By all means, forecast the number of M&A deals if you want to forecast bankers' bonuses, Wall Street profits, or new debt issuance. As for Risk Arbitrage, we have more interesting things to think about for 2022.

Where are we in the M&A cycle ?

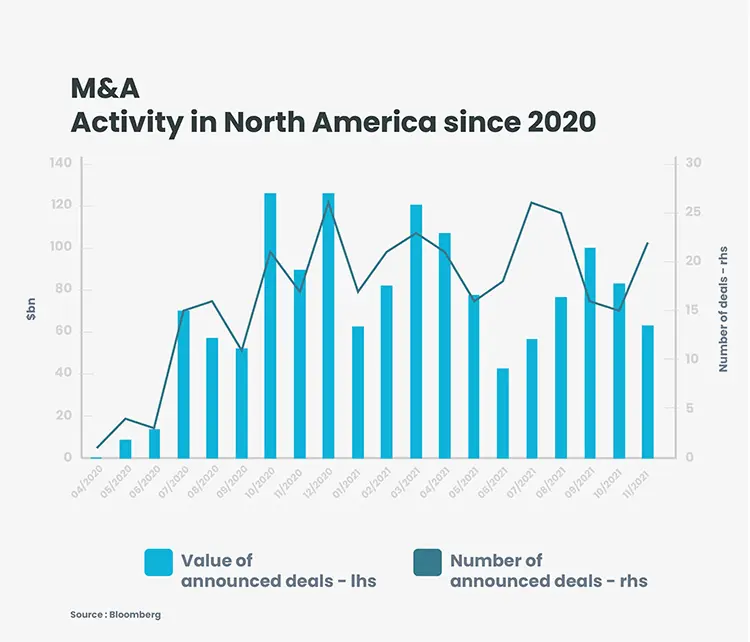

Like the economy as a whole, mergers and acquisitions have experienced a tremendous rebound since the summer of 2020. This new wave of M&A activity has encompassed most economic sectors, but as usual, there has been a greater number of deals in healthcare and technology. Regionally, North America continues to lead the M&A recovery in terms of deals over $10 billion in value. A healthy number of deals have also been announced in Europe and Asia. Since the beginning of this year's fourth quarter, M&A activity appears to be stabilizing at mid-cycle levels. Indeed, with the appointment of the new Chairman of the US Federal Trade Commission (FTC) last June, M&A market participants fear increased vigilance from competition authorities, particularly on large deals that could negatively impact the American consumer. While activity in the United States remains good, there is a virtual absence of transactions over $10 billion in size. In Europe, however, M&A activity remains very satisfactory.

How do you see M&A activity in 2022?

Senior bankers confirm that many M&A projects remain on the back burner for the time being due to uncertainties regarding potential pro-consumer changes in FTC policy. We believe that once these doubts are resolved, presumably during 2022, the number of M&A deals in the US should start to normalize.

During 2021, M&A activity has proven to be quite resilient to the successive waves of the Covid-19 epidemic and its new variants. Indeed, merger agreements have been adapted to take these new risk factors into account. All in all, we are rather optimistic about the M&A activity for the coming year.

What will drive returns in risk arbitrage in 2022?

M&A activity is an easy figure to chart, but perhaps not the only source of return in a risk arbitrage strategy. We do not have a particular expectation for the number of M&A deals in 2022, but less headline-grabbing performance drivers can be equally useful. Investors interested in Risk Arbitrage might be better served to consider spread levels, deal failure rates and the number of overbids.

We see a green light ahead in 2022 for both spread levels and deal completion rates. Indeed, risk arbitrage spreads are now 2 to 3 times higher than before the Covid crisis for an equivalent level of risk. Failure rates remain at historically low levels – or should we say, completion levels are high. The number of bid improvements, or bidding wars, has moderated from the very eventful early months of 2021. But keep an eye on spread levels and completion rates. "Two out of three ain't bad."

By all means, plot out the number M&A deals if you wish to forecast bankers' bonuses. But if you want to understand where Risk Arb opportunities are today, watch the spreads.