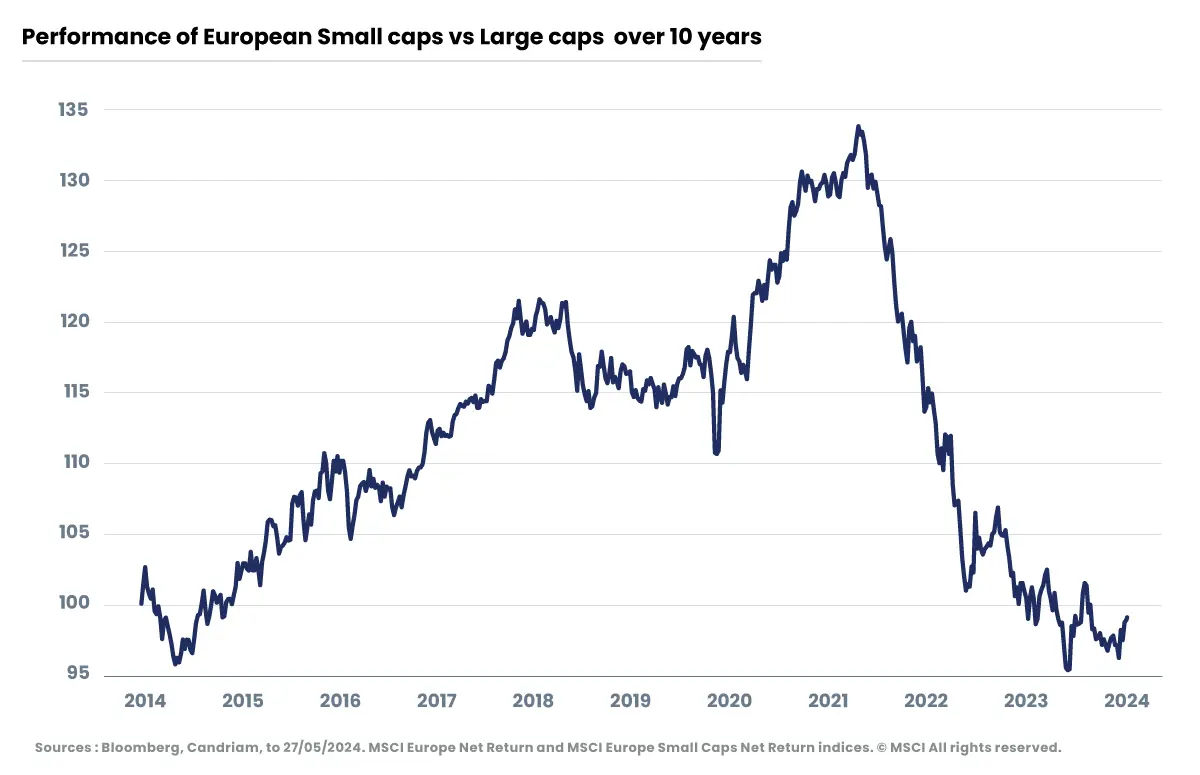

After a correction of 25% between November 2021 and October 2023, European small caps are now trading at lower valuations than large caps, both in terms of discounted cash flows and earnings multiples, which is a historical anomaly. Conversely, large-cap European cyclicals appear to be very fully valued, and in some cases overvalued. Thus, European small caps are currently trading on 12-month forward earnings ratios (P/E) of 14.2x (vs. 19.1x on average over the last ten years), while the large caps making up the MSCI Europe index are valued at 14.6x (vs. 15.5x on average over the last ten years)[1].

We see many reasons for this correction. Firstly, small caps suffered more than large caps from the rise in long-term rates, given the higher proportion of high-growth companies, with greater cash generation in the medium/long term than in the short term. In addition, outflows from Europe over the past two years as a result of the war in Ukraine and the energy crisis have particularly impacted less-liquid assets, i.e. small caps. Thirdly, the extended destocking period from the end of 2022 to autumn 2023 has weighed on the order books of smaller companies, particularly in the healthcare, industrial and specialty chemicals sectors. Finally, some smaller companies suffered from a difficult post-Covid comparison base, notably in the consumer discretionary sector.

At Candriam, we are convinced that the strengths of small caps (agility, growth, innovation, etc.), which have enabled them to outperform historically, have not disappeared. We even believe that their rebound should materialize in the short term, thanks to several potential catalysts. The first of these is likely to be the ECB's key rate cut , expected in the next few days, with a probable decoupling between European sovereign long rates (Bund) and US long rates. Secondly, the six-month upturn in leading indicators (the Euro Composite PMI) should also eventually translate into a rebound in small caps, given their historical correlation (abnormal decoupling over the past two years). The third catalyst is the acceleration in small-cap earnings momentum we've seen over the past two quarters, with many companies beating the consensus, particularly in certain sectors (consumer cyclicals, manufacturing, healthcare equipment, even technology).

Despite this expected improvement in small-cap momentum, selectivity will remain the order of the day in this segment. As a result, our disciplined approach, based on five investment criteria, seems more relevant than ever, and could continue to prove its worth over the long term, as it has in the past (outperformance of our Europe Small & Mid Caps strategy every year between 2017 and 2022 compared with the MSCI Europe Small Caps index, before a year of underperformance in 2023[2]). These criteria are: 1/ management quality, 2/ underlying market growth, 3/ competitive advantages (leading to pricing power or market share gains), 4/ profitability (actual, not potential), 5/ appropriate debt levels. These criteria are meticulously analyzed by a team with which averages 19 years' experience in small-cap investing.

Our investment process also incorporates extra-financial aspects, as we are convinced that a company with good ESG practices is better able to meet the challenges of sustainable growth and regulatory constraints. For example, we have an ongoing a dialogue campaign with the companies in which we invest to gain a better understanding of their organization and their policies on staff retention and development. You can learn more from our two case studies and our data report on human resource management in SMIDS, here.

In conclusion, our Conviction is that current valuations offer very attractive entry points for investing in small caps, especially those combining favorable earnings momentum and innovative capacity. Regularly predicted for a year but always delayed, the rebound of small caps could finally materialize!

Past performance of a given financial instrument or index or investment service, or simulations of past performance, or future performance forecasts are not reliable indicators of future performance.

All investments involve risk, including the risk of capital loss. The main risks associated with the Europe Small & Mid Caps strategy are : risk of capital loss, equity risk, currency risk, ESG investment risk.

The risks listed are not exhaustive, and further details on the risks associated with the strategy are available in the regulatory documents.

This document is an advertising communication. It is provided for information purposes only and does not constitute an offer to buy or sell financial instruments, an investment recommendation or the confirmation of any type of transaction, unless expressly agreed otherwise. While Candriam carefully selects the data and sources contained in this document, there is no guarantee a priori against errors and omissions. Candriam cannot be held responsible for any direct or indirect loss resulting from the use of this document. Candriam’s intellectual property rights must be respected at all times; the content of this document may not be reproduced without prior written authorisation.Warning: past performance, simulations of past performance or future performance forecasts of a given financial instrument or index or investment service are not reliable indicators of future performance. Les performances brutes peuvent être influencées par des commissions, redevances et autres charges. Les performances exprimées dans une autre monnaie que celle du pays de résidence de l’investisseur subissent les fluctuations du taux de change, pouvant avoir un impact positif ou négatif sur les gains. Si ce document fait référence à un traitement fiscal particulier, une telle information dépend de la situation individuelle de chaque investisseur et peut évoluer.The investor bears a risk of capital loss.Information on sustainability aspects: the information on sustainability aspects contained in this communication is available on the Candriam website https://www.candriam.com/en/professional/sfdr/.

[1] Price/Earnings ratios, MSCI Europe Small Caps and MSCI Europe indices, © MSCI All rights reserved Source: Bloomberg, as at 28/05/2024

[2] Net calendar performance, share I, of our Europe Small & Mid Caps strategy in EUR compared with the MSCI Europe Small Caps index. Past performance, simulations of past performance and forecasts of future performance of a financial instrument, financial index, investment strategy or service are not guarantees of future performance. MSCI, All rights reserved