…to deliver distinctly different results

Find out the answers in our latest educational paper where we offer our perspective on sizing optimal exposure to illiquid assets for global multi-asset portfolios. Getting it right can bring an array of potential rewards for your portfolio, including valuable diversification benefits, a superior risk-return profile and a higher potential for better return.

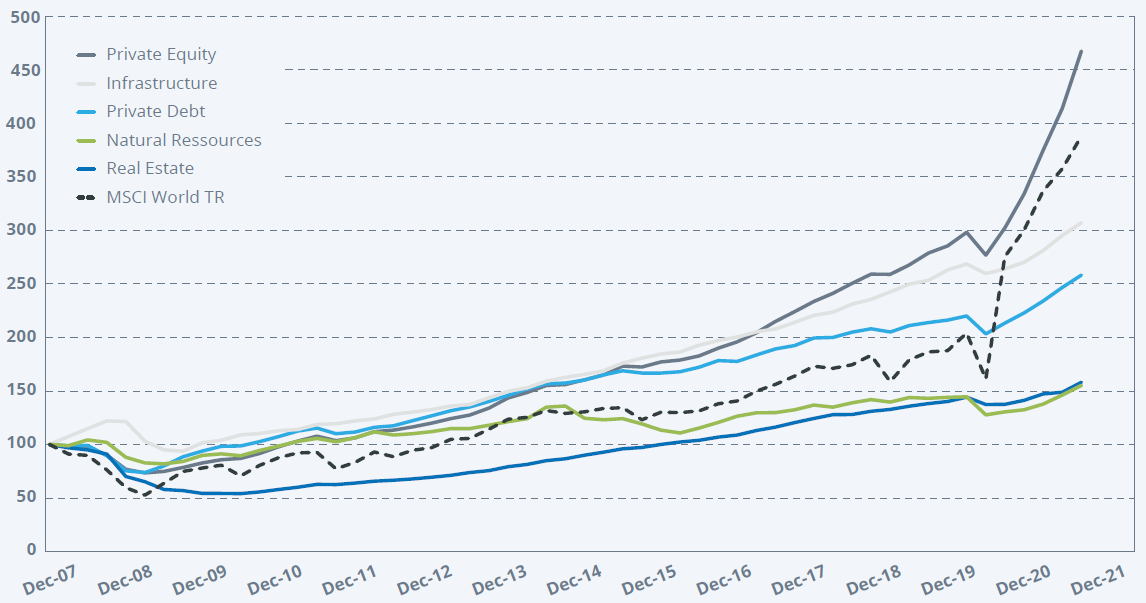

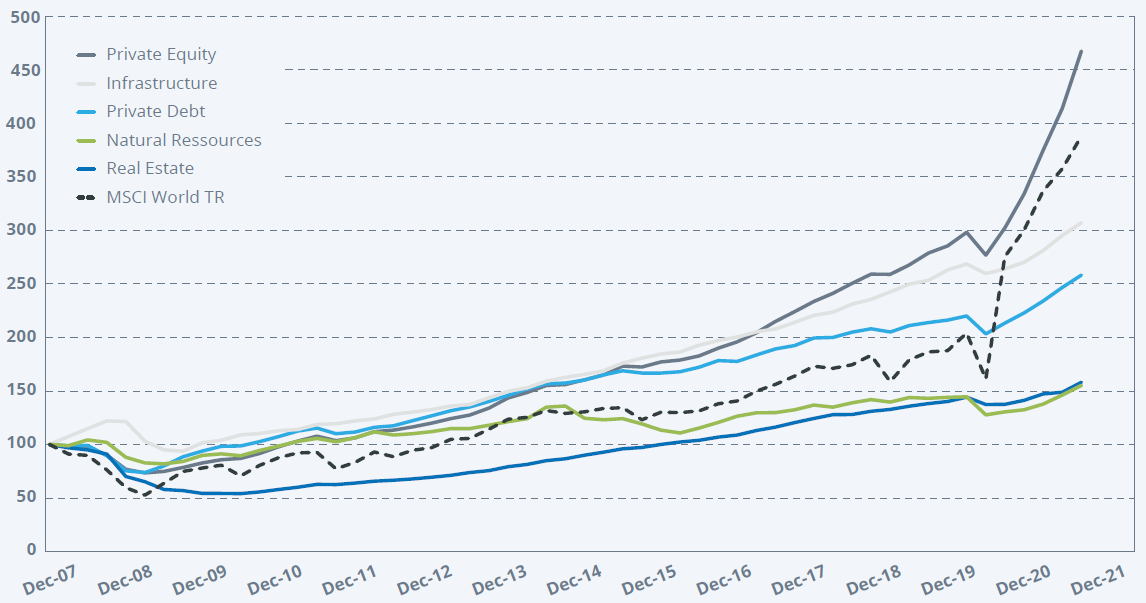

Performance of private capital indices

Source: Monthly returns of private capital indices (Preqin), 2021.

Essential due diligence

As our graph shows, Illiquid assets have performed very well over the past few years, outpacing global equities. However, monthly returns often hide high volatility and overestimate correlation with other asset classes. Therefore, careful assessment of these assets’ risk/return profile is essential.

So where do you start sizing illiquid allocations? Discover more about the key elements of this process, why they are important and how they fit together:

- Investor’s circumstances and long-term objectives

- Microeconomic and financial variable forecasts, as well as hidden risks

- Return generation and risk mitigation projections expressed through mean variance optimisation

- Modelling returns for different types of multi-asset portfolios, across different risk portfolios (such as conservative, balanced and aggressive)

- Quantifying the impact of illiquid allocations of different sizes on the overall portfolio volatility

New to the math? Our paper can help. So can our Client Services Team.

Read our full Educational Paper, and graduate to a more diverse allocation!

Please beware that risks to illiquid strategies include: risk of loss of capital, risk of illiquidity, risk of lack of pricing and valuation, credit risk and currency risk.

This document is provided for information and educational purposes only and may contain Candriam’s opinion and proprietary information. The opinions, analysis and views expressed in this document are provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Warning: Past performances of a given financial instrument or index or an investment service, or simulations of past performances, or forecasts of future performances are not reliable indicators of future performances. Gross performances may be impacted by commissions, fees and other expenses. Performances expressed in a currency other than that of the investor’s country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.