European equities: Energy rally

European equity markets continued to decline in September, after reaching a 2023 high at the end of July. Macroeconomic data confirmed that the European economy has been slightly weaker recently. Investors are also questioning the possible impact of the weak Chinese economy and rising oil prices on the European economy. The latter jumped in September on the back of low inventories and the announcement that Saudi Arabia and Russia will extend voluntary oil output cuts through the end of the year. Meanwhile, long-term interest rates spiked higher again.

European equity markets continued to decline in September, after reaching a 2023 high at the end of July. Macroeconomic data confirmed that the European economy has been slightly weaker recently. Investors are also questioning the possible impact of the weak Chinese economy and rising oil prices on the European economy. The latter jumped in September on the back of low inventories and the announcement that Saudi Arabia and Russia will extend voluntary oil output cuts through the end of the year. Meanwhile, long-term interest rates spiked higher again.

Against this backdrop, small caps continued to underperform large caps. In terms of sectors, energy was the main outperformer, on the back of rising energy prices, together with financials and communication services. Healthcare also did quite well in this more risk-averse period.

The information technology sector was the strongest underperformer, together with consumer discretionary, due to the strong rise in long-term interest rates. The defensive consumer staples sector also underperformed, but the industry groups food & beverage and HPC, our main convictions in consumer staples, clearly did better than the food retail sector and the broader European equity market.

Earnings expectations and valuations

Following the recent market correction, valuations have come down. The European equity market is currently trading at just below 12 times expected earnings in 2024, which is significantly lower than the long-term median.

Earnings are expected to grow by almost 7% next year and are mainly supported by growth in healthcare, information technology, communication services, materials and industrials.

Comfortable with defensive bias

Considering the economic slowdown, we remain cautious on more cyclical sectors, expressed by our neutral grade on consumer discretionary and industrials.

In the meantime, we are keeping our overweight in defensive sectors such as consumer staples and healthcare steady. The latter is now benefiting from a rebound of the USD against the euro and the end of destocking. A relative catch-up remains our base scenario, as the sector offers very good rewards.

Within consumer staples, our favourite industries remain food and beverage and household and personal products. Both are driven by top-line growth and resilient margins. We are still cautious on food retail, which is suffering as a result of margin pressure.

US equities: Spike in interest rates pressures equities

Global equity markets continued to decline in September, after reaching a 2023 high at the end of July. The US economy remains quite resilient, but investors were spooked by the strong oil price increase on the back of low inventories and a tightening supply, and the sigificant increase in long-term rates.

Small caps strongly underperformed

US equity markets have lost some ground over the past few weeks. Small caps underperformed significantly due to the strong increase in long-term interest rates in almost all sectors.

In terms of sectors, healthcare outperformed the broader market, as did energy and communication services. The latter’s outperformance was mainly supported by the good performance of Meta Platforms and Alphabet, whereas the energy sector benefited from increasing oil prices. Oil headed significantly higher in September, as oil inventories appear to be low, and both Saudi Arabia and Russia announced they would continue their voluntary oil output cuts of one million barrels a day.

Consumer discretionary and utilities put in weak performances in a context of rising interest rates. Consumer staples have also underperformed over the past few weeks.

Staying balanced

Valuations have come down following the recent market correction. The US equity market is currently trading at just below 18 times expected earnings in 2024, which is only slightly above the long-term median. Earnings are expected to grow by almost 12% next year and are mainly supported by growth in information technology, communication services, healthcare and financials.

However, considering that the economy is slowing down, earnings expectations are probably a little too optimistic and the upcoming US presidential elections markets are most likely to be somewhat more erratic in the coming months. We are not ready to take big sector bets in this market context and feel comfortable with solely a positive grade on healthcare.

Emerging equities: More pronounced decline than developed markets

Emerging markets experienced a correction of 2.8% in USD terms in September, hitting a six-month low, due to the strengthening USD and the continuation of the risk off sentiment seen in August. As US treasury yields nudged higher, risk off sentiment continued to weigh down emerging market returns. The relatively resilient regions over the month were in CEEMEA, including Egypt, UAE and Turkey. Emerging Asia performed slightly better, with India posting positive returns, helped by sentiment uplift following the G20 summit. India rose and is proving to be one of the most resilient emerging markets. Chinese equities fell in line with peers, with macro data showing signs of economic stabilisation, while policy stance remained supportive, even though arguably insufficient. The decline was driven by soft consumption and a weak property outlook. Taiwan and South Korea, however, lagged on relative returns, as the US tech and semiconductor sector saw profit-taking in the face of higher yields. In Latin America, Brazil outperformed following a sharp correction in August. On the macro front, Q2 GDP came out better than expected, while inflation is converging at historical levels, allowing the central bank to cut rates by 50 bps in September. Mexico lagged significantly, as rising US yields added to currency weakness, after seven consecutive months of gains.

In the commodities complex, oil prices saw a strong rally in September, with OPEC+ production cuts and falling US inventories supporting oil prices. The surge in oil prices is exerting a drag on growth. The ongoing easing cycle in many emerging markets is starting to be questioned.

On the currency front, a basket of EM currencies declined by 2%, as the US dollar index strengthened by 2.5%.

Outlook and drivers

As US treasury yields continue to rise, we retain our near-term cautious view on emerging market equities. However, over the longer term, we are convinced that emerging markets will benefit from multiple thematic tailwinds. These include: AI-driven semiconductor supply chain recovery, the green energy transition, cleantech opportunities, supply chain reorientation/diversification, and more. For Chinese equities, we are beginning to witness sequential improvement in economic data, although challenges associated with the property slowdown and oversupply might take longer to resolve. At the same time, policy support has turned more positive now, and we might be getting closer to witnessing positive outcomes from these policies. Regarding portfolio positioning, given the near-term headwinds from rising yields, we maintain a balanced portfolio exposure. We remain selective in our sustainable growth exposure, focusing on names with high cashflow generation and earnings visibility.

Positioning update

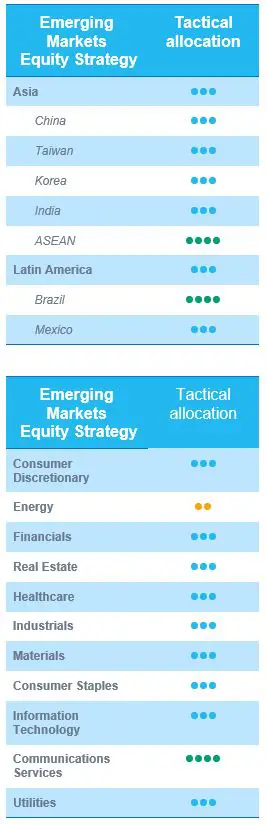

We make no changes to our regional views, but at sector level, we are downgrading capital goods to neutral following concerns of pricing pressure.

Regional views:

China Neutral: We maintain a neutral view on China. Despite some persisting headwinds on the property and real estate slowdown, policy support has turned positive, which should alleviate pressure on consumer sentiment and eventually uplift spending. Valuations reflect extreme pessimism which leaving scope for a cycical turnaround, given policy efforts.

India: Neutral, but positive on the long term – corporate profits continue to soar, driven by sustained government spending and a recovery in consumption demand as we approach the festive season. Despite higher oil prices, inflation continues to trend lower.

Sector and Industry views:

Capital goods is downgraded to neutral: given near-term pressures on EV supply chain thematic names, we are cautious on the sector.

Semiconductors: we remain positive on the sector, as a long-term beneficiary of sustained demand from secular drivers inlcuding AI applications, cloud and digital transformation, process and memory tech upgrades, amongst others. For broader memory and process foundry, we might be closer to a cyclical trough.