The investment landscape is marked by persistent macroeconomic uncertainties, uneven growth, and heightened geopolitical risks. Despite attractive earnings growth, healthcare has also been under pressure due to regulatory restructuring, drug pricing debates, budget constraints, and tariff concerns. Yet, these short-term challenges may provide a more favorable entry point for long-term investors. The sector’s fundamentals remain compelling, underpinned by demographics, innovation, and breakthrough medical solutions. In particular, oncology continues to emerge as one of the fastest-developing fields, where scientific progress is unlocking transformative therapies and creating new opportunities for sustainable growth.

We see several compelling reasons to consider investing in the oncology market today:

Oncology innovation fuels growth

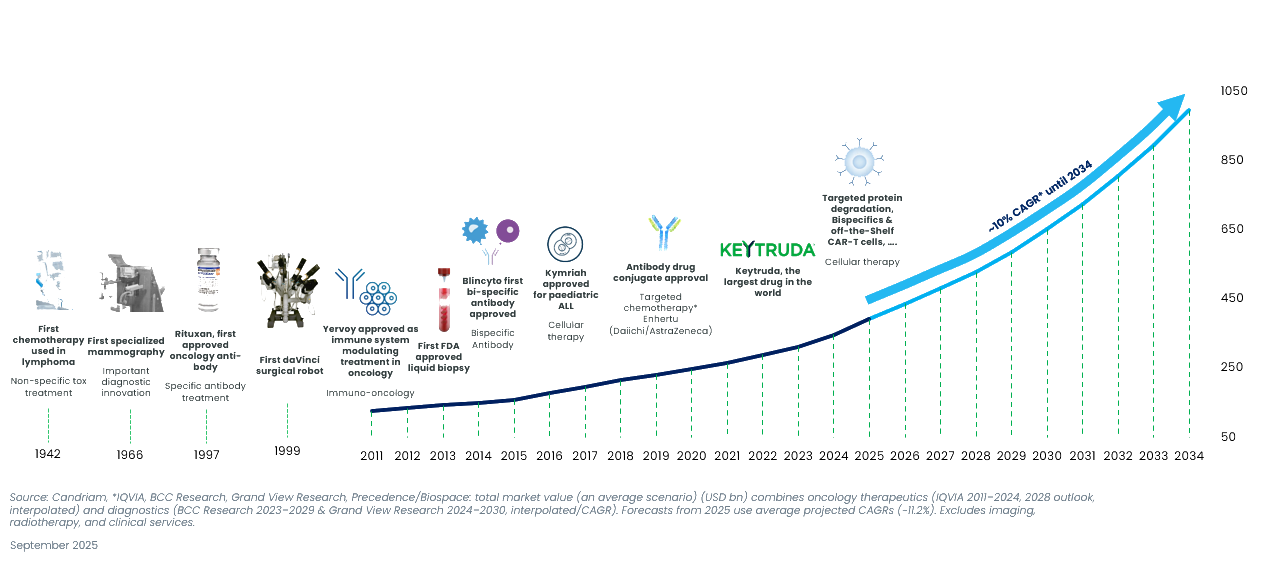

Despite notable improvements in cancer survival on the back of earlier diagnosis and advances in treatment, there remains a high unmet medical need. The future looks bright as innovation continues to improve patient outcomes. Several key trends, such as genome sequencing, biomanufacturing, liquid biopsies, and artificial intelligence, may lead to new breakthroughs. That continuing innovation fuels growth. The global oncology market (therapeutics and diagnostics) is expected to achieve double-digit annual growth from this year through 2034[1].

Global oncology market (in $ bn)

At the core of innovation and deal-making

Oncology has firmly established itself as the largest and most dynamic therapeutic area, with around 40% of the 8,325 drugs in clinical development at the end of 2024 targeting cancer[2]. The field is expected to deliver sustained double-digit growth over the coming decade, making it a prime strategic priority for healthcare companies. This focus extends beyond R&D into corporate activity, with roughly half of all M&A deals in the sector directed toward oncology[3]. Looking ahead, there is ample headroom for further consolidation: more than $400 billion in revenues are at risk from loss of exclusivity between 2025 and 2033 (Jefferies, September 2024), while the pharmaceutical industry collectively holds about $400 billion in cash (Jefferies, August 2024), providing both the incentive and the means to pursue transformative transactions.

Against this backdrop, our team has successfully positioned the portfolio in innovative, smaller companies that were later acquired by larger industry players. This demonstrates our ability to identify early-stage leaders at the forefront of oncology innovation and deal-making. Of course, many other M&A transactions have taken place in oncology in which we were not invested. The chart below highlights the transactions where our strategy directly benefited from this strong M&A activity.

The portfolio profits from the ongoing M&A activity

-

2018GSK +110% Tesaro

-

2019Merck +107% Arqule

-

Eli Lily +68% Loxo

-

2020Meranini +147% Stemline

-

Gilead +108% Immunomedics

-

2021Pfizer +200% Trillium

-

Morphosys +68% Constellation

-

2022Bristol Myers Squibb +122% Turning Point Therapeutics

-

2023Pfizer +33% Seagen

-

Bristol Myers Squibb +40% Mirati Therapeutics

-

2024Novartis +61% MorphoSys AG

-

2025Merck KGaA +26% Springworks Ther

-

Sanofi +27% Blueprint Medicines

-

Robust long-term foundations

Healthcare fell out of favor with investors following the end of the COVID-19 pandemic. The earnings outlook is nevertheless bright, as the post-pandemic normalization is clearly behind us and the sector is resuming its long-term trend on the back of fundamental drivers such as the ageing global population and the increasing prevalence of lifestyle-related diseases. This is especially true for cancer, which is strongly linked to age and risk factors related to lifestyle, such as smoking, alcohol consumption, and obesity.

Cancer mostly comes with age ...

Valuations reflect potential headwinds

The global healthcare sector has underperformed the broader market considerably over the past three years. This year has also been challenging due to regulatory uncertainty following the installation of the Trump 2.0 administration. As a result, healthcare’s relative valuation has reached historically low levels, broadly reflecting all potential negative news. The relative discount compared to the S&P 500, based on estimated price/earnings ratios, has reached more than 20%, compared with a historical median showing a 3% premium[4]. Biotechnology valuations are also interesting particularly for smaller clinical-stage companies. The enterprise value/cash ratio is close to its lowest level in over twenty years. Valuations therefore represent a compelling long-term entry point for investors.

Health care’s relative valuation is at historically low levels

The short-term pressures on healthcare, from regulatory uncertainty to pricing debates, are gradually being reflected in valuations, creating an interesting entry point for long-term investors. As the temporary disruptions from recent years subside, the sector’s core growth drivers remain intact. These include an ageing population, the rising prevalence of lifestyle-related diseases, and ongoing innovation. Oncology remains at the forefront, combining strong therapeutic potential with significant M&A activity, underpinned by a robust pipeline and attractive market dynamics. For investors, this represents a unique opportunity to gain exposure to a resilient, innovation-led sector poised for sustainable, long-term growth.

Notre expertise

-

Envie d’en savoir plus sur l'oncologie ?

Découvrez notre expertise en oncologie sur notre page Web dédiée

-

Candriam Institute

En savoir plus sur notre lutte contre le cancer

[1] Source: Candriam, *IQVIA, BCC Research, Grand View Research, Precedence/Biospace: total market value (an average scenario) (USD bn) combines oncology therapeutics (IQVIA 2011–2024, 2028 outlook, interpolated) and diagnostics (BCC Research 2023–2029 & Grand View Research 2024–2030, interpolated/CAGR). Forecasts from 2025 use average projected CAGRs (~11.2%). Excludes imaging, radiotherapy, and clinical services.

[2] Source: Pharmaprojects, 2024, Pharma R&D Annual Review 2024

[3] Source Pharmaprojects, 2024, Pharma R&D Annual Review 2024 & Statista

[4] Source: Bloomberg