A Volatile Spring: Tariffs, Threats, and Reversals

April unfolded as a month of intense turbulence in financial markets, driven by a barrage of political manoeuvrings, economic uncertainty, and shifting monetary policies. Markets were rattled by elevated tariffs, escalating rhetoric, and retaliatory measures that prompted investors to reassess growth prospects, price in heightened recession risks, and retreat from riskier assets. The transatlantic divergence in monetary policy added fuel to the volatility. In Europe, the European Central Bank acted decisively, cutting rates amid fears of stubbornly weak inflation and faltering growth. Across the Atlantic, however, the Federal Reserve resisted calls for easier policy, citing concerns that tariffs could exacerbate inflationary pressures. This policy split created crosscurrents in credit markets already on edge from macroeconomic uncertainty.

Risk Rears Its Head as Spreads Spike

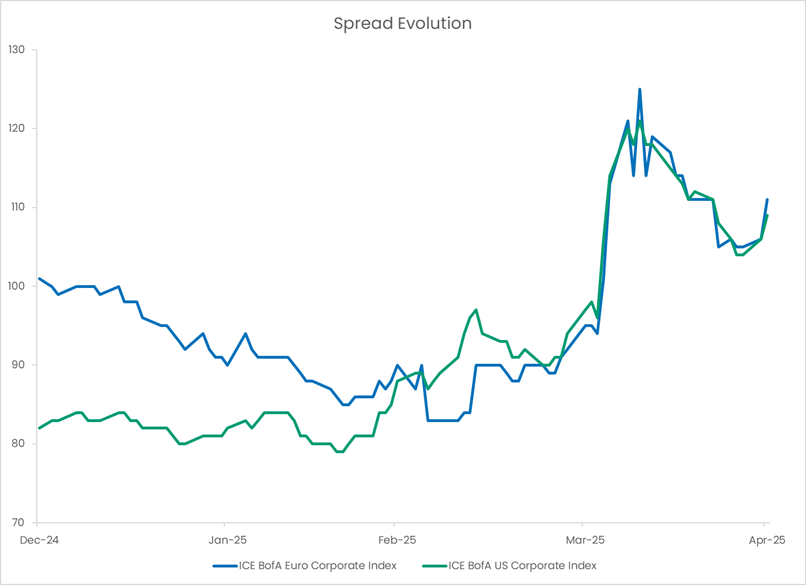

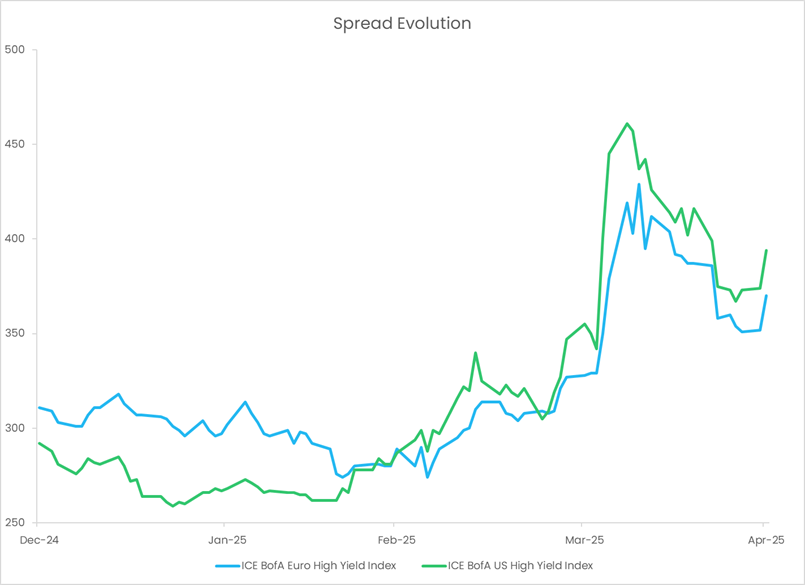

As risk aversion took hold, investment grade (IG) and high yield (HY) credit markets suffered pronounced spread widening. In Europe, IG spreads expanded by 30 basis points to 125 bps, while HY spreads surged 100 bps to 429 bps. A similar pattern unfolded in the United States, with IG spreads widening by 25 bps to 121 bps, and HY by 105 bps to 461 bps[1]. Credit markets, always sensitive to the spectre of recession, began pricing in a more pessimistic economic outlook. Yet in characteristic fashion, a sudden reversal in tone from Washington offered temporary respite. President Trump, signalling a softer approach toward China and a 90-day tariff reprieve, helped stabilize investor sentiment. As tensions eased, credit spreads retraced materially: US IG spreads tightened to 109 bps and US HY to 394 bps, while their European counterparts fell to 111 bps for IG and 370 bps for HY[2].

Sources: Candriam, Bloomberg© as of 30/04/2025.

Cracks Beneath the Surface: Weaker Fundamentals

Nevertheless, the scars left by the April turmoil run deep. The fundamental backdrop has weakened meaningfully. Corporate executives, unnerved by policy unpredictability, have increasingly suspended forward guidance, with retail and auto sectors particularly exposed. In the United States, corporate defaults are climbing at an alarming rate. According to S&P Global, the first quarter of 2025 saw 188 large corporate bankruptcies -- the highest quarterly figure since 2010. Compounding concerns, $150 billion of sub-investment-grade debt is due for refinancing this year, facing materially higher borrowing costs.

Technicals in the Driver’s Seat, Flows at the Wheel

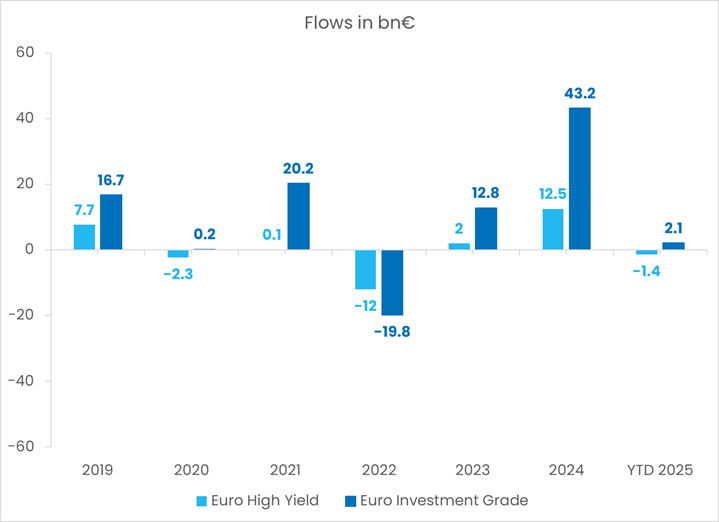

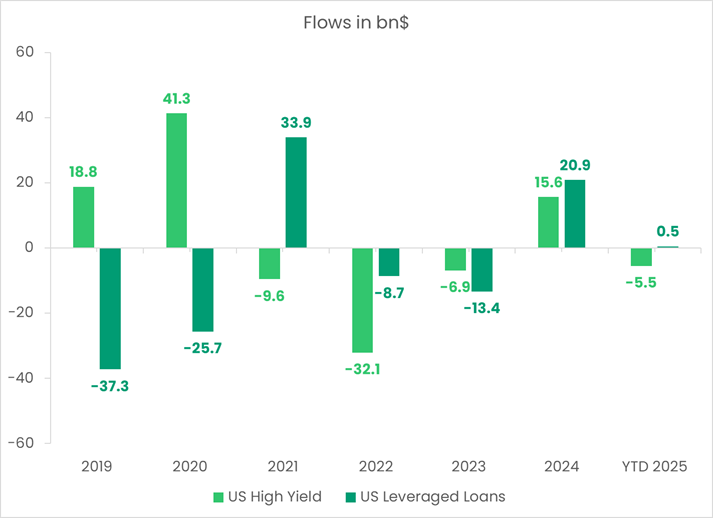

At the heart lies a crucial dynamic for credit markets: technicals. As fundamentals erode, credit markets have grown exceedingly sensitive to liquidity conditions and investor flows. Recent weeks have seen sustained outflows from both US and European IG funds, while HY markets -- already more fragile -- have borne even heavier redemptions. Although precise figures vary, the trend is unmistakable: risk appetite is waning.

Source: JPMorgan as of 25/04/2025.

Watch the Currents, Not Just the Weather

Looking ahead, the outlook for credit markets hinges largely on these technical factors. On the one hand, elevated yields -- around 5% for US IG and 3% for European IG, and nearing 6% and 8% for European and US HY[3], respectively -- offer attractive carry and cushion against further spread widening. Credit has also demonstrated notable resilience compared to other risk assets year-to-date. Moreover, while fundamentals are softening, they are deteriorating from relatively robust levels, suggesting the absence of an immediate crisis. This could lead to some stemming of outflows and temporary increase in investor appetite.

However, market psychology remains brittle. Negative headlines or risk-off sentiment could trigger further outflows, pressuring spreads and exacerbating volatility. Particularly worrisome is the spectre of fallen angels -- major issuers like Ford slipping from IG to HY status -- which could strain market liquidity and amplify selling pressure.

Nonetheless, amid volatility lies opportunity, credit markets are entering a phase of greater dispersion, favouring careful sector and issuer selection. Sectors less exposed to macro shocks, such as telecoms, are likely to outperform more cyclical industries like autos and retail. Geographically, European credit may offer relative resilience, buoyed by the ECB’s accommodative stance, whereas US credit could prove more vulnerable given the higher inflation and high levels of rates in the US.

In such an environment, investors must "go with the flows" -- attentively monitoring technicals, embracing selectivity, and positioning portfolios to navigate, and even benefit from, the currents shaping the global credit landscape.

[1] Europe Investiment Grade: ICE BofA Euro Corporate Index; Europe High Yield: ICE BofA Euro High Yield Index; US Investment Grade: ICE BofA US Corporate Index; US High Yield: ICE BofA US High Yield Index. Source: Bloomberg. Data as of 09/04/2025.

[2] Same indices as of 30/04/2025

[3] Europe Investiment Grade: ICE BofA Euro Corporate Index; Europe High Yield: ICE BofA Euro High Yield Index; US Investment Grade: ICE BofA US Corporate Index; US High Yield: ICE BofA US High Yield Index.

Source: Bloomberg. Data as of 31/03/2025.