Last week in a nutshell

- Ahead of the symposium in Jackson Hole, US Treasury yields hit their highest level since 2007 on elevated fears that monetary policy would remain tight.

- Several business and consumer confidence surveys missed expectations on both sides of the Atlantic pointing to fading growth momentum.

- NVIDIA delivered significant earnings growth despite very elevated expectations with the focus on AI-driven datacentre strength.

- Six new countries – Argentina, Egypt, Iran, Ethiopia, Saudi Arabia, and the United Arab Emirates – are set to join the BRICS next January, forming a highly heterogeneous group.

What’s next?

- Markets will continue to digest the “our-job-is-not-finished-yet” messages sent out by central bankers in Jackson Hole

- The US macro data climax will be on Friday as the Job report and the ISM Manufacturing PMI will be published. Markets expect a slowing growth in August but remain resilient.

- The economic calendar will be intense also in the euro zone. Inflation, unemployment, monetary aggregates, and credit supply releases will add fresh datapoints to Christine Lagarde’s speech at Jackson Hole in the assessment of future ECB monetary policy.

- In China, the publication of manufacturing and services PMIs will shed some light on the effect and need of further support measures from the authorities to help the economy recover more sustainably.

Investment convictions

Core scenario

- In the United States, latest data continue to point towards a soft landing. Inflation and wages continue to decelerate while growth remains resilient whereas Chinese growth keeps missing growth forecasts raising the odds for more stimulus.

- In the euro zone, growth is weak and expected to remain lacklustre: activity is contracting in the manufacturing sector and decelerating in the service sector. Receding inflation should help households to regain some purchasing power in H2.

- Most emerging economies have low inflationary pressures and some central banks have started to cut rates: They are not at the same stage, in the interest-rate cycle as developed markets.

- Central banks in developed markets are nearing their peak rates, but interest rates will likely stay high for an extended period. We expect no rate cuts in developed markets in the second half of 2023.

- We also expect a less supportive market environment during H2 than in H1 which should translate into a broadly lateral move of financial markets.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- After the dramatic drop in growth surprises in all major regions outside of the US, the global outlook could become less supportive.

Cross asset strategy

- We have a more cautious equities allocation than during the first half of the year, considering the limited upside potential. At current levels, a positive economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

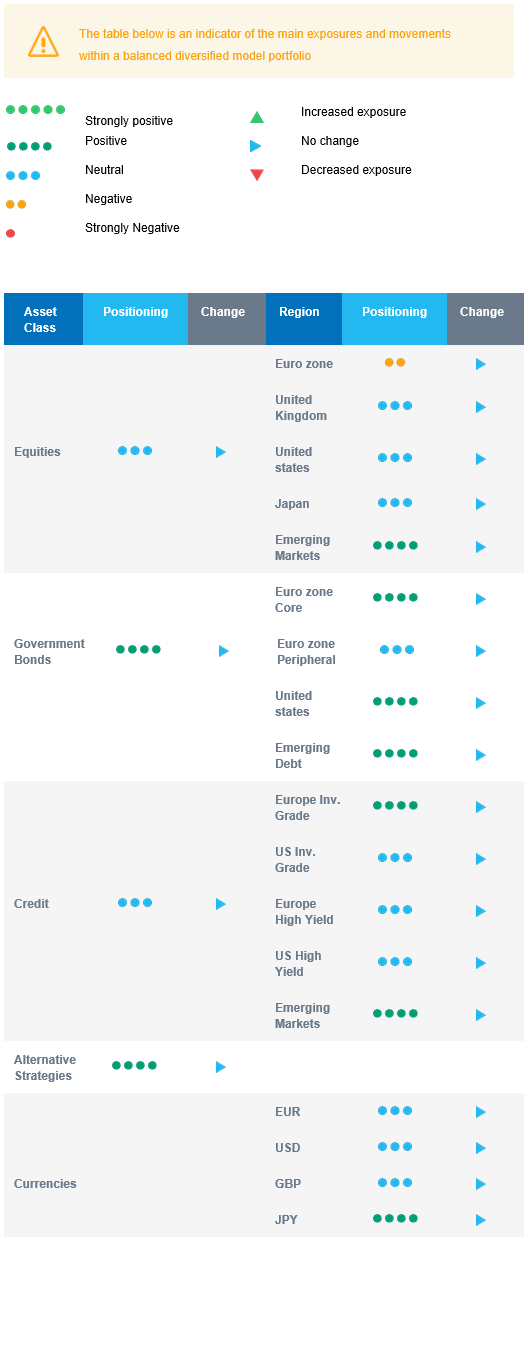

- We have the following investment convictions:

- Our positioning on equities is somewhat more defensive and we are underweight euro zone equities as pricing has become too complacent in our view given the restrictive monetary and financial backdrop.

- We believe in the upside potential of Emerging markets, which should benefit from improving economic and monetary cycles vs developed markets, while valuations remain attractive.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as cyclicals are already pricing a strong improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery which started in 2022, albeit at a reduced pace compared to the first half of this year.

- In the fixed income allocation, we have a long duration positioning:

- With higher rates and a reasonable level of spreads, we like US and European government bonds and high-quality credit as sources of carry.

- Our overweight stance on investment grade credit is a strong conviction on European issuers since the start of the year as carry-to volatility is attractive.

- We are more prudent on high yield bonds as tightening credit standards should act as headwind and the buffer for rising defaults has decreased in recent months.

- Emerging bonds continue to offer the most attractive carry. The accommodative stance of the central banks is positive for bonds. Investor positioning is still light post-2022 outflows. And the USD is not expected to strengthen, which represents a tailwind for local currency debt.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, both are good hedges in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into an overweight bonds vs equities. Within fixed income, we identified European Investment Grade bonds as attractive and remain confident in the asset class. We have a long duration seizing the opportunity as the hawkish ECB policy has driven long-term yields to attractive buying levels. Within equities, we see value in a barbell approach: Overweight Emerging markets mitigated by an underweight on euro zone. Further, we acknowledge a supportive momentum and a US goldilocks episode: More positive surprises on economic growth and less negative surprises on inflation. However, our exposure to the US market comes with a derivative protective strategy as sentiment, positioning, and market psychology are stretched. Markets are increasingly reflecting our soft-landing outlook, limiting the performance potential going forward. Our “late cycle” asset allocation strategy is also axed around defensive sectors over cyclicals.