2023: a disappointing out of breath sector

The health care sector is typically seen as defensive, and a sequential and stable grower. Still, the sector disappointed in 2023, despite the world facing a lot of issues, from inflation, economic slowdown to war. There are several reasons for this:

- The strong investor focus on AI and technology in general this year has left most other sectors out of the limelight.

- The broad under performance of small and mid caps did hit the innovative biotechnology sector hard.

- And finally, de-stocking by customers of life sciences companies (biomanufacturing, biomedical research) has hit some companies also, and the post pandemic environment obviously punished those companies that could raise their sales based on their vaccine exposure, direct or indirect, and now face difficult comparisons.

How do we see 2024 shaping up?

Many headwinds are disappearing, as both the covid pandemic base of comparison is getting easier in 2024 and many life sciences companies are signalling that the de-stocking by their customers is levelling off and orders are coming in again.

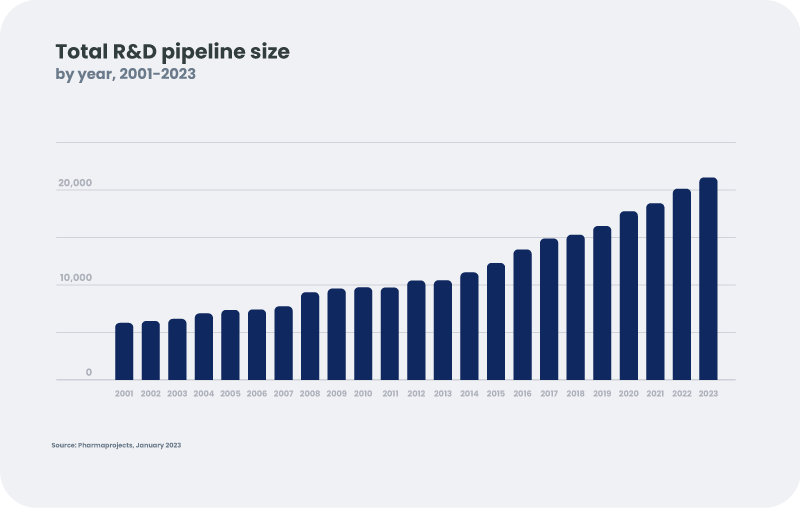

Moreover, the underperformance driven by the macro backdrop makes current valuations an attractive opportunity. The pharmaceutical subsector's price-to-earnings ratio at 15 indicates undervaluation, falling below its long-term average[1]. This becomes particularly intriguing when considering that core fundamentals, such as innovation, remain intact. Notably, the biotech and healthcare sectors have showcased a robust commitment to innovation, exemplified by the steady growth in the number of drugs in the development pipeline. From 5,995 in 2001, this figure has surged to an impressive 21,292 by 2023. Furthermore, the approval rate by the FDA reflects this momentum, with at least 60 new drugs approved in 2023 alone—a significant surge compared to the 39-53 approvals over the preceding four years (latest data as of December 8th, 2023)[2].

Source: Pharma R&D Annual Review 2023, Pharma Intelligence UK Limited, a Citeline company, January 2023

Other good news makes the diagnosis more favorable:

- A crackdown by the Chinese government on corruption in the hospital ecosystem had also negatively impacted some China-exposed companies, as hospitals froze and limited all ordering of new equipment and even consumables whilst letting the investigation pass. Again, this negative impact is expected to become a tailwind again (catch-up ordering) by the beginning of 2024.

- A big positive (at least for the health care sector) comes from our economic scenario: signs of a slowdown are already apparent in many regions, like China and some European countries but we also expect the US economy to move to a slower rhythm in 2024 as high interest rates continue to bite. Inflation is already moderating and we expect this “normalisation” to continue, opening the spectre of FED rate cuts in 2024 with long term rates also coming down. The combination of slower growth with lower rates is a very appealing macro mix for the health care sector, as the health care business is much less dependent on economic conditions compared to other sectors – the demand for treatment is always there, irrespective of economic conditions. Lower rates will help the investor sentiment towards not yet profitable but innovative biotechnology companies.

The temperature is expected to rise above 40 degrees for the GLP-1 drug category

Obesity, a global health challenge, affected over 40[3]% of US adults in 2020 and is projected to rise to 50% by 2035. The consequences of obesity are severe, and lead to a host of related health care expenditures. The history of anti-obesity drugs has been marked by safety concerns and market withdrawals, leading to scepticism about therapeutic options, whilst approaches based on lifestyle modifications often prove insufficient for sustained weight loss. Initial therapeutic options were riddled with off-target effects, low receptor specificity, replacement dopamine activation leading to addiction, and behavioural side effects. After 100 years of failures, the approval of a new class of drugs targeting glucagon-like peptide-1 (GLP-1) marks a paradigm shift, offering for the first time in history reasonably tolerable, effective treatments for weight loss, after proving useful as diabetes medicines. Reimbursement, driven by positive outcomes data on co-morbidities, gains support from commercial and government payors. The focus on safety and tangible endpoints, such as cardiovascular events and mortality, shapes the clinical and regulatory landscape, with GLP-1 therapies so far demonstrating effectiveness.

The sector might encounter some persistent infections:

Some subsectors within health care have however suffered as investors fear that cardiovascular devices or orthopaedic implants will see less demand, as people will be healthier. We believe that GLP-1 medications are effective and a big advance in treating obesity, at the same time the decline of medical technology companies seems exaggerated as cardiovascular and other issues have multiple aetiologies and are also the result of decades of overweight. As such, we see this as a buying opportunity for the impacted MedTech companies. Furthermore, very obese patients do not qualify for some specific surgeries and moving to a less extreme Body Mass Index (BMI) might make it possible for those patients to qualify for an artificial hip for instance, hence the impact of the GLP-1 can also have some positive effects for medical technology companies. Looking at the details of Novo Nordisk’s outcome trial shows that the health benefits were less pronounced for US patients, for reasons yet unclear but maybe linked to very high baseline BMI’s at study entry – again, the assumption that cardiovascular and other ailments would disappear, as some stock reactions would make you think, seems exaggerated.

American elections good for social welfare?

With presidential elections looming in the US (and some seats in Congress open for re-election) there is the risk of negative comments on the cost side of the health care sector – obviously a relevant topic. We think it might be different this time, as health care does not seem to be the battlefield this time. The election is more on international trade, security, and broad social and societal issues, hence we are less afraid of negative rhetoric during these elections.

That does not mean there is no focus on health care costs in general.

In 2022, President Biden signed the Inflation Reduction Act, which includes provisions for Medicare. Under this act, Centers for Medicare & Medicaid Services (CMS) will now be able to negotiate drug prices. CMS will select the drugs with the highest total expenditures from among the top 50 qualifying single source drugs. The cumulative list will begin with 10 drugs from Part D (administered at home) in 2026, 15 from Part D in 2027, 15 from either Part B (administered at the hospital) and Part D in 2028 and 20 from either 2029.

The negotiable drugs are brand-name or biologics without generics/biosimilars, eligible only after being on the market for 9-13 years, depending on the drug type. It's worth noting that drugs face loss of exclusivity (LOE) or patent cliffs anyway, hence the protection of 12 years for biologicals offered in the Biden plan is anyhow close to the effective patent protection after start of commercialisation that a new drug de facto enjoys. So in the end, the impact of the plan is rather limited.

Furthermore, the IRA also specifies factors leading to exclusions from price negotiations, such as orphan drugs, drugs with generics/biosimilars available, or those from small biotechnology companies.

The precise impact of the plan remains uncertain due to various factors, including ambiguities in negotiation language, ongoing pharmaceutical lawsuits. Given the impending presidential election, even the implementation of this plan in 2026 is far from sure.

As the year 2024 gets underway with still a great deal of uncertainty, investors in the health care sector will, once again, need to exercise discernment and in-depth analysis in their stock selection and portfolio construction. We are convinced that innovation and companies creating the next breakthrough in drugs development represent the best protection against any political interference.. In the US, innovation will always be rewarded and the plan by Joe Biden does indeed protect innovation by excluding newly approved drugs from any price negotiation for a considerable time frame, giving visibility to the originating and innovating companies.

We believe the health care sector will be more resilient in 2024. But whatever it shape, we'll be there to support you and help your portfolios benefit from these opportunities. Wish you a healthy 2024!

This communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

[1] Sources: Bloomberg, Average 2018-2022, index: MSCI World Pharmaceuticals

[2] New Drugs at FDA: CDER’s New Molecular Entities and New Therapeutic Biological Products | FDA and Biological Approvals by Year | FDA

[3] Lobstein, T., Brinsden, H., & Neveux, M. (2022). World obesity atlas 2022

“Obesity Exceptionalism: It’s Different This Time. Framing the Opportunity and Challenges for a New Era of Obesity Treatment” (September 2023) by BMO Capital Markets