Growth and inflation indicators ended the year on a steadier footing. In the euro area, the flash estimate showed headline HICP easing to 2.0% y/y in December, broadly consistent with the ECB’s December decision to hold policy rates and projections pointing to inflation near target over the medium term. US inflation also held steady, with December CPI at 2.7% y/y, while China’s official PMIs edged back above 50, hinting at tentative stabilisation in activity. Geopolitics remained in the background. Overall, macro signals into year-end supported a “late-cycle but not recessionary” narrative in developed markets, with Europe still lagging the US in momentum but benefiting from cooling inflation.

Risk assets advanced into December’s close as rate expectations stabilised. European equities outperformed most markets, driven by financials, materials and industrials. Core rates were range-bound: the 10-year Bund yield oscillated around 2.85%, ending little changed versus mid-month. In credit, investment-grade and high-yield spread compression trend continued into year end. Commodities diverged: Brent averaged roughly $62–63/bbl in December, extending its 2025 downtrend on ample supply, while gold rose into month-end as real-rate expectations softened and diversification demand persisted.

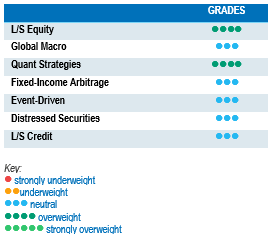

The HFRX Global Hedge Fund EUR Index was slightly up at +0.39% over the month.

The market has put higher emphasis on corporate earnings and fundamentals, leading to higher dispersion levels. This was a fertile environment for relative positioning rather than directional beta. This was particularly the case across the AI ecosystem due to greater scrutiny of monetisation, margins and capex intensity. As the unknowns become less so, investors seem to be focusing more on identifying dispersion rather than crowding, helping broaden market participation. This is beneficial for Long Short Equity strategies and was reflected in a strong December in terms of performance. Some strategies carrying short positions with poor fundamentals in trending sectors were rewarded during the month. Long Short strategies will benefit from persistent dispersion and normalization of valuation spreads across growth versus cyclicals and regions.

Global Macro

Despite a choppy December, Global Macro strategies performed relatively well during the month. Relative-value global macro strategies outperformed as peak rates, curve steepening, FX divergence and rising fiscal and political risk shifted focus from beta towards policy differential, curves and asymmetry. Naturally, rates were an important source of returns during the month. Directional trades in equities and precious metals also contributed positively to performance. Overall, global macro strategies enter 2026 with a constructive outlook, supported by an environment favouring relative value, flexibility and asymmetric positioning rather than directional beta.

Quant Strategies

Overall, it was a very strong month for Quantitative strategies. CTA gains were driven by strong trends in equities and commodities, while giving some performance back through losses in fixed income and foreign exchange. More generally, quant models benefited from a rich environment as market dynamics shifted away from concentrated beta toward greater cross-asset and cross-sectional differentiation. Systematic models were clear beneficiaries of renewed factor dispersion. Quantitative strategies remain core, positioned for tariff-driven volatility, style rotations and rate or forex directional or relative value opportunities.

Fixed Income

In December 2025, fixed-income arbitrage strategies were shaped by a benign but uneven rates and spread environment, where opportunities arose primarily from relative-value dislocations within rates markets rather than large directional moves. With peak policy rates firmly in place and volatility subdued in many core markets, arbitrageurs focused on curve anomalies, basis trades, and mispricing between on- and off-the-run securities, capitalising on subtle inefficiencies created by year-end liquidity flows and technical repositioning. Treasury and swap curve steepening presented profitable matrix and carry opportunities, while corporate cash vs futures basis oscillated amid mixed macro signals. Conversely, positions that leaned on large directional rate bets underperformed due to range-bound yields and limited volatility. Fixed-income arbitrage in December and overall 2025 delivered measured returns as managers navigated a late-cycle, low-volatility regime.

Event Driven

In December 2025, event-driven strategies benefited from a steady but selective opportunity set, shaped by year-end deal activity and a more stable financing backdrop following the confirmation of peak interest rates. Merger arbitrage performance was supported by contained deal spreads, improving regulatory visibility and lower volatility in funding costs, while idiosyncratic outcomes dominated returns rather than broad market direction. Among the deals contributing positively to performance was the competitive bidding process for Warner Bros’ by Netflix and Paramount. Another positive contributor to performance was the deal completion, ahead of schedule, of the UK-based Alphaware by Qualcomm. Event Driven has benefited from the strong momentum in M&A activity, supported by the policy direction under the Trump administration and a more favourable regulatory backdrop following the leadership change at the Federal Trade Commission, with the departure of Lina Khan. The environment should remain highly supportive, with several structural and cyclical factors underpinning continued activity.

Distressed Securities

Distressed and opportunistic credit strategies operated in a tight-spread environment through December, where broad beta tailwinds were still present, but valuations offered less cushion. Credit spreads across major sleeves remained at the “rich” end of historical ranges, reinforcing a market where security selection and structuring matters more than simply being long-risk. Despite tight headline spreads, there were pockets of opportunity. Defaults and stress remained more idiosyncratic than systemic, with dislocation concentrated in disrupted pockets; including areas tied to heavier LBO issuance and normalising earnings. Finally, the “classic” broad distressed wave still looked delayed rather than cancelled: current conditions suggest the universe is gradually building, especially as financing structures evolve and liability-management dynamics play a larger role, keeping managers constructive on a wider opportunity set into 2026.

LS Credit

In December 2025, long–short credit strategies navigated a backdrop of significant dispersion across credit markets. Carry was a significant performance contributor as volatility remained low during the month. However, managers were able to generate alpha from credit picking, with performance driven by idiosyncratic corporate stress and sectoral divergence and managers harvesting opportunities from differentiated credit fundamentals, refinancing risks and spread dislocations rather than broad market beta. In the context of tight spreads and increasing geopolitical risk and risk of corporate management execution, Long-Short Credit strategies appear an interesting way to exploit relative-value and idiosyncratic dislocations to generate returns.