;

;

Our deadly beautiful cities

According to the United Nations, 2007 was the year when, for the first time, more people in the world lived in urban rather than in rural areas. This trend is continuing at high speed, and global urban populations are projected to increase by 2.5 billion over the next 30 years[1], significantly impacting infrastructure needs.

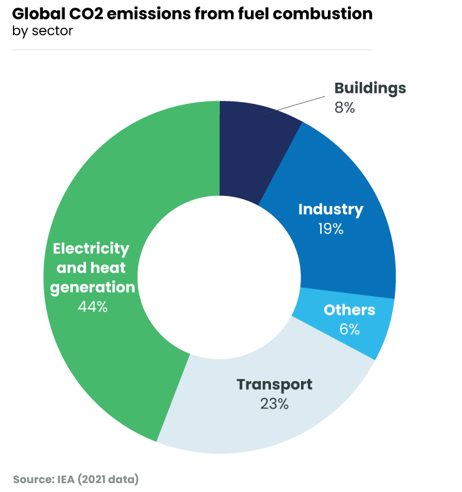

Transportation is the main cause of air pollution in cities plagued by traffic congestion, and represents almost of quarter of global CO2 emissions[2]. With 1.5 billion cars operating worldwide[3], road traffic accidents are adding over a million deaths each year[4] to the victims of pollution.

As we move forward in the 21st century, the global population is likely to continue growing and urban areas to develop. This continual growth presents complex challenges that we need to address as we prepare our cities of the future.

Preparing for the cities of the future : towards a cleaner, safer and smarter mobility

What can we do to reduce the negative externalities of urban life? We are convinced that a transition to next generation mobility solutions can generate value while favoring the reduction of our carbon footprint. We have identified three areas where we can potentially benefit from high-growth opportunities:

- Cleaner mobility: through the development of public transport or lower GHG emission solutions such as electric cars and bikes;

- Safer mobility : through autonomous driving systems, advanced driver assistance systems, car connectivity technology;

- Smarter mobility: through car-sharing or digital software supporting the avoidance of emissions.

;

;

”Mobility in its current form must be redefined. Adopting a more sustainable approach is the only way to reduce the externalities of our current transportation systems.

A disciplined investment approach at the crossroads of our ESG and thematic expertise

Our strategy relies on a thorough ESG analysis combined with thematic stock selection. This dual fundamental framework combines financial and extra-financial criteria and is key to detect tomorrow’s potential winners, i.e. the companies offering both a strong financial and sustainability profile. Our portfolio is built from our strongest convictions, while seeking alignment with a temperature scenario equal or lower than 2.5°C today and 2°C in 2025[9]. It also aims to invest a higher share of assets in high-stake companies than the reference index – high stake companies being defined as those belonging to one of the sectors considered to play the biggest role in achieving the Paris Agreement objectives.

Johan Van Der Biest, Co-Head of Thematic Global Equity, explains the team’s approach in more details in a short video:

Our teams’ know-how, backed by 20 years of thematic investing, is a differentiating factor in our management of this innovative and promising strategy.

All investment strategies involve risks, including the risk of loss of capital.

The most significant risks on this strategy are:

- Risk of loss of capital

- Equity risk

- Foreign exchange risk

- Emerging countries risk

- ESG Investment risk

For further details on risks associated with investing in the promoted strategy, a general description and explanation of the various risk factors is available in the section Risk Factors of the relevant regulatory documents.

[1] United Nations

[2] IEA, 2021 data

[3] https://hedgescompany.com/blog/2021/06/how-many-cars-are-there-in-the-world/

[4] World Health Organization

[5] United Nations

[6] Sdworks Europe, “The high cost of free parking” Book by Donald Shoup

[7] IEA, 2021 data

[8] World Health Organization

[9] The strategy aims to achieve an overall portfolio alignment with a temperature scenario equal or lower than 2.5 degrees. As the availability and reliability of company climate data evolves over time, the strategy aims to be aligned with a temperature scenario equal or lower than 2 degrees by January 1st 2025. For details about the methodology used to calculate the temperature to which a portfolio is aligned, please refer to the Transparency code on Candriam’s website: https://www.candriam.com/en/private/market-insights/sri-publications/#transparency