"With regards to corporate governance, disclosure is only the first step in a sustainable path. What truly matters for us is that companies are not just talking the talk but also walking the walk."

Corporate governance practices are improving in emerging markets... although some room for improvement remains.

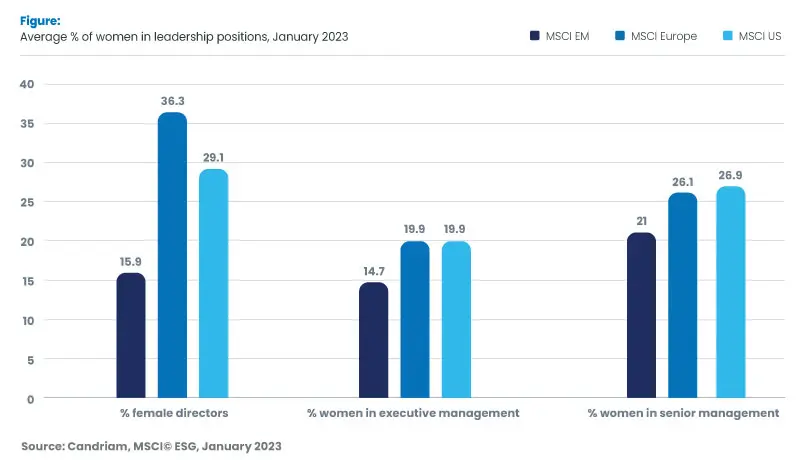

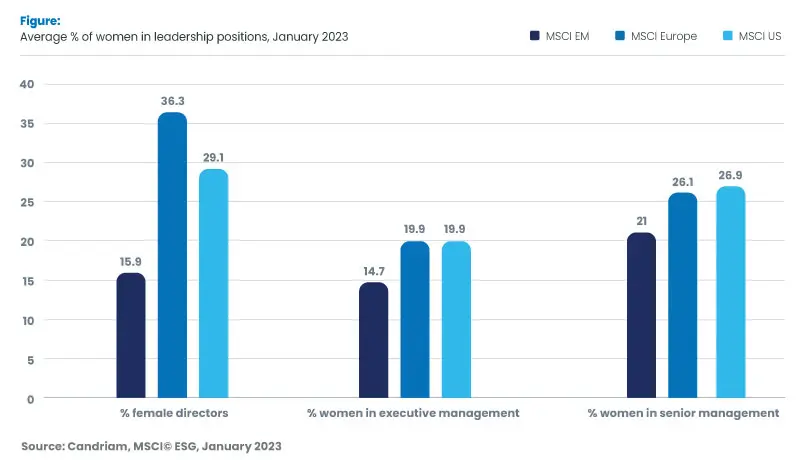

There are several examples of emerging markets where corporate governance standards and ESG disclosure have evolved in recent years, among which China, India, South Korea, Taiwan… Despite this progress, we observe a certain lag in emerging market companies’ practices compared to their peers. To name one example: gender diversity in leadership positions. While MSCI EM companies are close to MSCI Europe and MSCI US levels with respect to women representation in top management, they are clearly lagging with respect to the presence of female directors on the Board.

For emerging markets, a regional approach is required

When analyzing corporate governance, one may be tempted to apply global standards – after all, why should Samsung be treated differently from Microsoft? Should our standards be lowered for emerging market companies? A Board is a Board, and minority shareholders’ interests should be protected in all parts of the world.

But of course the situation is not that simple. In India for example, the majority of the largest listed companies are promoter firms, which means that they have a concentrated ownership, or that their founders still have significant influence over the company’s direction despite no longer being controlling shareholders or executives. From global standards, this situation can raise questions about the risk of potential conflicts of interest or a certain lack of transparency. We find a similar example in South Korea with family groups: can their corporate governance be truly independent from the founder family’s influence?

How should investors factor in these regional specificities in corporate governance analysis?

At Candriam, as a responsible investor and manager of sustainable emerging market strategies, we engage with emerging companies on each of the E, S and G factors. What we learnt from our experience is that a cookie-cutter approach is not relevant. What’s better is to use overarching themes to guide our analysis, on top of the standard information.

Want to learn about these three key themes? Click here to read the report !