Monthly Coffee Break, Asset Allocation

Battles on multiple fronts

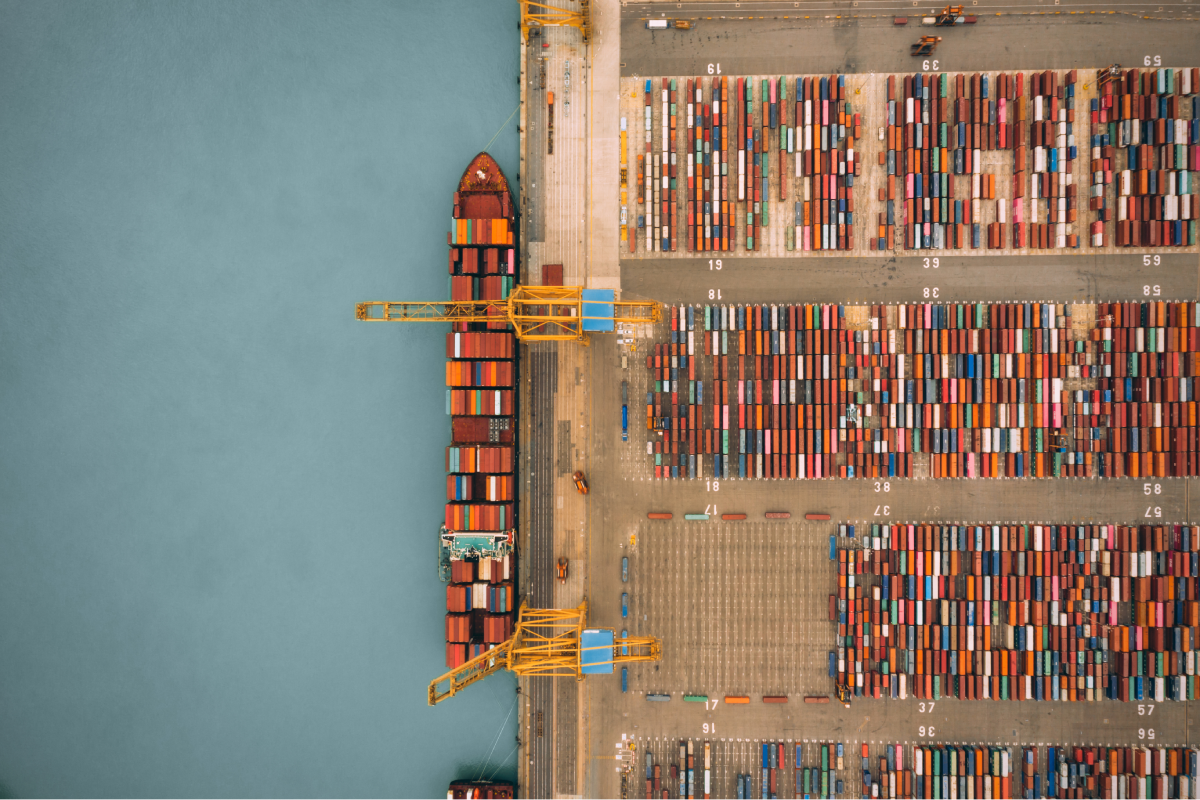

The year opens with a global economy that is neither stalling nor accelerating decisively, but increasingly shaped by overlapping and, at times, conflicting forces. Growth .