“Nowhere has it been considered a disastrous indirect tax is created by constantly rising inflation, nor what the results are.” (Welche vernichtende indirekte Steuer zudem in der fortschreitenden Papiergeldinflation liegt, wird übrigens an keiner Stelle berücksichtigt – Rudolf Havenstein, 1922[1])

High inflation often produces dramatic consequences, as emphasized by Reichsbank President Havenstein in his 1922 letter to the Governor of the Federal Reserve Bank of New York. Its causes are often multiple and generally involve a weak economy, large capital flows outside the country, a high level of government debt, widespread economic fraud and excessive money supply.

Money issuance is always understated in the official speeches, whether by Cambon describing the assignats during the French Revolution or by Havenstein about the Reichsmark during the hyperinflation of the Weimar Republic. Even at the time, Federal Reserve officials were struck by “the curious evasion of the fact that it is the increase in currency and not the increase in the floating debt that is responsible directly for the fall in the mark; and with this a justification Reichsbank's course.”[2] In both examples, the man on the street lost confidence in the domestic currency, causing deep changes in the economy and the society.

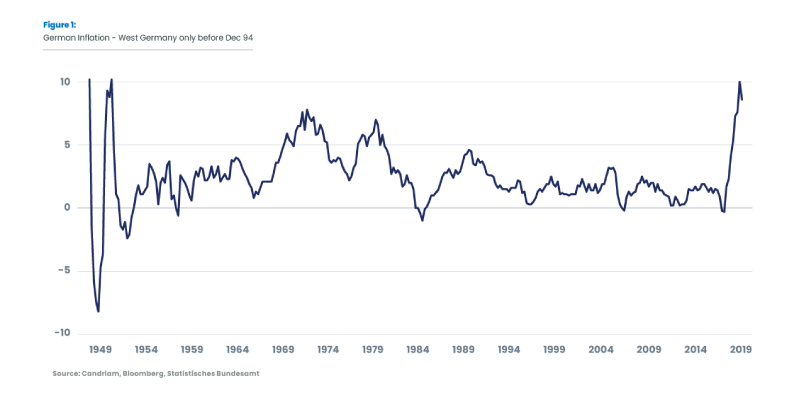

We are not there! But inflation is here, with a Consumer Price Index increase of 16% in Germany from end 2020 to September 2022. This is substantially the same rise over a period of less than two years as was seen over the 13 years from the end of 2007 to the end of 2020.

The recent episode of inflation is unprecedented during the last forty years. It even remains remarkable over a much longer history, as shown by the German experience since 1950, in figure 1.

The causes are well known. First, the huge injections of liquidity into the economy. Then, the tensions in supply chains linked to de-globalization trends, accelerated by the Covid-19 crisis; the war in Ukraine; and the zero-Covid policy in China.

The market consensus for the Eurozone remains that inflation will be moderate in the long term, with the 5-year inflation swap 5 years ahead remaining between 2% to 2.5%[3] from March to December 2022, in line with recent history. However, both the amplitude and duration of the increases in price levels have been systematically underestimated, and the consequences for interest rates are unprecedented in recent memory.

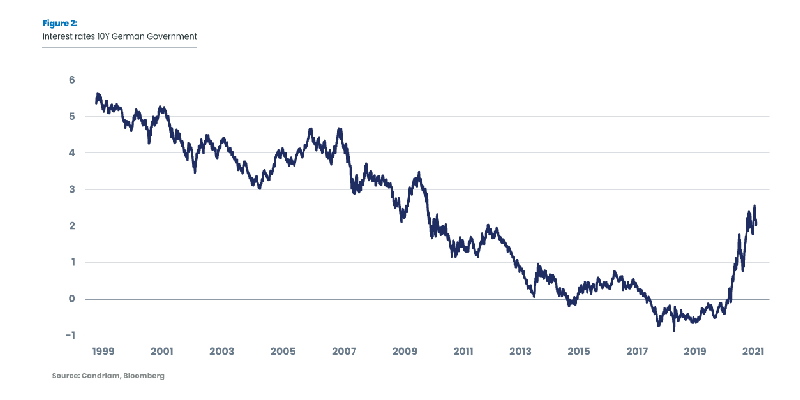

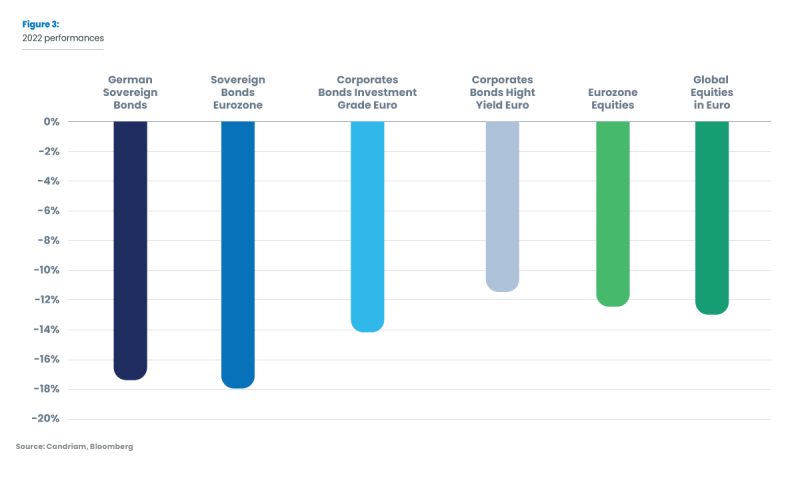

The absolute level of interest rates reached at the end of 2022 seems more “normal” compared to the last twenty years, as shown in figure 2. This is still the case if we consider a longer-term history, such as in the US National Bureau of Economic Research (NBER) database NBER Macrohistory: XIII. Interest Rates | NBER. On the other hand, the brutality of interest rate changes can certainly destabilize economic players. Inflation combined with the rise in interest rates and the widening of spreads has thus resulted in a fall in all asset classes (figure 3)[4]

These shocks are too recent to quantify all the consequences for insurers, but early trends are emerging.

Non-life insurance activities are affected by increased in claims and expenses, reflected in a deteriorating combined ratio. As this insurance segment is mainly associated with one-year contracts, this deterioration can be temporary if insurers increase premiums. However, pricing is constrained by competition. Rising interest rates have a limited and generally positive impact -- investments are generally in short-term maturities, allowing for rapid reallocation to more attractive yields.

Inflation has little direct impact on life insurance, but rising rates are a major change.

The risks to commercial activities of life insurers are significant for both unit-linked products and traditional life products. The traditional life insurance products issued since 2012 have been offering ever-decreasing returns over the last ten years, with the offer on the most recent contracts between 1% and 2% in general. In the short term, these cannot with bank offers, in a context of bond yields between 2% for Bunds and 4% for corporate bonds. If policy lapses are significant, these insurers could be forced to realize losses on the bonds purchased during the last seven years. Unrealized gains should decline sharply in 2023, while profit sharing would not rise for some time. At the unit-linked level, the perception of risk by policyholders could also be shaken for a long time. As shown in figure 3, asset classes associated with lower risk profiles such as government and corporate bonds have lost between -10% and -15% between January and December 2022.

On the other hand, solvency ratios for certain life insurance players should improve with the rise in rates, first and foremost for those who have not fully hedged their interest rate risk. Insurers should also benefit from the spread widening, which is partly included in the regulatory discount curve for technical provisions.[5]

Therefore, insurers and mutuals can take advantage of this context to readjust their investments. Bonds now offer more attractive yields. Corporate credit makes it possible to capture the rise in spreads, with a moderate capital requirement under Solvency II There are several aspects to consider.

- First, determine an ambitious ESG policy. Even with very basic economic considerations, the insurance is more exposed to natural catastrophes than any other business and therefore sits in the forefront of climate change. Environmental, social and governance (ESG) issues are at the heart of society's concerns. Heat waves and mega-fires have hit all Europe from Spain to Romania. Mud floods in 2021 have caused hundreds of deaths in West Germany and Belgium. They have all significant impacts on claims to be paid by insurers. “Die Stärkung der Widerstandsfähigkeit gegenüber möglichen Katastrophen ist eine gesamtgesellschaftliche Aufgabe (Strengthening resilience to potential disasters is a task for society as a whole)”[6], said Staatssekretärin im Bundesministerium des Innern und für Heimat Juliane Seifert in an interview for the Gesamtverband der Versicherer.

And for those not yet convinced about climate change, the financial and insurance regulations leave no room to avoid climate considerations. ESG is everywhere: in information publications with SFDR, the marketing of products under the Insurance Distribution Directive (IDD), and in the definition of a prudent person by Solvency 2 since August 2022. The likely inclusion of capital requirements for environmental risks will further strengthen this momentum towards including ESG factors.

- Second, determine the amount to invest. The insurer calibrates and plans its reinvestments based on the expected net cash flows and on its capacity to reinvest assets which are held with unrealized losses. The amount of prepayments in the mortgage market have declined significantly as interest rates have risen. The opposite should occur also for life insurance policies when financial institutions begin to offer investment products offering higher “safe” returns. Beyond interest rates and inflation, the behavior of policyholders is rather uncertain and should be impacted by more competition between insurers.

- Third, determine the capital allocated in the investment strategy to each bond category. Depending on the return target and the capital budget, the portfolio may include bonds with higher or lower ratings.

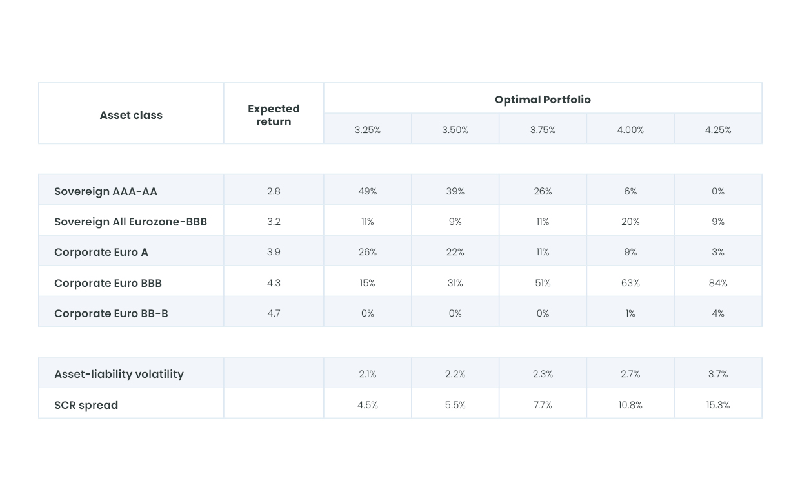

Optimal coverage portfolio for 10-year insurance liabilities according to risk capital budget

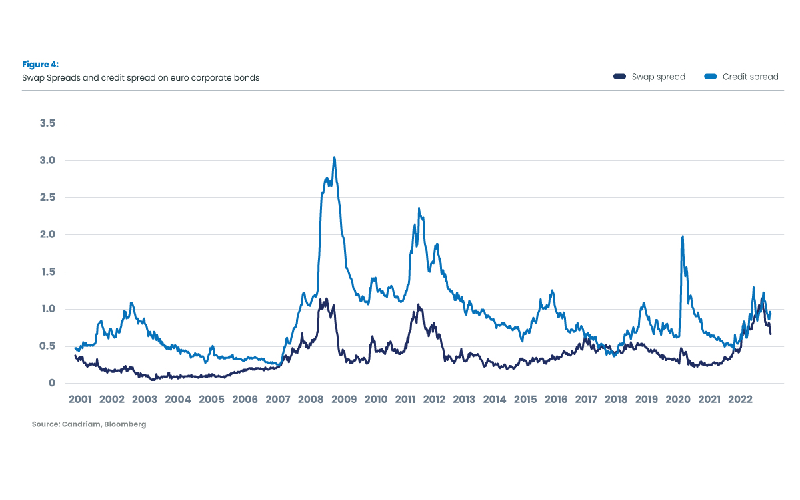

Figure 4 presents a simplified, purely quantitative portfolio construction by major asset class. We minimize the difference in volatility between a 10-year duration liability discounted at swap rates and a bond portfolio under the constraint of a given target return in the first line of the table. A company with little available capital will invest mainly in sovereign bonds. Where capital margins are wider, investments in lower-rated bonds may be included in the portfolio. We automatically exclude bonds with ratings below B, as those are not usually a part of insurance portfolios

The expected yield used here is the offered yield on the ICE BoA indices for each segment, corrected for the expected loss linked to the risk of default, i.e. 0% on sovereign bonds, around 0.1% on corporate bonds with ratings greater than or equal to BBB and 2.2% on lower ratings.

Past performance is no guarantee of future performance.

The scenarios presented are an estimate of future performance based on historical values of this investment that vary, and/or current market conditions and are not an exact indicator. The results you get will vary depending on market performance and the shelf life of the investment/product.

The two previous points also imply minimum prudent management of default risk in the portfolios. Economic and political uncertainties also encourage active management for at least the riskiest pockets of the portfolio.

Although we have presented our opinion, it remains unclear when inflation will return to the ECB target and what level of interest rates will prevail when inflation does align with targets. Our proposal does not fit all insurers. But we strongly believe now is the right time to review their investment strategy.

[1] Der Präsident des Reichsbank-Direktoriums to the governor of the Federal Reserve Bank of New York, Mr Benjamin Strong, the 31st May 1922, on 1135.1 Correspondence with Germany -- Reichsbank, President, Rudolph Havenstein (1921-1923) (stlouisfed.org)

[2] Office correspondence From Mr Snyder to the US Federal Reserve Governor Strong, the 10th July 1922, on 1135.1 Correspondence with Germany -- Reichsbank, President, Rudolph Havenstein (1921-1923) (stlouisfed.org)

[3] Source: Bloomberg

[4] German Sovereign Bonds: J.P. Morgan GBI Germany Unhedged EUR, Sovereign Bonds Eurozone: J.P. Morgan GBI EMU Unhedged EUR, Corporate Bonds Investment Grade Euro: IBOXX Euro Corporates Overall Total Return Index, Corporate Bonds High Yield Euro: ICE BofA Euro High Yield Index, Eurozone Equities: MSCI EMU Net Return Index, Global Equities in Euro: MSCI World AC Net Return Index EUR

[5] The return on a Eurozone corporate bond index, the ICE BofA Euro Corporate Index, is broken down into three components: interest rates, swap spreads and credit spreads. The interest rate component corresponds to the yield on sovereign bonds and is not represented in the graph. The swap spread is the difference between the swap yield and the sovereign yield. The credit spread is the difference between the credit bond yield and the swap yield.

[6] download-naturgefahrenreport-2022-data.pdf (gdv.de)