For 2024, we anticipate a buoyant environment for both ‘buckets’ of the Equity Market Neutral strategy, index rebalancing and relative value investments. As we march through the first quarter of 2024, the first major rebalancing of the year took place on Leap Day (the MSCI indices were rebalanced on 29 February), with the bulk of the year’s rebalancing activity to begin in March. Our decade-long core methodologies within both these ‘buckets’ will be maintained and reinforced as we strengthen our management team.

Outlook – a Supportive Environment

- The growth of passive investing continues to be the structural driver of performance opportunities for the strategies. In 2023, the ETF industry posted its second-largest year in terms of net inflows.[1]

- M&A activity was strong during the second half of 2023, and certain sectors, such as healthcare and technology, are consolidating despite higher rates. A rate cut cycle, if it occurs, should reinforce this trend, resulting in on-going index rebalancing opportunities for both buckets of the strategy.

- Macroeconomic uncertainties, multiple national elections, and geopolitical tensions could significantly increase market volatility in the coming months. This type of environment may benefit our strategies as it may reward liquidity providers, such as this strategy, with an additional premium.

- All else equal, positive rates may provide additional performance to the strategy.

Source: Candriam.

Index Rebalancing Strategies

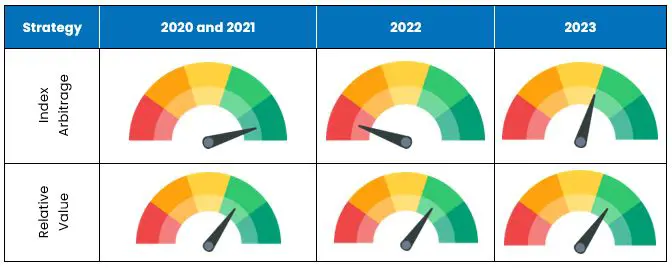

An eventful year, 2023 can also be described as a year in which the environment for index rebalancing returned to normal. It followed a very tough environment in 2022, and a very positive environment in 2021. Throughout the first half of the year, we saw incremental improvements of the arbitrage space as several other participants left the market. As a result, the strategy renewed its performance during on-going as well as quarterly rebalancings and practically recovered its prior drawdown.

New index arbitrage opportunities continue to emerge. The trend of European firms towards US listings continued in 2023, creating possibilities as these stocks exited European indices and joined US ones. Examples include the German Linde chemicals firm, Irish CRH building materials company, and the Italian CNH Industrial agricultural machinery company.

July of 2023 saw significant rebalancing flows when the Nasdaq announced a special rebalancing to reduce the concentration of the ‘Magnificent Seven’ of Meta, Apple, Tesla, Microsoft, Alphabet, Amazon, and Nvidia in the Nasdaq 100 index.

In the end, 2023 was a year of renewed performance for this strategy bucket, both during on-going index changes as well as quarterly rebalancings.

Relative Value Strategies

These market-neutral investments aim to provide a balance to the index rebalancing strategy. The environment remains favourable for mean-reversion strategies within the relative value bucket, with a fairly consistent environment during 2021, 2022, and 2023.

Our relative value methodology is based on both quantitative, and fundamental analysis. This allows the strategy to benefit from multiple types of market environments. We believe the three-year performance of the overall strategy demonstrates our aim for this bucket.

Interest Rates

The rate hikes of 2023 were beneficial to the Equity Market Neutral strategy. As a long-short one, most of the available cash is invested in money market instruments, reflecting the performance of the Euro short-term rate (€STR).

Through the Cycles

An important risk for index arbitrage strategies is the level of ‘crowding’ (excess liquidity provision) by arbitragers in the market. During 2022, there were many investors in the index arbitrage category. During 2023, there was a better balance. This balance may change. We, however, have remained involved, even while many market participants have left (or entered) the category.

This strategy aims to provide a positive absolute return across economic cycles and across markets. It aims to offer investors an asset class with low correlation to other asset classes to help create a diversified asset allocation. Candriam offers a long-term track record in liquid alternative strategies, as well as a range of products and processes.

With geopolitical risks, soft landing uncertainty, and central bank actions creating uncertainty and dispersion, isn’t it time to think about your allocation to liquid alternatives?

Risks

All our investment strategies involve risks, including the risk of loss of capital. The main risks associated with our Equity Market Neutral Equities strategy are: risk of loss of capital, equity risk, risk associated with derivative financial instruments, counterparty risk, arbitrage risk, sustainability risk

For further details on risks associated with investing in the promoted strategy, a general description and explanation of the various risk factors is available in the section Risk Factors of the strategy regulatory documents.

This is a marketing communication. This document is provided for information purposes only and does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Warning: Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance does not predict future returns. Gross performances may be impacted by commissions, fees and other expenses. Performances expressed in a currency other than that of the investor's country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.

[1] Morningstar, 2 January, 2024. Accessed 30 January, 2024.

ETFs Cap Off Another Year of Inflows in Style | Morningstar