticipation of the central banks' pivot in 2024 and independently of the number of expected rate cuts (7 cuts planned for 2024 in December 23 for the Fed, compared with 3 today).

Chart S&P weekly gains

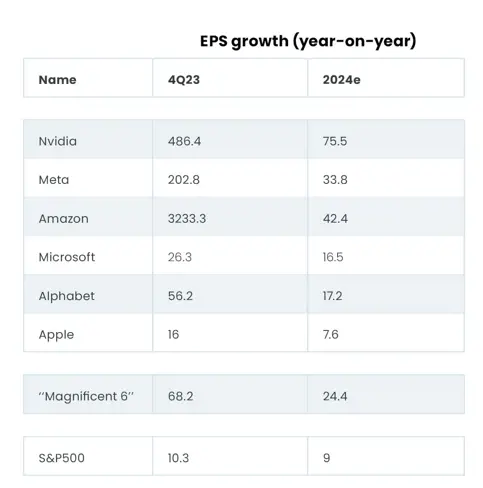

The “Magnificent 6” against the world, the exception goes on…

The season of earnings releases continued to support the rise in equity markets. This is particularly true in the United States, where market growth continues to be highly concentrated around the "magnificent 7" or “6” if we exclude Tesla that is struggling since the beginning of the year.

The fourth quarter of last year ushered in a robust earnings landscape, slightly above expectations and marking a 7% year-over-year (YoY) increase in reported earnings per share (EPS). This increase indicated an acceleration from the preceding quarter, with a widespread beat observed across various sectors, albeit with Materials and Utilities falling short of consensus estimates. The Magnificent 6 (ex-Tesla), posted a a striking +68% YoY growth compared to a modest -4% for other companies. Similarly, those US Megacaps have seen their 2024 earnings revised upwards, while the rest of the market faced cuts in estimates. The slowdown in Capex growth during the fourth quarter is anticipated to rebound in 2024, propelled by domestic and AI investments. Despite weak guidance in the first quarter, corporate sentiment has seen improvement, hinting at a positive earnings cycle ahead. Conversely, in Europe, earnings were down in Q4, commodity sectors and industrials being the weakest sectors. overall.

Earnings growth expectation for 2024 is now 3-4% for Europe and almost 10% for the United States, while the rebound in emerging markets is an impressive +16%. While expectations for emerging markets are questionable, the achievement of such strong earnings growth will depend in particular on China's ability to deliver growth, as the country has steadily disappointed in recent years. In Europe, expectations are more modest and realistic, consistent with persistently weak economic growth. In the United States, the economy remains extremely resilient, and the transatlantic earnings growth gap could once again follow the difference in economic performance.

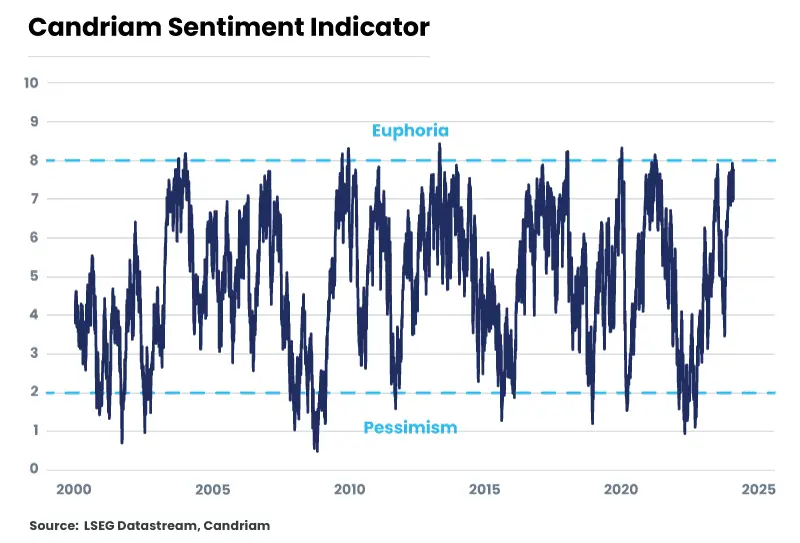

…fueling an increasingly bullish positioning and sentiment

The resilience of economic activity and corporate earnings, has fueled increasingly optimistic investor sentiment.

In one of the latest BofA Merrill Lynch survey, there's a lot of optimism. Only 4% of the 240 people they asked think there will be a recession in the US in 2024. This is a big change from last year when 85% were worried about it. It's interesting that only 7% are really worried about prices going up and hurting investments. Market outlook shows a generally positive sentiment, with a majority expecting a continuation of the bull market and a preference for equities over bonds and cash. US equities are favored the most, followed by Japan, while Europe is viewed bearishly for the first time since 2019.

Flows show that more people are putting their money into stocks, while bonds are a bit less popular. Cash is still a safe bet for 10% of people, the same as last year, because it's still making good money. But on equity markets, investors remain exposed to concentrated positions: the “magnificent 7” in the US and the “Granolas” in Europe. Small and Mid caps post negative performances year-to-date. While concerns around concentrated positions persist, there remains room for further bullish sentiment and positioning, especially amidst potential rotations into risky assets and equities' laggards.

A broader participation by other sectors and regions will now depend on economic momentum and corporate earnings while keeping inflation under control. And this is where one of the market's vulnerability could lie. Inflation is no longer a concern for investors and the principle of a dovish pivot has been discounted.