Chinese authorities have begun addressing deflationary pressures through a series of monetary and fiscal measures, signaling their growing urgency to stabilise the economy. While these measures are a move in the right direction, they are insufficient to fully achieve this objective. As China seeks to bolster its property sector and support domestic growth, the US elections could renew trade tensions, potentially leading to new tariffs and currency devaluation. As a consequence, stock-picking in China is increasingly relevant.

More upside on Chinese markets

The recent stimulus has triggered a furious rally in Chinese equity markets, which had been underperforming and significantly under-owned. Despite a rally of 40% from the September trough[1], there is still room for further upside if China can reverse its downward spiral. Several factors support this optimism:

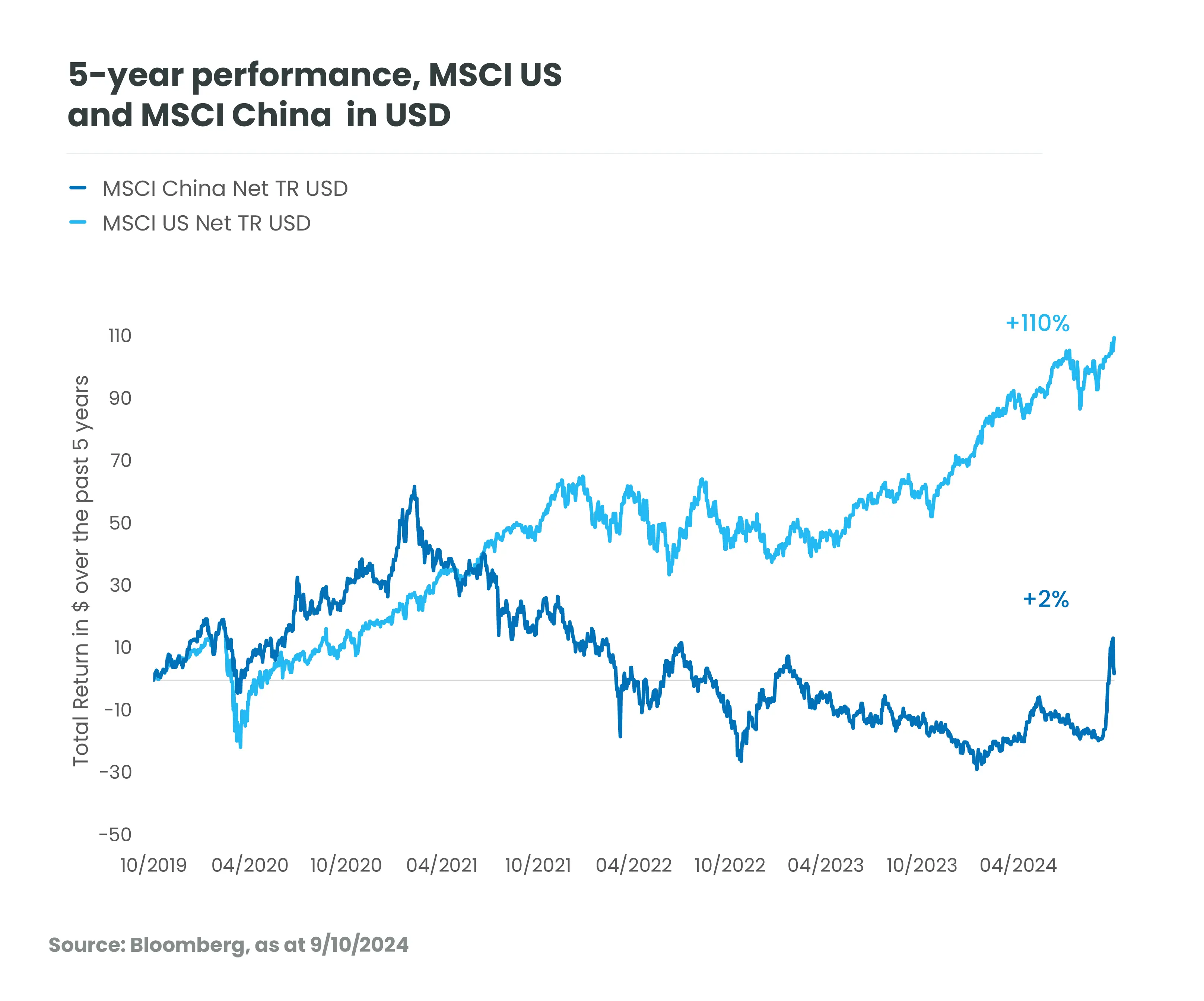

- Chinese stocks are trading at multi-decade lows compared to US markets[2], providing room for a re-rating (see graph).

- Historically, China has benefitted from lower US interest rates.

- The rally back to historical levels has been driven primarily by market re-rating rather than upward earnings revisions. Despite the lack of concrete improvements in earnings (too early to estimate), we believe long-term investors are becoming more constructive and have growing confidence in a potential structural turnaround.

- Market participants are increasingly focused on the possibility of deeper reforms and stronger government support, which could set the stage for sustained economic growth and further market upside.

Past performance, simulations of past performance and forecasts of future performance of a financial instrument, financial index, investment strategy or service are not reliable indicators of future performance and are not guaranteed.

Effective execution and further fiscal support are key for a sustained rally

To exit deflation and support long-term economic recovery, more central government leverage is needed, potentially exceeding a few trillions of RMB over the next few years. Effective execution of these measures is crucial. They should target consumer spending, further property market support, and structural reforms, particularly those aimed at improving employment conditions.

The upcoming US elections represent external risks to China’s domestic recovery

The US presidential elections on November 5 will have implications for China. Both Democrats and Republicans recognise the importance of reducing the trade deficit with China and reducing reliance on Chinese imports. In 2018, Trump imposed tariffs of 25% on some goods, which continued under the Biden administration. While both Trump and Harris aim to continue to address Chinese trade imbalances and national security, they diverge in their approach.

A Trump administration could see tariffs on Chinese goods soar to 60%, potentially broadening to other countries such as Vietnam, even though enforcing such tariffs could be challenging. This would put further pressure on China’s export-driven economy, which is already fragile. Trump is likely to be more aggressive in words and actions towards China than in the past, signaling that the trade war is not over! This could present additional headwinds to Chinese corporates as international funding availability would likely deteriorate.

Whilst the introduction of tariffs should result in more fiscal spending at the central government level, . As a result, we expectto rise modestly although we see any upward move as likely to be contained by China’s strong external position.

A Harris administration would be likely to maintain the current de-risking, predictable, gradual strategy to protect American interests rather than adopting a full-scale decoupling approach. While it would likely not introduce new tariffs, it would continue targeting strategic sectors, such as technology and semiconductors, putting pressure on China’s high-tech industries.

But China has been actively preparing for potential tariffs by diversifying its trade partnerships away from the US, with trade between China and other emerging markets reaching an all-time high, underscoring a robust shift towards regional interdependence. The adaptability of Chinese companies should not be underestimated, as many have effectively leveraged alternative distribution channels and expanded their networks to ensure they continue reaching their end customers despite external pressures

Pressure on the renminbi

Fiscal stimulus may lead to some gradual weakness in the Chinese renminbi, as fiscal expansion of this magnitude is likely to generate elevated inflation. The overall impact on Chinese price levels will depend on how the stimulus feeds into the wider Chinese economy. More imminently, a Trump victory could lead to a more pronounced weakness in the renminbi, on the back of markets pricing in the prospect of higher US tariffs.

A Harris victory, conversely, may lead to a more gradual deterioration in US-Chinese trade and eventually hurt the currency over a longer period. Yields on local Chinese government bonds remain very low compared to other bond markets. For this reason, the Chinese local government bond market is likely to remain a popular underweight for investors tied to global local-currency emerging markets benchmarks. With little room for yields to decline further, we view the imminent increase in fiscal spending as a likely catalyst to drive yields higher from their current low levels.

Taiwan, a sensitive issue in US-China relations

While Taiwan is not a topic for US elections, it should be a geopolitical concern for the new president. If Trump impose new tariffs and the Chinese economy remains in a deflationary spiral, the desire to take the island back could be more pressing. The US administration’s response will depend on US-China relations, how American leadership is tested, and how the global situation evolves.

Focus on stock-picking

Whoever the US election winner is, stock-picking in China becomes even more relevant. The recent upward trajectory of markets depends on the follow-up and effective implementation of recent monetary and large fiscal stimulus, as well as structural reforms to address labour markets and real estate. This could potentially help improve business conditions for Chinese companies and consumers.

Furthermore, economic decoupling poses a significant challenge to China’s economic outlook, but also generates investment opportunities. The "new productive forces" policy in China emphasizes the development of strategic sectors such as technology, green energy, and advanced manufacturing as part of the country's long-term economic restructuring. As this policy aims to foster self-sufficiency and innovation, aligning investments with these policy developments becomes critical for capturing growth opportunities. Investors should focus on sectors that the government is actively supporting.

[1] Source: Bloomberg. MSCI China in USD, from 09/09/2024 to 07/10/2024. As at 09/10/2024, performance from this trough was 27%. Past performance, simulations of past performance and forecasts of future performance of a financial instrument, financial index, investment strategy or service are not reliable indicators of future performance and are not guaranteed.

[2] Source: Bloomberg, performance spread between MSCI China and MSCI US in USD, 56% over 3 years and 108% over 5 years, as at 09/10/2024. Past performance, simulations of past performance and forecasts of future performance of a financial instrument, financial index, investment strategy or service are not reliable indicators of future performance and are not guaranteed.