European equities: Markets consolidate after strong run

European equities: Markets consolidate after strong run

After a sustained period of outperformance versus other regions, European equity markets have underperformed in recent weeks. This shift was marked by a notable rotation into US technology stocks during the month of June.

Small caps outperforming large caps

European equity markets have been broadly flat over the past few weeks after a prolonged period of outperformance. Small-cap companies led the broader market, outpacing their larger counterparts. Some investors shifted towards US technology stocks, driven by concerns about valuations in the EU.

From a sector perspective, Industrials led the way—still supported by strength in the aerospace and defence segment—within cyclical sectors, followed by Financials. In contrast, Consumer Discretionary continued to lag, while Materials lost some ground due to the impact of tariffs.

Defensive sectors such as Healthcare, Consumer Staples and Energy were among the weakest performers. Lastly, Utilities, Information Technology and Communication Services remained broadly flat during the period.

Earnings expectations & valuations

Given the current environment, earnings growth expectations for 2025 have been revised downwards to +2.3%, compared to +2.8% four weeks ago. Consensus forecasts that growth in earnings per share in 2025 will be driven primarily by Real Estate and Healthcare, with expected increases of 13% and 9% respectively. In contrast, Energy, Consumer Discretionary and Consumer Staples are the only sectors where negative earnings growth is anticipated this year, at -11%, -3% and -2% respectively.

Since the last equity committee, European valuation multiples have remained stable, with the 12-month forward P/E now at 14.7. Information Technology and Industrials remain the most expensive sectors, trading at 26.9 and 20.8 times forward earnings respectively, while Energy continues to be the cheapest European sector, trading at 9.6 times expected earnings.

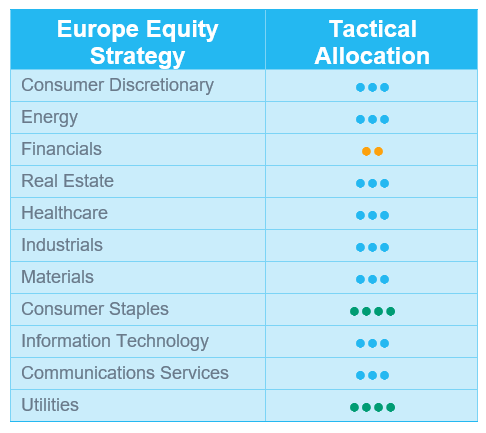

Utilities and Consumer Staples remain our sole positive convictions

While awaiting more clarity on tariffs, we have not made any structural changes to our sector allocation over the past few weeks.

We have maintained our positive (+1) rating on Utilities, given the upside potential from Germany’s upcoming €500 billion infrastructure plan, as well as on Consumer Staples.

As a reminder, in recent weeks we downgraded Healthcare to neutral, taking profits on some European pharma companies that had outperformed year to date. We also downgraded Financials to -1 from neutral, due to stretched valuations and our expectation that the ECB will continue its rate-cutting cycle, which could weigh on banks’ net interest income.

At this stage, we remain comfortable with our stance and see no reason to make significant shifts, as it continues to make sense to maintain a cautious approach.

US equities: Cyclicals and IT drive US equity rally

US equities have continued their strong performance over the past few weeks, largely driven by easing tariff stances and an easing of tensions in the Middle East. In addition, the announcement of Donald Trump’s “Big Beautiful Bill” drove investors’ optimism about economic growth and industrial activity.

Global market participation

US equity markets have edged higher again over the past few weeks, extending May’s rally despite broader macroeconomic volatility. Investors focused on positive developments on the geopolitical front instead. US equity market performance was broad-based, as there was no meaningful difference between value and growth stocks across large and small cap segments.

At sector level, there was nevertheless a clear rotation towards cyclical sectors, such as Industrials, Financials and Information Technology. The latter was the best-performing sector over the past few weeks, with semiconductors and semiconductor equipment producers in particular delivering a strong outperformance.

Defensive sectors clearly underperformed the broader market, especially Healthcare, which continued to lose ground. The sector remains under pressure from regulatory overhang and, together with Real Estate, was one of the only sectors to post a negative performance over the past few weeks. Energy remained broadly flat despite the recent decision by OPEC+ countries to continue increasing daily oil production.

Q2 earnings season kicks off

The start of the summer holiday season also marks the beginning of another round of earnings reports. Investors will closely monitor second-quarter results in the coming weeks to gain more visibility on earnings growth for the second half of the year. Ahead of the earnings season, investors have been revising their earnings expectations upwards. Positive earnings revisions were driven by Information Technology, Communication Services and Utilities, and to a lesser extent by Financials and Healthcare.

For the full year 2025, investors currently expect earnings growth of 9.6%, which may prove challenging in the current macroeconomic context. Expected earnings growth is mainly driven by Information Technology, Healthcare and Financials, leaving little room for disappointment, particularly given relatively tight valuations, with the market trading at around 24 times expected earnings.

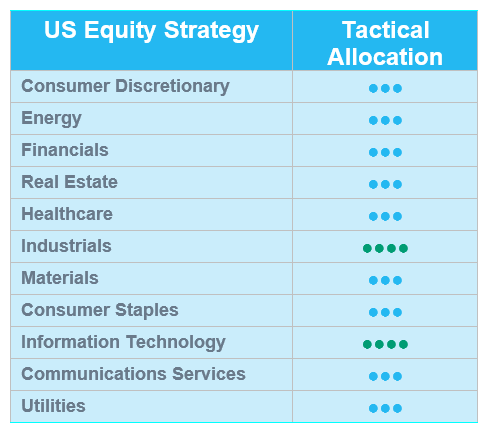

More cautious on Household & Personal Products

While awaiting more clarity on tariffs and corporate guidance, we did not make any structural changes to our sector allocation. We have maintained our positive stance on both Industrials and Information Technology while remaining neutral on all other sectors.

Within Consumer Staples, however, we slightly adjusted our sub-sector allocation by reducing Household & Personal Products from +1 to neutral. We have observed some structural weakness in earnings and concerns over volumes, justifying a more cautious stance on the sub-sector.

Emerging equities: Outperforming developed markets

Emerging market equities extended their rally in June, with the MSCI Emerging Markets NR© Index gaining 5.7% (in USD) and outperforming developed markets (+4.2%). Early in the month, the Israel-Iran conflict briefly rattled sentiment and pushed oil prices higher, but markets quickly stabilised following a US-brokered ceasefire.

A weakening US dollar, driven by softer inflation and growing expectations of Federal Reserve rate cuts, further supported emerging assets. Declining US treasury yields and improved risk appetite fuelled capital inflows across Asia and Latin America.

South Korea (+17.3%) led the advance, driven by optimism around newly announced domestic reforms and fiscal support under the newly elected President Lee Jae-myung. The Korean tech sector, particularly AI and memory stocks, saw strong foreign inflows. Taiwan also performed well, supported by sustained demand in the global AI and semiconductor sectors.

In Latin America (+5.7%), Peru (+7.8%), Colombia (+7.7%) and Brazil (+7.2%) posted solid gains. Brazil’s inflation cooled more quickly than expected, though political friction re-emerged as Congress challenged government fiscal initiatives. Mexico (+2.1%) lagged behind its peers on the back of mixed macro and corporate earnings data. Turkey (+10.8%) rebounded despite political tensions, with financial stocks benefiting from easing inflation and expectations of looser monetary policy.

Commodities put in a mixed performance. Oil prices spiked briefly before settling, with Brent gaining 5.8% during the month. Platinum posted its strongest monthly rise in over 20 years, with an increase of 28%. Gold saw a slight upside of +0.4%. Industrial metals also advanced, reflecting solid demand. Copper rose by 7.5%. US yields finished the month at 4.24%.

Outlook and drivers

Tensions between Israel and Iran appear to be easing following the US’s intervention, despite episodes of conflict and military engagement. Oil prices briefly spiked following Iran’s threats to block the Strait of Hormuz, but market stability was swiftly restored.

On the trade front, consensus does not expect further escalation of tariffs, but underlying risks persist. Donald Trump claimed that a deal has been signed between US and China, but this has yet to be verified.

Recent trends related to the softening US economy increasingly point to dollar weakness. This backdrop favours EM currencies and suggests that the dollar depreciation cycle could continue. However, the trend could reverse due to surprises stemming from Donald Trump’s unpredictable decisions.

The passage of the GENIUS Act through the US Senate marks a pivotal regulatory step for stablecoins. The bill introduces necessary oversight for USD-pegged stablecoins. Stablecoins are a cryptocurrency category where the value of the coin is pegged to another asset/target. Simultaneously, China’s central bank is closely monitoring these developments. A digital RMB could thrive within a more diversified global digital payments ecosystem, accelerating the currency’s internationalisation.

South Korea’s equity market has reached its highest level since 2021, buoyed by the new president’s continued push for the "Value Up" programme focusing on corporate governance and shareholder returns. Meanwhile, Korean companies also stand to benefit from rising global investment themes in defence, AI and nuclear energy.

In the AI space, Nvidia delivered another standout performance. CEO Jensen Huang underscored the immense long-term potential at the intersection of AI and robotics, which he described as a "multitrillion-dollar opportunity". Within emerging markets, China is a first mover in AI application, driving investment waves across humanoid robotics, autonomous vehicles and smart home technologies.

Positioning Update

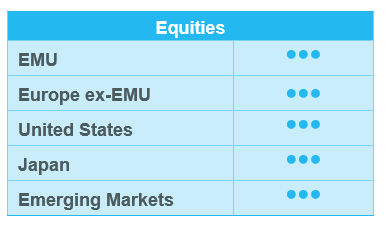

No rating change in the month. Emerging markets are seeing a confluence of favorable macroeconomic and market dynamics.

Market sentiment has also turned more constructive. Global equities continued a rising trend, and Trump’s latest tariffs announcement were mostly in line with previous reciprocal levels. Within this context, emerging markets offer both cyclical recovery potential and structural growth exposure, making them compelling in a global "risk-on" environment. Addtionnally, emerging markets are more attractive relative to developed markets in terms of valuations.

Monetary policy is another key catalyst. A majority of emerging market central banks are expected to enter easing cycles in the coming months. Statistics show that emerging markets have more potential to outperform developed markets during such periods.

Regions

China

Earnings remain under pressure, especially among large-cap Chinese tech names. Major e-commerce players such as Alibaba, JD.com, Meituan and PDD continue to struggle with weak top-line growth and intensifying competition. The electric vehicle space is facing a similar landscape. The government has expressed concerns overs the risk of a heated price war. Still, some niche players are doing exceptionally well, such as Xiaomi.

Trade is subject to lingering uncertainty, with a big fall in trade with the US. China is trying to diversify exports away from the US, and recent newsflow appears to be encouraging.

Policy support remains an open question. Attention is now turning to the upcoming July meeting, though expectations are muted. Investors are not pricing in aggressive stimulus or major shifts, lowering the risk of disappointment but also limiting near-term catalysts from the policy side.

Valuations are reasonable, trading at 11.5–12x forward earnings, broadly in line with long-term averages. Current multiples suggest that much of the negative sentiment is already reflected in prices.

South Korea

We have downgraded our view on South Korea to neutral, primarily due to extreme overbought conditions, with the market having rallied over 35% in just three months. While this move reflects strong momentum and improving sentiment, such a rapid re-rating warrants caution in the near term. That said, we remain fundamentally constructive on the market’s medium-term outlook. We are monitoring the country ahead of a possible upgrade.

Beneath the headline figures, specific segments continue to show strong potential. Defence and shipbuilding remain structural beneficiaries of geopolitical realignment, while holding companies are responding positively to the government's Value-Up initiative (to improve corporate governance and investor returns). Financials and some Technology names also delivered gains.

Brazil

Brazil outperformed both emerging markets and the region of Latin America during the month. Inflation fell more quickly than expected, which can help end a tightening cycle. Market strength may continue in the coming months. We are taking some profits.

Sectors

Technology

The sector posted overall positive news. Several Taiwanese names reported strong monthly sales, including Elite Material (printed circuit board), Wiwynn (data server), Quanta (data server) and Asia Vital (thermal solutions), all beating estimates. In Korea, SK Hynix (memory chip) was very strong, while Samsung Electronics and LG Electronics were the opposite.