Wage trends, reflecting tensions on the labour market, play an important role in the formation of prices, particularly for services. And yet, in both the United States and the Eurozone, labour markets are tight. A simple principal component analysis of the U.S. labour market highlights three dimensions... both sources and reflections of tensions.

The employment dimension

The first dimension is quite naturally "employment". It includes indicators for employment rate, unemployment rate and participation rate (graph 1). After contracting sharply during the pandemic, it quickly returned to levels close to those observed in 2019, and therefore fails to explain the surge in salaries during the decontainment period following Covid, or indeed the relatively high rate of increase in recent months.

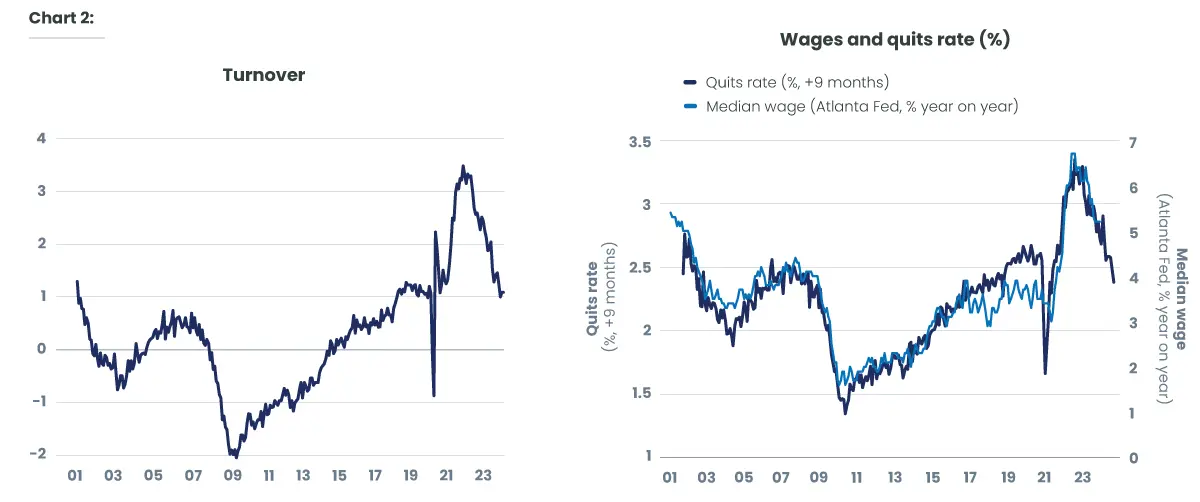

The "turnover" dimension

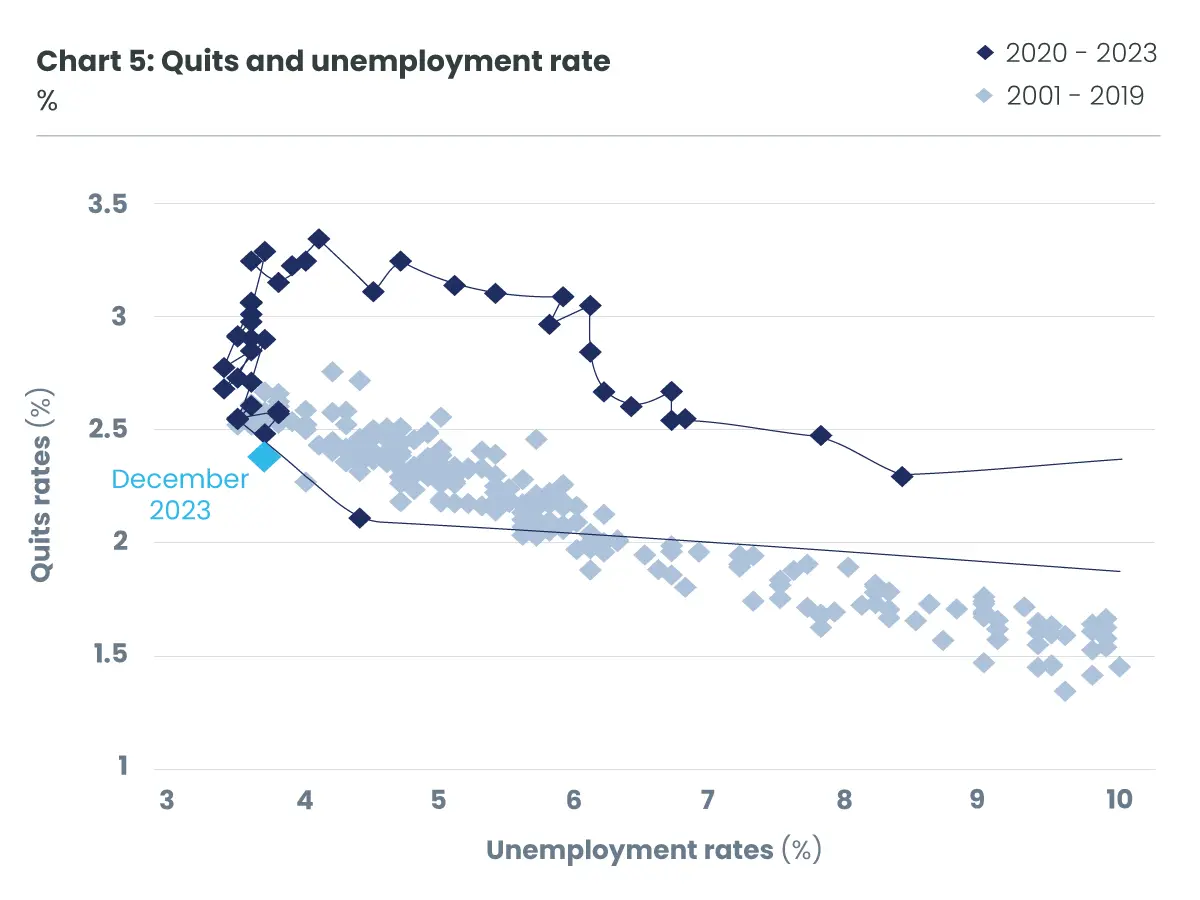

The second dimension (graph 2), which includes turnover indicators (vacancy rates, attrition rates and hiring rates), is far more relevant in explaining salary trends between 2020 and today. To understand this, we need to remember that some 25 million jobs were destroyed in the space of two months during the pandemic. The huge hiring needs to cope with the tremendous rebound in demand during deconfinement put workers in a position of strength. To attract this labour supply, wages had to be increased, particularly at the lower end of the scale... where job destruction had been most massive! In this very particular context, the proportion of employees who left their jobs voluntarily to find a better-paid one increased considerably... and helps explain the surge in salaries! As the demand for jobs was met, the rate of voluntary redundancies fell, and with it, wages (graph 5).

The "wages" dimension

After soaring, salaries (graph 3) fell back sharply. However, they are still rising significantly faster than before the pandemic... at a rate that could jeopardize inflation's return to the Federal Reserve's target.

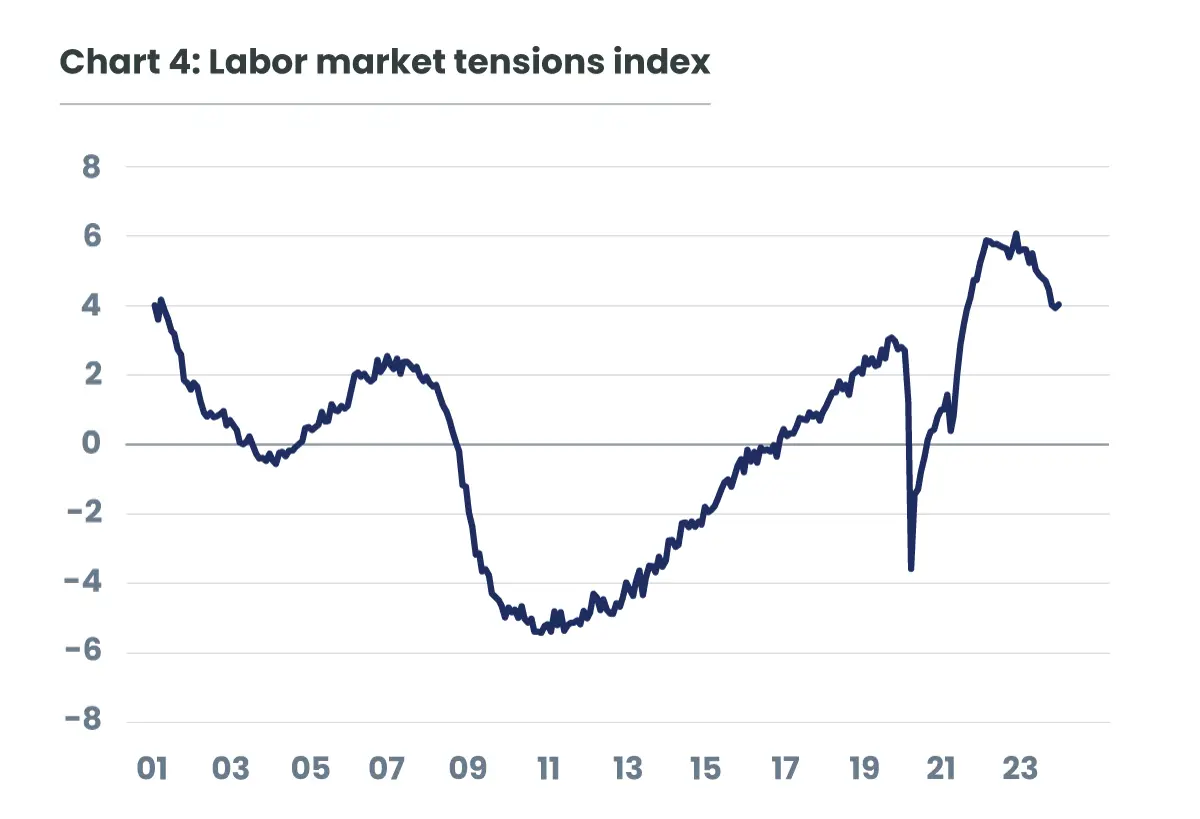

A synthetic index of tensions on the US labour market

While wages have begun to ease, the U.S. labour market remains tight: the stress index calculated from the three dimensions mentioned above says it all (graph 4). Despite a decline, the level of tension is significantly higher than before the pandemic.

The need to relax the US labour market

Further easing of the labour market therefore seems necessary. While wages have so far been able to slow without a rise in the unemployment rate (which has been below 4% for the past two years), a further slowdown in wage growth is now likely to require a slight rise in the unemployment rate.

The link observed in the past between the unemployment rate and the voluntary departure rate points in this direction (graph 6). In normal times, when the labour market eases (when the unemployment rate rises), the attrition rate falls... and wages slow in their wake. But the very particular shock of the pandemic pushed the rate of voluntary departures far beyond what the unemployment rate justified. By normalizing the relationship between these two variables, the attrition rate fell... without the unemployment rate rising. We have now returned to the "normal" relationship: a further drop in the rate of voluntary redundancies (and therefore a further slowdown in wages) now requires a slight rise in the unemployment rate!

In a nutshell, the need to re-employ the 25 million or so jobs destroyed during the health crisis pushed up American wages. As these hiring needs were met, wage growth slowed. But for them to return to a rate of increase compatible with the Federal Reserve's inflation target, the unemployment rate will probably have to rise a little in the coming quarters...

Europe's labour market in the next episode...

This communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.